Sakhalin offshore search interest strong, despite poor legislative progress

Exxon and Texaco are anxious to raise the exploration tempo off Sakhalin Island. Legislative stonewalling has hindered their efforts to date, but authorization is in sight for two production sharing agreements (PSA) in Block III. In the case of the Kirinsky PSA, that would clear the way for drilling on some of the region's most prospective structures.

Progress on this and the Exxon-led Sakhalin I project was outlined in London recently at the annual Sakhalin Oil & Gas conference, organized by IBC Global Gas Conferences. Delegates also gained insight into activities at the offshore Astokhskoye Field. First oil here has been achieved, but working conditions are proving tougher than expected.

The Sakhalin I consortium consists of Exxon and Sodeco, both with 30%, plus the Russian companies Rosneft and Sakhalinmornefgtegaz (SMNG), with respectively 17% and 23%. Their PSA, which became effective in 1996, covers the Chayvo, Arkutun-Dagi, and Odoptu fields. Most attention to date has focused on the first two fields, although SMNG has drilled a directional well from the beach into the northern dome of Odoptu, in 1998.

According to Rex Tillerson, President of Exxon Neftegas, the present estimate is that Chayvo has 10 tcf of recoverable gas, 75% of which is contained within three reservoir zones. "The gas resource is well defined," he claimed. "Five wells have been drilled, with 80 MMcf/d production rates possible individually. Also, 3D seismic analysis shows good seismic amplitude, indicating good reservoir continuity."

The consortium's major disappointment last year was the failure to drill a well to test the Chayvo oil leg. The well was vetoed by the State Ecological Committee because of an interpretation of Russian law concerning the legality of discharging low toxicity muds and cuttings into the sea. That sentence was vigorously contested by Exxon at the time, and Tillerson reiterated his company's view that the discharge method was consistent with the laws. "Three years of extensive monitoring by Exxon during drilling, from 1996 to 1998, demonstrated that low toxicity cuttings from water-based muds did not harm the Sakhalin environment. Laboratory tests also confirmed their low toxicity."

John Aaronson of AATA International in Fort Collins, Colorado, USA, pointed out later that a Caspian-specific eco-toxicological testing protocol had been approved for muds and cuttings disposal offshore Azerbaijan. "Sakhalin must take the lead in establishing similar protocols, so that a modern infrastructure of environmental management and protection can be achieved with a more appropriate regulatory approach," he stated.

Tillerson said that Exxon and its partners were ready to drill through the summer to the end of the drilling window, and were looking to do the same this year - the Duma (Russian legislature) and weather permitting. "If we are allowed to drill this well, we could deliver first gas from Sakhalin I by late 2005."

Heavily faulted

On Arkutun-Dagi, exploration to date by the partners has revealed extensive faulting. The Dagi-6 well in 1997 showed that all potential reservoirs were water-bearing, leading to a reduction in reserve estimates. "We will continue to analyze core samples, well test information, and so on," Tillerson said. "A successful development of Chayvo - based on shared infrastructure costs with the Sakhalin II fields - would improve prospects for economic development of Arkutun-Dagi."

For the central oil and gas production platform, the Sakhalin I partners are gravitating towards an in-house Exxon design. This is

an ice-resistant, conical steel structure also engineered to withstand heavy seas and earthquakes, and which could be manned or unmanned. However, there could also be a sequential development, Tillerson said, involving three platforms, two with living quarters and drilling facilities for year-round drilling. A fourth platform could be added a few years later on Arkutun-Dagi. At peak, oil production could reach 150,000 b/d, but all process equipment and separation equipment would be stationed onshore.

As for the gas, "we have completed our assessments of export markets to Japan and China," he said. "We feel that a pipeline link would be more competitive than shipping equivalent volumes in LNG. We are also developing a framework for gas sales to Russian domestic consumers. At this stage, the government is the only thing standing in our way."

Kirinskiy still pending

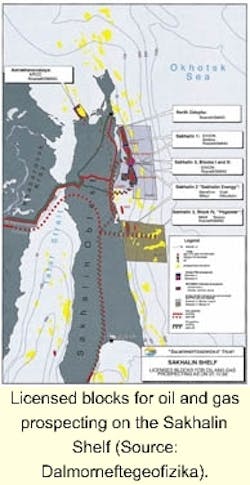

Texaco's Bill Maloney seemed optimistic that drilling could proceed shortly on the Sakhalin III Kirinskiy Block, managed by the PegaStar consortium (Texaco, Mobil, SMNG and Rosneft). Exploration has been stalled since a DMNG/PGS vessel acquired 1,100 km of 3D seismic over two of the block's larger structures in 1998. Last May, however, a List Law covering this block was enacted which authorizes the Russian Federation to conclude the PSA. The same applies to East Odoptinsky and Ayyashskiy blocks to the north in Sakhalin III, where Exxon is the consortium leader.

