Shell's Bonga, EA development, deepwater renew interest off Nigeria

Heavy bidding by oil and gas producers is underway on Nigeria's current deep water licensing round. Some of the important factors rekindling interest by small and large offshore operators include the following:

- Recently enacted production sharing contract (PSC) terms

- Decision by Shell and partners to pursue Nigeria's first deepwater development, Bonga

- Recent deepwater exploration success, led by Texaco's Agbami discovery.

Simultaneously, Shell Petroleum Development Company of Nigeria Ltd and partners are undertaking exploitation of the shallow offshore near shore EA oilfield, as well as harnessing gas from EA, Bonga and other fields for the Bonny LNG Train 3 extension scheme. Shell's partners in the joint venture are Nigerian National Petroleum Company (NNPC) - 55%, Shell - 30%, Elf - 10%, and Agip - 5%.

Combined capital and operating costs of these projects total $ 8.5 billion. As Heinz Rothermund, Shell's E&P Director for Africa points out, that represents Nigeria's biggest single oil and gas investment to date, and is central to the country's aim of raising daily oil production to 4-5 million b/d by 2010.

Shell's focus

Shell has been the dominant foreign player in Nigeria since the 1930s. It brought the country's first oil field onstream in 1958, and through its joint venture, produces around 40% of the country's total oil output of just under 2 million b/d. According to analysts Wood Mackenzie, the joint venture (JV) has remaining recoverable reserves of 10 billion bbl of oil, 70 tcf of gas, and 2 billion bbl of condensate.

A key component of the current development initiative is the JV's efforts to promote a local gas market with associated infrastructure. Currently, the JV flares 0.75 bcf/d of gas. The aim is to eliminate flaring altogether by 2008.

The size of these assets makes Nigeria the focus of Shell's activities in West Africa. The KA platform, installed in the early 1980s, was its first Nigerian offshore project. "But it is evident that given all our onshore activities, the offshore has taken on its current high priority only in recent years," Rothermund admits. EA, for example, was discovered in 1965.

"However, clearly, we must now look at other opportunities," he said, "and offshore is hugely important. To develop in 1,000 meters of water is obviously more costly than onshore in Nigeria. For such projects to work", he adds, "Shell must transfer techniques adapted successfully in other deepwater provinces."

Bonga development

Bonga lies in block OPL 212 some 100 km offshore in a water depth of around 1,000 meters. Shell has operated the PSC since 1993, and brought in three major partners the following year. The current interests are Shell (55%), Exxon-Mobil (20%), Agip (12.5%) and Elf (12.5%).

Sediments in the deepwater section of the Niger Delta are of Tertiary age. According to Wood Mackenzie, the greater delta sequence can be divided into three main units:

- Basal marine pro-delta deposits that form source rocks for hydrocarbon generation (Akata Formation)

- Middle sand rich sequence, consisting of coastal barrier bars, beaches, tidal channels and lagoonal deposits (Agbada Formation reservoirs)

- Benin Formation overlying alluvial sands.

Continuous deposition of the Akata Formation in the deep waters in front of the prograding Niger Delta has helped preserve sediments from major erosional events that might otherwise have threatened hydrocarbon trap integrity. Akata Formation turbidites have potential traps that can be sourced locally from underlaying mature source rocks via faulting.

Seismic (2D), gravity, and magnetic data surveys were first conducted over OPL 212 in 1991 by TGSI-MABON Geophysical Co. on behalf of Nigeria's Ministry of Petroleum Resources. Subsequently, 3D seismic was acquired by Shell over the acreage between late 1994 and early 1995.

Oil was discovered by the first exploratory well on Bonga in March 1996. The well, in 1,020 meters water depth, was subsequently tested in three zones. The following year, two appraisal wells were drilled, and a fourth well was drilled in 1998.

Shell has since completed its appraisal of the field, and now puts recoverable reserves at 600 million bbl of oil and 500 bcf of gas. First half 2003 is the scheduled production start. Oil and gas output will be maintained for at least 14 years, possibly longer, depending on the results of future exploration in this area.

Improved terms

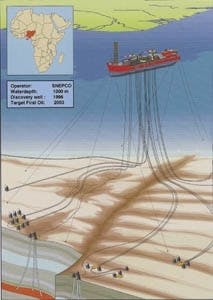

Rising oil prices are coincidental to the timing of the development, Rothermund maintains: "We've been busy doing a lot of studies and optimization for this project over the past three years." Nigeria's enactment of the PSC terms also improved the investment atmosphere. "PSCs are a big departure for the government," he explained. "As a project investment is made and recovered 100% by private oil companies," he said, it compares favorably with the previous system where NNPC always contributed 55%. The enactment of the new terms provides for the stable investment climate investors are looking for. - Subsea layout for the Bonga development.

Bonga is being developed for $2.5 billion using a newly constructed floating production, storage, and offloading (FPSO) vessel. Hitherto in deepwater, Shell was best known for its Gulf of Mexico tension leg platform (TLP) dynasty. "On the surface, however, the technology on Bonga is more closely linked to our UK North Sea FPSOs," he suggests. "Reservoirs in the Gulf of Mexico developments are mainly deeper-lying. That favors accessibility from the TLP's entry point, combined with deviated wells. On Bonga, the reservoirs are, by contrast, more shallow and spread over a large area, which favors subsea wellheads connected to an FPSO, as the host production center."

