Ageing wells could spur intervention demand offshore Mexico

Offshore staff

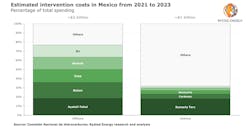

OSLO, Norway – Intervention spending on Mexico’s producing oil and gas wells could exceed $3 billion from 2021-2023, according to Rystad Energy.

Around 75% of the wells are ageing, the consultant said, and therefore potentially in need of attention. Offshore wells look set to incur 70% of the expenditure.

The number of producing offshore wells dropped by 14% between 2015 and 2020, due to a slowdown of drilling activities, with offshore drilling during the period at around 60% of the level for 2010-2015.

As a result, the average age of producing offshore wells has increased from 8.1 years to 11.5 years and in many cases, water cuts have also risen, said Rystad energy research analyst Daniel Holmedal.

Four of the top five fields in terms of spending are said to be fixed facilities, the exception being Ku, produced through a floater.

In terms of wellbore age, Ayatsil-Tekel at two years and Balam at six years have the lowest median wellbore age, along with the longest offshore wells at 4,300 m (14,107 ft) and 4,900 m (16,076 ft), respectively.

For service suppliers, there are a broad range of intervention possibilities in the years ahead, Rystad claimed, with a growing willingness to perform interventions on younger Mexican offshore fields.

Ayatsil-Tekel and Balam are likely to require costlier intervention techniques, with Zaap and Maloob needing lighter interventions.

11/06/2020