Equinor and its partners have ruled out constructing a dedicated terminal in northern Norway for ship-to-ship transfer of oil from fields in the Barents Sea. The decision follows a study of various options in a fjord or by a quay at a proposed site in Veidnes, Finnmark County. Based on anticipated volumes from the only two oilfields in the Barents Sea currently in production or under development (Goliat and Johan Castberg), the predicted scenario was a financial loss before tax of around $400 million compared to conventional arrangements for exporting production directly to the market. Even taking into account other fields likely to be developed over the next few years such as Wisting and Alta/Gohta, the estimated pre-tax loss was more than $320 million.

In the Utsira High region of the North Sea, the license partners have agreed that the power-from-shore solution for Phase 2 of the Johan Sverdrup development will include additional capacity of 35 MW to meet the needs of the nearby Edvard Grieg, Gina Krog, and Ivar Aasen fields and others that might be developed in the future. The Sleipner field center and the Gudrun platform in the North Sea will also receive power from shore: operator Equinor estimated that partial electrification of Sleipner would cut the complex’s carbon dioxide emissions by more than 150,000 metric tons (165,347 tons) annually.

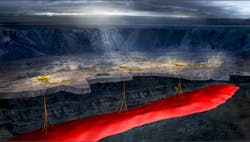

Farther north, Norske Shell has commissioned Schlumberger company OneSubsea and alliance partner Subsea 7 to engineer and install a subsea multiphase compression system for the deepwater Ormen Lange gas field. This will comprise two 16-MW compression stations on the seafloor in a water depth of 850 m (2,789 ft), connected to existing manifolds and pipelines and powered and controlled via two new 120-km (75-mi) power umbilicals from the onshore gas processing plant at Nyhamna, to be installed by Nexans. The compression system will be surge-tolerant, with no requirement for pre-processing of the wellstream and will be adaptable to variable conditions over the remaining life of the field.

Stimulation technique proven at Valhall

Aker BP has started operations at the new Flank West platform on the Valhall field in the southern Norwegian North Sea. The facilities should over time produce close to 80 MMboe: the company is targeting a further 1 Bboe from the field as a whole over the next 40 years. Kvaerner, Aker Solutions, and ABB worked on the normally unmanned platform which is designed to receive power from shore via the Valhall field center. The crane, seawater pump, and lifeboat are also electrically operated. Development drilling started last July, with the first two wells – drilled by the jackup Maersk Invincible – employing the first-ever application offshore of ‘single trip multifrac’ technology, developed jointly by Aker BP, NCS Multistage, Stimwell Services, and Schlumberger.

Valhall’s chalk formations deliver low flow rates, necessitating use of a stimulation vessel with coiled tubing. The new technique allows several zones to be fractured with just one trip down the well by means of a sleeve in the completion that can be opened and closed downhole: sand mixed with fluid can be pumped in while the coiled tubing remains in the hole the entire time. Last November four zones were stimulated in the G10 well using this method.

Decommissioning spend on downward curve

Britain’s offshore decommissioning burden is easing, according to the latest long-term forecast by Oil & Gas UK (OGUK). The association now estimates the total bill for all UK offshore fields at £51 billion ($66 billion), including those newly sanctioned for development or with facilities installed over the past two years. This is more than £8 billion ($10.5 billion) less than the baseline figure issued by the Oil and Gas Authority, reflecting the industry’s continuing progress in reducing costs.

OGUK’s report, published at the end of last year, predicted overall UK oil and gas industry expenditure of around £15 billion ($19.6 billion) for 2019 with decommissioning accounting for just under 10%, despite long-held fears that this sector would by now be dominating UK spending. At the same time, UK production efficiency is at its highest since 2018, and that, coupled with the industry’s successes in restraining opex, is extending the viability of fields, allowing decommissioning in certain cases to be increasingly deferred. During the 2020s, the UK is set to spend £15.2 billion ($19.8 billion) on decommissioning, the report concluded. •

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.