Northwest Africa emerging as a key offshore frontier area

Northwest Africa is emerging as a key oil and gas-producing region in the international offshore marketplace. E&P activities are ramping up offshore Morocco, Mauritania, and Senegal in order to meet growing crude oil, natural gas, and LNG demand in local, regional and international markets.

The key play of interest – the MSGBC basin – stretches all the way down from Mauritania southwards off the coasts of Senegal, The Gambia, and Guinea-Bissau. (MSGBC is an acronym of those countries’ names.) The major discoveries in the basin over the past few years have proven the significant hydrocarbon potential, and upcoming developments are expected to boost oil and gas production significantly. Combined with drilling programs taking place offshore Morocco, the larger offshore northwest Africa region is expected to see sustained exploration and development campaigns well into the 2020s.

The biggest field development program in the region is the Greater Tortue Ahmeyim LNG project offshore Mauritania and Senegal. Led by bp, the project partners sanctioned Phase 1 of the cross-border development in 2018. The project will produce gas from an ultra-deepwater subsea system and mid-water FPSO vessel, which will process the gas, removing heavier hydrocarbon components. The gas will then be transferred to a floating liquefied natural gas (FLNG) facility at a nearshore hub located on the Mauritania and Senegal maritime border. The FLNG facility is designed to provide circa 2.5 million tonnes of LNG per annum on average, with the total gas resources in the field estimated to be around 15 tcf. The project is designed to provide LNG for global export as well as making gas available for domestic use in both Mauritania and Senegal.

First gas for the project was originally scheduled for this year, but labor shortages and coronavirus restrictions led to delays and rising costs. Phase 1 start-up was initially expected in the first half of 2023, with an initial capacity of 2.5 million mt/year. Under phase two, production capacity is expected to double to 5 million mt/year. Phase 2 is reportedly being restructured, with a final investment decision expected by late 2022 or early 2023. Officials from the Ministry of Petroleum, Energy and Mines at Mauritania have indicated that the second phase needs to be better optimized and made more capital efficient, as “significant capital expenditures” have been allocated towards Phase 1.

Offshore Senegal, the Sangomar deepwater development is poised to become the country’s first offshore oil production system. Located 100 kilometers south of Dakar, the Sangomar field (formerly the SNE field) contains both oil and gas in commercial quantities. The project calls for a stand-alone, 100,000-b/d FPSO with 23 subsea wells and related subsea infrastructure. The FPSO will process the oil before offloading it via tankers, and will be designed to accommodate future development phases, including gas export to shore and other subsea tiebacks. Project partners include operator Woodside Energy, Lukoil (who purchased Cairn Energy's share), FAR, and Petrosen.

Phase 1 will focus on developing the less complex reservoir units, and testing other reservoirs to support gas export to shore. This phase of the development will target approximately 230 million barrels of crude oil. The first development well for Phase 1 was drilled and completed last fall, including installation of the xmas tree. It was also the first horizontal production well drilled in Senegal, according to Woodside Energy.

A partnership of Subsea 7 and OneSubsea has been selected to build and install the SURF system and associated subsea production systems. The development will include 23 wells, 107 kilometers of rigid flowlines, 28 kilometers of flexible risers and jumpers, and 45 kilometers of umbilicals in water depths between 700 and 1,400 meters. A pre-lay survey is under way at the Sangomar field; Woodside Energy has commissioned the program ahead of the start of the subsea installation campaign, scheduled for 2Q 2022. Currently Sangomar Phase 1 is 48% complete and on track for first oil in 2023.

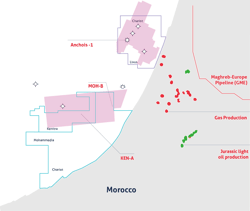

Offshore Morocco, Chariot Energy has been active as it pursues development in the Lixus and Rissana licenses. The Anchois development, in the Lixus license in 381 m (1,250 ft) of water, is emerging as major gas discovery. In January, Chariot reported that the semisubmersible Stena Don completed drilling activities on the Lixus license, and confirmed the viability of the 2009 Anchois-1 gas discovery well as a future producer. Chariot is partnered with Morocco’s Office National des Hydrocarbures et des Mines (ONHYM), on the Anchois development. The Anchois-2 well also fulfilled the partners’ appraisal and exploration objectives, delivering over 100 m (328 ft) of net pay. Drilling activities there have since been suspended, again for potential completion as a future producer.

Chariot says that data recovered from multiple gas discoveries in Anchois-2 included results from a subsurface formation testing program, which recovered 12 gas samples across seven gas-bearing reservoirs. The results could have positive implications on the scale of the proposed gas development, Chariot added, as well as de-risking other exploration prospects with similar seismic attributes in the Lixus license area.

Current plans for Anchois call for an initial two wells tied into a subsea manifold with a 40-km (25-mi) offshore flowline connected to an onshore gas processing plant. From there, a 40-km pipeline would connect to the trunk pipeline that takes gas to southern Europe.

In February, the Moroccan government awarded Chariot Energy a 75% operated interest in the Rissana Offshore license, again in partnership with ONHYM. Rissana, covering an 8,489-sq km (3,277-sq mi) area, surrounds Chariot’s existing Lixus Offshore license, which includes the planned Anchois gas field development. It is said to contain potential for further discoveries on-trend with Anchois. The minimum initial commitment is the acquisition of a 2D seismic survey, to assist evaluation of the extension and potential of gas plays across Rissana.

Hydrogen energy

Meanwhile, Mauritania is also advancing a hydrogen production project. Last fall, the country’s Ministry of Petroleum, Mines and Energy entered into a memorandum of understanding with Chariot Energy to progress Project Nour, a potential green hydrogen development of up to 10 GW. The proposed project would cover a 14,400-sq km (5,560-sq mi) offshore/onshore area. Pre-feasibility and feasibility studies will investigate the possibilities for power generation from solar and wind resources, and these would be used in an electrolysis process that would split water in order to produce green hydrogen and oxygen.

Chariot says it will assess the available wind and solar potential, and also conduct environmental impact, macro-economic, and social impact studies. Project Nour, the company claims, could lead to Mauritania producing the lowest-cost green hydrogen in Africa.

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.