Unlike Sakhalin I and II, which are purely development PSAs, Sakhalin III also embraces exploration. Kirinskiy block covers an area of over 7,000 sq km, with one recorded gas discovery, Kirin. The major undrilled prospect is South Kirinskaya, with numerous other undrilled targets in waters up to 300 m deep. If South Kirinskaya contains oil predominantly, Dalmorneftegeofyzika estimates reserves could be up to 3.3 billion bbl, which would make it the largest oilfield yet discovered on the Sakhalin shelf. If gas dominates, the estimate is 34.3 tcf recoverable.

Since water depths are much greater than those in Sakhalin I and II, production design will vary accordingly.

The base case, Maloney said, would be a steel structure or gravity-based concrete platform, either one supporting topside production and processing, and also resistant to sea ice and other environmental forces. The platform would likely be built in a local shipyard such as at Nakhodka or Nikolayevsk-na-Amure. However, PegaStar may opt instead for subsea completions tied back to a land-based processing facility, or early production (if oil was the upshot) using an a floating production vessel.

A major oil discovery could trigger construction of a Trans-Sakhalin oil pipeline, with conventional tankers and oil loading in an ice-free port nearby such as Korsakov or DeKastri. Alter natively, ice-breaking tankers could be deployed with direct oil loading via offshore loading systems in ice. The gas scenarios include a:

- Southern or western LNG plant with conventional LNG tankers

- Northern LNG plant with ice-breaking LNG tankers

- Gas pipeline to mainland Russia, China and/ or Japan.

Production start

Sakhalin II is the only producing licence to date in the region. It is managed by the Sakhalin Energy Investment Company con sisting of Marathon, Mitsui, Mitsubishi, and Shell. Each have their special responsibilities: Marathon drives upstream activities; the two Japanese companies focus on marketing the gas in the Far East; Shell concentrates on the potential LNG plant.

Two fields are under phased development within this license. To the south, Lunskoye, 13 km offshore and in 50 meters water depth, is chiefly gas-bearing (there is a small condensate rim). Gas reserves are estimated at 14 tcf. Further north, Piltun-Astokhskoye is a complex oil-bearing structure, 16 km offshore and in 30 meters water depth. Oil and condensate reserves here are estimated at 750 million bbl.

Under Phase I, the Molikpaq platform was successfully installed on the Astokhskoye Field in 1998, with first oil achieved last August, and the first cargo delivered from the floating storage offloading (FSO) vessel Okha in September (oil heads to the FSO via a subsea pipeline and a single anchor leg mooring buoy). According to Alan Grant, president of Sakhalin Energy Investment. Phase I cost $655 million, including $220 meters to build new offices and accommodation on the island for support staff. A new six-level office block in Yuzhno was due to open this month. "We're not here for a few years, but for up to 40 - hence this commit ment," Grant said. In Nogliki, in the northern part of the island, the consortium shares a base camp with the Sakhalin I team, from where 90 people are shuttled back and forth to the Molikpaq. Nogliki is also the base for oil spill operations.

The Sakhalinskaya jackup has been stationed alongside the Molikpaq for development drilling. Currently, production is limited from July to December, with the FSO removed thereafter as the weather deteriorates. Drilling, however, had to go ahead during the winter of 1998-99, and the weather was even worse than expected, according to Grant.

Production currently has to be shut down in December when ice in the Sea of Okhoysk reaches a certain thickness. However, as part of the Phase II development, the consortium aims to achieve year-round production from all three fields as more platforms and associated pipelines come into service to the south. The plan is to construct facilities onshore at Katang* with pipelines transporting oil and gas 400 km to an ice-free port at the island's southern end. Piltun will be the next field to be developed, with two delineation wells planned this year. Grant predicted an eventual capex figure for Sakhalin II of up to $10 billion.

Unsurprisingly, Grant put the Russian approvals process on a par with the environment as a development hazard. "To get where we are today has taken a huge effort. Over 80 gov ernment ministries and agencies have been involved in granting environmental and technical approvals for the installation phase. We then required another 200 approvals to operate the Molikpaq and FSO.

His pointers for the region's petroleum future included more effective implementation of PSA legislation. "The future political climate in Russia will influence financing. Banks and clearing agencies are very nervous. Obviously, infrastructure sharing would boost development, but we're way ahead of the others already at Sakhalin II. We can't wait for them.