Shell advancing Mattox project in deepwater Gulf of Mexico

Pipeline expected to become new transportation corridor

Bruce Beaubouef

Managing Editor

With the arrival of the Appomattox platform to the deepwater Gulf of Mexico in May, Shell moved closer to first production of the related fields, which are expected to start production in 2019. At its peak, the Appomattox development is expected to produce 175,000 boe/d.

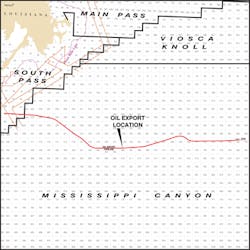

To move that product to market, the Mattox Pipeline Co. LLC, jointly owned by Shell and Nexen, is building the Mattox pipeline, a roughly 90-mi, 24-in. system that will move the produced crude oil from the Appomattox semisubmersible to an existing system, and from there to onshore markets.

Mattox will move the oil from the Appomattox platform in Mississippi Canyon block 437 westward to the existing Proteus pipeline system in South Pass 89. At its deepest, Mattox will reside in roughly 7,250 ft of water. The slope of the Gulf becomes less deep as the pipeline moves west, such that in South Pass 89 the pipeline will lie in 394 ft of water.

Allseas served as the installation contractor for both the deep and shallow-water portions of the pipeline. Allseas utilized the pipelay vessel Audacia to install the shallower one-third of the line, and this part of the project was completed in January 2018. For the deeper two-thirds of the pipeline, Shell selected the Allseas pipelay vessel Solitaire, and that work was completed in July 2018. Follow-up work on the Mattox pipeline is expected to continue through the fall and wrap up in late 2018.

The Mattox pipeline is the first long-distance, large-diameter deepwater crude pipeline to be built in the Gulf of Mexico in recent years. But in addition to that, for Shell, Mattox represents a key component of its “corridor strategy” for pipelines in the Gulf of Mexico – a strategy that it has employed and built upon for decades.

Shell selected the pipelay vessel Solitaire to perform the deepwater installation, based on her flooded holding capacity for the 24-in. pipeline. (Courtesy Allseas)

Recently, Offshore spoke with two Shell officials that have been intricately involved with the Mattox project – Mike Thompson, General Manager—US Pipelines, and Richard Davis, Sr. Staff Engineer.

“Shell’s general strategy in the offshore Gulf of Mexico is really to build, own, and operate corridor pipelines,” says Mike Thompson. “We believe there’s a lot of strategic benefit for us by owning the ‘super highways’ in the Gulf of Mexico. Typically, they’re anchored by Shell equity production.”

In this case, Mattox represents a new corridor pipeline for Shell, anchored by its own Appomattox platform and production. “But we anticipate that with the way it’s positioned in the Gulf, that future discoveries, either by Shell or others, will find it advantageous to tie into our Mattox pipeline,” Thompson explained. “We’ve been successful in leveraging that strategy with our Mars corridor and with our Amberjack corridor. And we expect Mattox to be another one of those.”

In reviewing its export strategies for Appomattox, Shell considered all market options but kept a focus on the possibility of employing under-utilized assets. Related to that was the effect that a new pipeline system might have on the environment. “That was basically what led us to build a new pipeline,” said Rich Davis, “but one that would tie into existing assets; in this case, the Proteus system, which Shell also operates. There were some other ways to export the crude from Appomattox, but those options could have had more impact on the environment.”

When it came time to design and engineer Mattox, Shell recognized the tradeoffs inherent in deepwater pipeline systems -- with deeper water comes greater external pressure on the pipe; which necessitates greater wall thickness; which in turn inevitably constrains pipe diameter, and therefore export capacity. “So, in selecting a diameter, we necessarily get into details such as the amount of pressure in the wells, and how much can I push down the line with that pressure, then to the next spot where we can boost pressure again and get it flowing at the flow rate we need,” Davis said.

Richard Davis

Shell recognized that there were numerous factors that had to be taken into account when determining the pipe’s optimal diameter and wall thickness. For the Mattox pipeline, Shell selected a 1.219-in. wall thickness for the deepwater line pipe, which was supplied by Nippon Steel & Sumitomo Metal Corp. “These specifications help ensure that the system is protected against crush pressure on the pipe itself,” Davis added.

