Record Gulf of Mexico oil production expected to continue

Offshore staff

WASHINGTON, D.C. – Crude oil production in the US federal Gulf of Mexico (GoM) averaged 1.8 MMb/d in 2018, setting a new annual record, according to the Energy Information Administration (EIA).

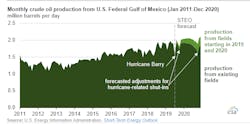

The EIA expects oil production in the GoM to set new production records in 2019 and in 2020, even after accounting for shut-ins related to Hurricane Barry in July 2019 and including forecasted adjustments for hurricane-related shut-ins for the remainder of the year and for 2020.

Based on EIA’s latest Short-Term Energy Outlook’s expected production levels at new and existing fields, annual crude oil production in the GoM will increase to an average of 1.9 MMb/d in 2019 and 2.0 MMb/d in 2020.

However, even with this level of growth, projected GoM crude oil production will account for a smaller share of the US total. The EIA expects the GoM to account for 15% of total US crude oil production in 2019 and in 2020, compared with 23% of total US crude oil production in 2011, as onshore production growth continues to outpace offshore production growth.

In 2019, crude oil production in the region fell from 1.9 MMb/d in June to 1.6 MMb/d in July because some production platforms were evacuated in anticipation of Hurricane Barry. This disruption was resolved relatively quickly, and no disruptions caused by Hurricane Barry remain. Although final data are not yet available, the EIA estimates GoM crude oil production reached 2.0 MMb/d in August 2019.

Eight new projects are expected to come online in 2019 and four more in 2020. EIA expects these projects to contribute about 44,000 b/d in 2019 and about 190,000 b/d in 2020 as projects ramp up production. Uncertainties in oil markets affect long-term planning and operations in the GoM, and the timelines of future projects may change accordingly.

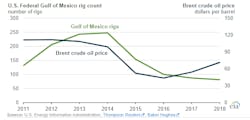

Because of the amount of time needed to discover and develop large offshore projects, oil production in the GoM is less sensitive to short-term oil price movements than onshore production in the Lower 48 states. In 2015 and early 2016, decreasing profit margins and reduced expectations for a quick oil price recovery prompted many GoM operators to reconsider future exploration spending and to restructure or delay drilling rig contracts, causing average monthly rig counts to decline through 2018.

Crude oil price increases in 2017 and 2018 relative to lows in 2015 and 2016 have not yet had a significant effect on operations in the GoM, but they have the potential to contribute to increasing rig counts and field discoveries in the coming years. Unlike onshore operations, falling rig counts do not affect current production levels, but instead they affect the discovery of future fields and the start-up of new projects.

10/16/2019