TotalEnergies prioritizing greener offshore energy, reduced waste

Emissions control and offshore electrification were among the priorities singled out by speakers at the recent SPE Offshore Europe virtual event. During the session “Facilities of the Future: An Integrated Approach to Energy Efficiency,” Guillaume Chalmin, SVP Development and Support to Operations at TotalEnergies, said his company’s oil production was nearing its peak and would not grow. However, in its new guise as a global energy provider, the company will continue to step up production of gas, which it sees as critical to power systems, heat and transport, also ramping up green electricity to support low-carbon power supply.

Since 2015, TotalEnergies has cut emissions from its facilities by more than 20%, Chalmin said, and is targeting a 40% reduction by 2030 (compared with 2015). It has set up a dedicated organization to ensure delivery of carbon footprint reduction initiatives identified by its teams worldwide. Within E&P there are three priorities, the first being to addressing `lost energy’ associated with flaring and venting. Examples include a project in Nigeria to eliminate routine flaring and venting, and venting-re-routing and compression projects in Congo and Gabon. Brownfield facilities are being modified by re-routing venting or flared gas to low pressure compressors.

A second focus is on better use of energy for offshore operations, such as fuel gas, via operational efficiency measures. “We can reduce fuel gas consumption,” Chalmin said, “through a greater focus on process optimization, using digital solutions. We can also optimize our facilities by better taking into account the evolution of the production conditions as fields mature, i.e. by re-building compressors.”

Goals include promoting greater use of green electricity offshore to minimize fuel gas needs. “We will take our future facilities a step further by embedding low-carbon solutions into the design. Selection of low-carbon development concepts and the adoption of low-carbon equipment are now general. The process starts with lost energy: as an example, native CO2 will be re-injected for the Cameia field development offshore Angola” (a similar process is under way on the Mero field in the Santos basin offshore Brazil, where TotalEnergies is a partner).

In the contractual arena, the company is seeking to incentivize FPSO operators to minimize greenhouse gas emissions from leased facilities. “We systematically consider electrification of compression and injection systems while implementing centralized power generation systems. Also, we now favor the use of variable-speed drives to adapt compressor use to the evolution of production when fields mature. High-performance gas turbines and compressors are other means of minimizing fuel gas use. As an example, combined-cycle gas turbines allow for 25% greenhouse gas reductions compared to open-cycle.”

TotalEnergies’ third main objective in its E&P operations is to reduce power demand. “That starts with selecting less power-intensive field development concepts,” Chalmin said. “In some cases, this could be at the expense of oil recovery.

“Electrification is now considered a base case in our [offshore] developments, with power from shore the first to be investigated.” The company is assessing the merits of electrification supplied potentially by smaller wind farms, or partial electrification provided by a single offshore wind turbine. TotalEnergies is also looking at bottom-fixed wind facilities alongside its platforms offshore Denmark.

North Sea operators face growing pressures to find electrification solutions for their offshore facilities to comply with national emissions reduction targets. In Norway, new standalone projects are designed from the outset to run on power from shore, but progress is slower in UK waters, where the authorities are more focused on seeking area-wide power for clusters of mature fields.

ABB has supported numerous projects and studies in both sectors as Asmund Maeland, Group SVP, Subsea and Offshore Power Segment, explained during his presentation. Offshore Norway, power from shore (PFS) started in the late 1990s and is now a must for all greenfield developments, with plans to have half of all Norwegian offshore assets electrified to meet offshore emissions targets by 2030. In the UK, one of the central problems is that power costs are three times higher. Here the most likely outcome, Maeland said, is a combination of some sort of electrification with power from offshore wind.

Over the past couple of years, ABB has seen demand increasing in the North Sea for PFS for brownfield and also unmanned platforms, where PFS reduces complexity by removing the need for gas turbines. But brownfield economics remain difficult due to the cost of the platform modifications and the associated interruptions to production. In the UK, studies are under way for solutions involving dedicated hub platforms supplying electricity to other installations in the area. However, there are issues to resolve concerning regulation, and coordinating the installation schedule with the different owners of the various platforms. As for modifications, brownfield platforms have space and weight restrictions which could make it difficult to perform offshore electrification the ‘conventional’ way, Maeland said. And different installations may have 50 or 60 Hz frequencies that complicate matters further, with extra power conversion needed in some cases.

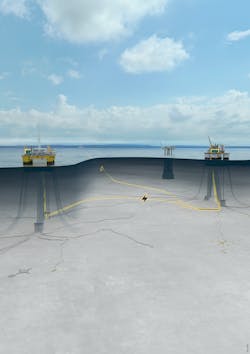

Subsea technology could help, as subsea power systems do not require hub platforms to place the equipment on, and would also reduce the need for topside modifications. But then there is a debate over whether to go for an AC or DC power supply. “It’s a question of cost and weight. HVDC is normally more costly, so it makes sense to explore an AC solution – but you need to do simulations with AC to ensure you can upgrade the different operations modes. For fixed platforms, there are almost no transmission technical challenges, aside from weight/space. With circular FPSOs and semisubs, both need a dynamic cable, but no DC cable is yet qualified for the dynamic part. Ship-shaped FPSOs also need a dynamic cable which can be compatible with the turret and swivel. With DC, several qualification programs are ongoing for the swivels.”

As for technology to enable AC transmission to ship-shaped floaters, one solution ABB is investigating is a subsea transformer below the vessel to allow for an HV transfer on longer cables, then transforming the voltage down to the correct levels for feeding into the vessel. Another possibility could be to use a subsea reactor to compensate for the reactive power. “For ship-shaped FPSOs, you also need electrical swivels to transfer power from the long cable to the rotating part of the vessel. Today, swivels are qualified in the range 50-60 kV, but there is an ongoing project to go up to 145 kV for floating vessels.”

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.