Offshore staff

CANTERBURY, UK -- Offshore industry spending is expected to rise to $840 billion in capital expenditures and $715 billion for operations, over the five year period to 2012, compared to the $550 billion and $390 billion estimated to have been spent in the previous five years, according to the World Offshore Oil & Gas Production and Spend Forecast 2008-2012 by Douglas-Westwood and EnergyFiles.

Offshore production output is expected to reach 30 MMbbl/d in 2008 with gas production having risen to 988 Bcm/y; rises of 22% and 55% respectively since 2000. The report details prospects for offshore oil and gas production by region and type of activity.

Report author Dr. Michael Smith of Energyfiles says the industry will have to spend in every part of the world to attain such growth. Higher energy prices and the need to exploit much more expensive environments also are driving spending.

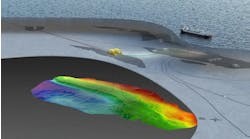

"Where a decade ago, fixed platform developments in the North Sea, the shallow waters of the Gulf of Mexico and the relatively benign environments of the South China Sea attracted much of the spending, now billions are directed at expensive deep water and deep reservoir environments - usually using complex subsea solutions, remote gas developments and subsea wells that scavenge for satellite accumulations in the traditional areas," Smith says.

The only significant exceptions are in the low cost Persian Gulf and moderate cost Caspian Sea, Smith says.

"In the [Persian Gulf], the OPEC countries are dramatically increasing their expenditure as they struggle to increase capacity to take advantage of the tight, light, oil supply market as well as the strength of global LNG for which demand is rocketing," Smith says.

Deep water production additions are increasing in all regions where such prospects exist, particularly in West Africa. Shallow water additions are only increasing in the Middle East and in a scattering of countries elsewhere, especially supported by new marketed gas production.

"Deep water is also one of the few remaining situations offering potential for major oil discoveries," says Steve Robertson, head of oil & gas at Douglas-Westwood. "This is particularly important for the major international oil companies as their shallow water reserves deplete and the major onshore reserves are increasingly controlled by national oil companies."

According to Robertson, in the 1970s oil majors controlled 80% of the world's oil reserves while, today 80% is controlled by state companies.

Spending will continue to rise due to the much more expensive developments that must be exploited. Yet, most of the high technology sectors of the offshore industry will continue to be equipment and people resource-constrained, says Smith.

"So even with exceptional growth, companies need to remain selective in the areas in which they concentrate and the services they offer and develop," Smith says. "When times are good, future direction often gets lost in the excitement of apparently ever-increasing profits. But, with cash available, this is the very time when properly thought-out and focused strategies can be most effective."

07/01/2008

Production

Europe