“It’s actually an interesting puzzle to sort through these factors,” says Davis, “because you look at a lot of the driving factors as to how we can get the pipe safely installed on the seabed, and which vessels are available to do that, and what installation capabilities do they have, those sorts of things. It’s a very intricate process to lay the pipeline within plus-or-minus 20 ft of the designated route, 7,250 ft down on the seabed.”

When the Shell engineers surveyed the available pipelay vessels, they selected the Audacia and Solitaire. These vessels enabled Shell to make use of the S-lay installation method, and benefit from the relatively high speed of pipelay that these vessels offer. Davis noted that the Mattox’s 24-in. diameter represented “one of the biggest diameters that you would be able to get safely installed at these water depths.” Shell recognized that while J-lay had been traditionally used in recent years to install large-diameter pipe in deepwater, there were trade-offs in terms of productivity.

The Mattox pipeline is laid off the stinger of the Allseas pipelay vessel Solitaire. (Courtesy Allseas)

When Shell opted to use S-lay for the entire Mattox pipelay, it did so based on the knowledge that the S-lay technology has improved significantly. “This water depth, line size, pipe wall thickness and weight are pretty close to the limit of the S-lay technique at the moment,” Thompson observed. “But Allseas is clearly one of the leaders in the industry, and we have confidence in their ability to safely install 24-in. pipe in 7,250 ft of water using the S-lay technique. Mattox is not the deepest subsea pipeline that we have installed, but it definitely ranks with any deepwater facility that we have designed and installed,” said Davis.

In designing the pipeline, Shell also took into consideration future field development and production facilities that could be built in the area in the future, and their possible transportation needs. “While we were engineering the pipeline, we were not only examining our production capabilities at Appomattox, but we were also looking down the road, trying to predict the overall greater Appomattox area, and do what we might call ‘urban planning,’” Davis explained. “We predict that there will be a certain number of developments in the area, and we apply a probability of success to all of them. Then, we map that out over a period of time and see how they line up with kind of the overall volume requirements for the pipeline.”

To help determine the best pipeline route, Shell selected Fugro to conduct surveys of the seabed in the area. The route selected was optimized to avoid topography that included steep peaks and valleys, and areas of gas venting. There was also some alteration of the route to avoid benthic communities on the seabed. But overall, the route did not present the types of dramatic challenges seen on other offshore pipelay projects. “With regard to the seabed topography and routing, there was nothing that really jumped out as extremely or overly challenging,” Thompson noted.

Still, Shell engineers recognize that even after the route had been mapped and the pipe laid, “we might still have some situations where you don’t know exactly how the pipe is going to lay and how much span we might end up having on some portions of the pipeline,” Davis noted. “The key question on this front will be: ‘Do we have any excessive spans in the pipe that are going to strain kind of the middle of that sag area?’ It’s something that we will have to keep our eyes on.”

With the pipeline installation now completed, Shell will hydrotest it for integrity. This will include running cleaning pigs to remove construction debris to facilitate hydrotesting. “Once we have a steady flowrate, we can then look to run an intelligent in-line inspection pig to get our baseline wall thickness and any kind of concerning areas mapped out,” Davis notes. “That will help us determine how quickly we need to go back in and take another look.”

“Once we get Mattox installed, inspected and mitigated, it should be able to operate for decades,” Davis said. “We spent a lot of time and effort in the planning and design to make sure that Mattox remains a reliable transportation system for many years to come.”

The Mattox pipeline will have a 300,000 boe/d capacity, while the Appomattox fields are expected to produce 175,000 boe/d, at peak capacity. That leaves a significant amount of capacity available for future developments in the area, whether from Shell or other producers.

“The greater Appomattox area is definitely a growth area and there will be more volumes coming out of that area,” Davis said. “So Mattox has been designed and built for future growth.” It’s an assessment Thompson shares. “The Mattox pipeline underscores Shell’s long-term strategy,” he says. “We’re very bullish on the long-term prospects in the Gulf of Mexico. We’re building infrastructure to be there for a long time and to capture that current and future production.” •