Rosebank critical to UK’s long-term production, Westwood claims

Offshore staff

LONDON — Equinor and Ithaca Energy’s newly sanctioned Rosebank oil and gas development west of Shetland is the UK’s largest new standalone field project since Culzean in 2016, according to Westwood Global Energy Group.

It is also the biggest development in the area since bp approved the Clair Ridge project and the Quad 204 Schiehallion redevelopment in 2011.

Chevron discovered the Rosebank Field in late 2004 and drilled three appraised wells in 2007, but it could not find an economic way to develop the field. It divested its 40% interest to Equinor in late 2018, and Equinor doubled that stake earlier this year through acquiring Suncor Energy’s UK business.

The sanctioned plan involves development in two phases, the first priced at $3.8 billion with first oil scheduled for 2026-2027. Four production and three injection wells will be tied back to the leased FPSO Petrojarl Knarr, which will be refurbished to include a new process module and structural strengthening and modifications in readiness for full electrification.

According to Yvonne Telford, Westwood’s research director, Northwest Europe, the Phase 2 will feature a further three producers and two injectors, although timing will be dependent on reservoir performance. The oil will be exported via shuttle tankers and gas via a newbuild pipeline connecting to the west of Shetland's pipeline system via the Clair tie-in point.

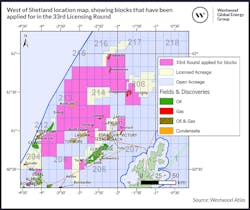

Westwood believes the development is important to the UK’s long-term production. It predicts that by 2043, only three of the UK’s 74 currently producing offshore hubs could still be operational, and two of these are west of Shetland. So Rosebank would add another hub to the region that would in turn provide tieback opportunities for undeveloped discoveries in the area.

It would also support the case for a power-from-shore solution for the region, Telford said, because electrification in this area looks technically and economically complex. During a presentation at Offshore Europe in Aberdeen this month, Equinor and bp spoke of a best-case electrification solution post-2030, with power from shore from Shetland the most likely option.

A 65-90-km cable connection would be needed to supply power to the Clair and Clair Ridge platforms, and 140-160 km of cables to reach Rosebank and the yet-to-be-sanctioned Cambo Field development. Electrification could open a path to production from nearby stranded discoveries and in addition, drive renewed exploration in the area.

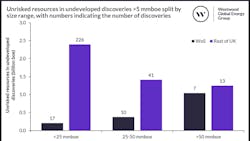

Westwood estimates a total of 1.6 Bboe of unrisked resources in undeveloped discoveries west of Shetland. And the average field size is about 128 MMboe compared to 25 MMboe for the other UK offshore sectors.

Companies have applied for 49 blocks in the region under the UK’s 33rd Licensing Round, many to the northeast of Rosebank, according to Telford, with a first set of awards due to be announced shortly.

The applications likely contain relatively high-risk prospects, but development prospects could improve with the emergence of more hubs in the region.

Rosebank is the fifth new field development to be sanctioned in UK waters this year, and two more could go forward before year-end, Westwood claims. Partner Ithaca is also aiming to progress Cambo, but it needs to bring in a partner to help fund the project.

09.29.2023