BP facing income replacement issues under lower production scenario, consultant claims

Offshore staff

LONDON – BP’s goal of achieving net zero for the carbon content of its upstream oil and gas production by 2050 or earlier is one of the most radical of any IOC, according to Westwood Global Energy Group.

Last year the company produced 3.8 MMboe/d globally.

BP expects its equity production to decline to around 1.5 MMboe/d in 2030, with plans to sell 600 MMboe/d of production by 2025, of which 200 MMboe/d is from transactions already agreed.

According to Keith Myers, president, Research at Westwood, the company’s 19.75% stake in Russian oil major Rosneft contributes 1.1 MMboe/d and is not included in these targets.

However, Rosneft looks increasingly peripheral to BP’s goal of carbon neutrality and becoming an international energy company, rather than an IOC, he suggested.

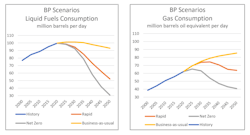

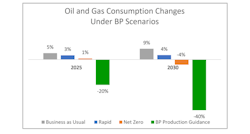

The company’s planned cuts to its oil and gas production, he added, are much steeper than the implied fall in global demand under its own scenarios, even in a world on track for 1.5°C (35°F) of warming.

It has also indicated that it will cut E&P capex from ~$12 billion in 2019 to ~$8 billion during 2021-2025, with average point forward development costs estimated at $9/boe.

The company recently stated that it had 16 Bboe of resources, which appear to be more than sufficient to replace reserves – based on the lower production targets – without exploration.

It will reduce its exploration spending to $350-400 million/yr, focusing on new hubs in existing areas. Near-term drilling that appears to fit this description, Myers said, includes the Ironbark gas prospect on Australia’s NW Shelf; the Shafag Asimam gas prospect in the Azerbaijani sector of the Caspian Sea; and the Galapagos Deep frontier oil prospect in the Gulf of Mexico.

But there will be no new country entries, and likely departures from acreage that no longer fits the strategy.

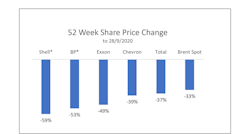

BP’s share price has fallen by 53% in the last 12 months with only Shell performing worse among the five supermajors, and the wider investor community has not yet seemingly rewarded BP for its future ambitions.

According to Myers, some may question whether the sums add up, as the company’s planned production cuts are at a faster rate than its own scenarios suggest is needed to align with the Paris Agreement and achieve <2°C (36°F) of warming. And the 600 MMboe/d it plans to divest by 2025 will not contribute to the Paris goals, he suggested, as the barrels will still be produced by others.

In 2019, BP’s production provided around $12/boe of net income at average Brent prices of $64/bbl: under its new strategy, it would be producing 400 MMboe less in 2030 and would therefore need to add $4.8 billion of annual net income from alternate sources to compensate for the ‘lost’ production.

Asset sales will help in the short term, Myers said, but this is a lot of profit to find in order to sustain a business of BP’s current scale.

10/06/2020