OPEC+ production cuts are not enough, says analyst

Offshore staff

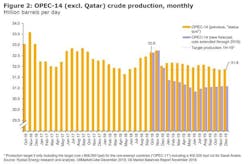

OSLO, Norway– OPEC+ will need to stay 700,000 b/d below its agreed targets of 31.8 MMb/d through 2019 in order to bring a recovery in Brent prices to the $70 level, according to analyst Rystad Energy.

On Dec. 7, the OPEC countries and Russia agreed to cut oil production by 1.2 MMb/d in 2019 – slightly larger than the 1.0 MMb/d cut expected by many observers.

Rystad Energy’s head of oil market research Bjornar Tonhaugen said: “The OPEC+ agreement predictably came up short of what Rystad Energy argued would be required to fully balance the market in 2019. The agreed production cuts will not be enough to ensure sustained and immediate recovery in oil prices. The muted market reaction seen thus far comes as no surprise to us.”

In a note to clients, Tonhaugen writes:

• The agreed OPEC+ production cuts will not be enough to ensure sustained and immediate recovery in oil prices

• The decision does stand as a Christmas gift to budget-setters in the US shale industry, where the relentless growth in production is set to continue also for the second half of 2019 and beyond

• OPEC+ succeeds in preventing massive over-supply in the first half of 2019 and in putting a soft floor under oil prices for now

• If production cuts by OPEC and Russia are extended through 2019, the market can balance.

“Most likely, OPEC will be forced to conduct production management sporadically over the next few years, unless US shale supply grows even faster than we currently expect. OPEC members have their work cut out for them in the years to come,” Tonhaugen said.

12/12/2018