Field details

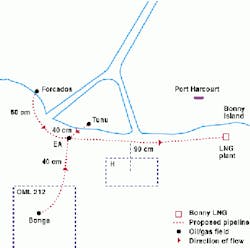

Bonga's production vessel will be capable of processing 225,000 b/d of oil and 170 MMcf/d of gas, with 65 MMcf/d set aside for lift purposes. There will be 27 seabed locations for 20 producer wells and 16 water injectors - nine of the wells will have side-tracks. Onboard water production capability will be 100,000 b/d, upgradable later in the field's life to 160,000 b/d, with a maximum water injection rate of 300,000 b/d. - Schematic shows main components of the Shell joint venture's offshore gas gathering system.

The vessel will be able to store 2 million bbl of oil, offloaded on average every five days to visiting export tankers. The OPL 212 partners had hoped to appoint a fabricator for the hull in mid-February, but the approvals process has taken longer than expected. Other main contracts to be allocated shortly relate to the 25,000-ton topsides, subsea engineering, flowlines, risers, and the mooring system.

Findings from some of the West African Development Organization's studies have been incorporated into the project, but the majority of the conceptual design work has been handled by Shell. "However, despite the 1,000-meter water depth, we're not doing anything here technically that hasn't been done before somewhere else," Rothermund insists.

EA development

More unusual is the way Bonga is being tied into the gas-gathering scheme focused around the shallow water EA development. This project is also based around an FPSO. EA, in OML Block 79, was discovered by Shell in 1965. The field lies 15 km off the Niger Delta in water depths of 13-26 meters. The $1 billion capital expenditure development will also tie in the Eja Field some 10 km West of EA, in the same OML block 79 that lies in 29 meters water depth. Oil production is slated to start in early 2003, building to a plateau of 120,000 b/d before depleting at 9,000 b/d net oil around 2018, developing 363 million bbl of oil.

According to Wood Mackenzie, the Shell/ NNPC JV's fields in the Delta region produce mainly from the Agbada Formation. Reservoirs in this basin are normally gas cap-driven with aquifer support, and usually display a high oil/gas ratio. Much of the gas produced has been flared, although of late, some has been deployed for injection or lifting to counter falling reservoir pressure. Gas from EA and Bonga, however, will be exploited for commercial use.

Development of EA/Eja will involve drilling 54 new wells, of which eight will be multilateral and 42 horizontal. Initially, two jackup rigs will be employed and the drilling contractor will be appointed shortly. To minimize disturbance to the schedule (Wood Mackenzie claims), the JV opted for an offshore development requiring minimal servicing from onshore facilities. The FPSO, for instance, obviates the need for a land-based terminal.

Eventually, four drilling platforms on EA and one drilling platform on Eja will service the floater. The weathervaning FPSO will be able to process 170,000 b/d of gross liquids and 100 MMcf/d of gas with single train, accepting high and low pressure production, and a produced water capability of 95,000 b/d. Various other prospects near EA may be drilled in future in an attempt to prolong the vessel's productive life.

EA tie-ins

Near EA, a riser platform will be installed being at the hub of an extensive offshore gas pipeline system. A 24-in. 90-km line will be laid to tie back gas from the onshore Forcados Yokri Field to the riser platform. An additional 18-in. 30-km pipeline will convey gas from South Forcados via Tunu (another onshore field on an island at the mouth of the Niger River) to the riser platform.

Gas from Bonga will be delivered to the riser platform by a 16-in. 100-km spur line, while gas from the EA field will be delivered to the riser platform by a 12-in. 5-km spur line. Gas will be delivered from the riser platform to Bonny NLNG by a 32-in. 190-km pipeline.

The JV will also provide for two further tie-ins to the new pipeline's eastern end to cater for further gas discovered in near-offshore Block H. Front-end engineering for the main line is statistically complete, and will have a likely capacity of 1,000 MMcf/d. It should come onstream by late 2002, coinciding with commissioning of the third LNG train at Bonny. Pipeline investments are expected to reach $475 million.

"Shell prides itself in being the first oil company to have addressed the problem of gas flaring in a major way," Rothermund comments. "Prior to the agreement to build an LNG plant, gas utilization was primarily for the local market, which is very limited still, and for re-injection and pressure maintenance"

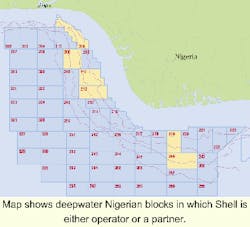

Elsewhere in the Nigerian offshore, Shell is a participant in blocks operated by Agip and Esso, including the latter's Erha discovery in 209, west of Forcados. Shell also actively considers to bid for some of the new deepwater acreage.

Although Angola offers equally good deepwater returns, overall, Shell is content with its current position. Shell has also gained confidence to pursue its current investment from the improved political climate. "Obasanjo has done a very good job since he came to power. He has re-established Nigeria in the world community."