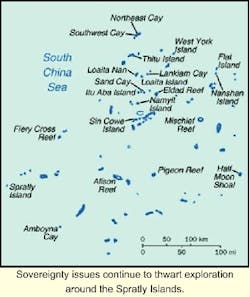

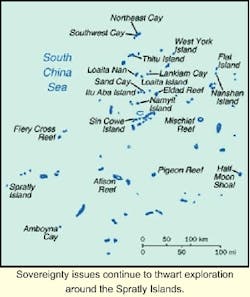

ASIA/PACIFIC: Interest in Spratly Islands search fading as disputes continue

The South China Sea is host to a complex web of overlapping maritime jurisdictional and sovereignty claims, complicated by the presence of two disputed archipelagos of islands and reefs known collectively as the Spratly and Parcel Islands. There is a widely held perception among the littoral states that in addition to important fisheries resources, the disputed area also boasts considerable seabed resources, most especially hydrocarbons. While it is clear that the "oil factor" is significant, is it an illusory one?

Estimates of the hydrocarbon resource potential of the Spratlys area falls into the very broad range of 1-30 billion tons of oil, but how realistic are these claims? Even if present in commercially viable quantities, oil and gas exploration and exploitation may take decades to realize.

An energy map of the region reveals that exploration and exploitation activities are marginal to the South China Sea and the Spratlys area specifically. Concessions, exploration wells, and proven oil and gas fields are all concentrated in the nearshore, shallow fringes of the Sea. Indeed, research from the East/West Center has indicated that in excess of 90% of commercial oil and gas reserves in the South China Sea are likely to be discovered on the shelves and slopes of the surrounding littoral states rather than further offshore.

Exploration potential

The Spratlys area can be subdivided into three distinct regions:

- The Reed Bank Basin to the east

- The central area, or Nansha basin

- The Vanguard Bank (Wan'an Bei) area in the west

The Reed Bank is underlain by as much as 9 km of Tertiary and Cretaceous sediment. Additionally, preliminary drilling efforts indicate the presence of good source and reservoir rocks while stratigraphic sections point to the existence of the structural traps necessary for oil accumulation, notably faulted anticlines.

Since the 1970s, The Philippines has been licensing survey work on the Reed Bank, despite protests from China and Vietnam. In the late 1980s, Kirkland Oil received a geophysical survey and exploration contract from The Philippines covering around 6,000 sq nautical miles. In May 1994 Vaalco Energy and its Philippine subsidiary Alcorn Petroleum and Minerals gained a permit to conduct a desk-study of the Reed Bank area - a move duly protested by China.

What's been found? Of the four test wells drilled on the Reed Bank, it is believed that three were dry, while the other contained sub-commercial gas quantities. In the central area, there has been a distinct lack of drilling or seismic exploration. The Vanguard Bank looks far more promising.

The limited seismic data available suggests the area does host geological structures that could contain significant quantities of oil and gas. It could even be considered analogous to the Cuu Long and Nam Con Son basins off Vietnam (to the west) or the more distant Natuna basins to the south.

Overlapping concessions

The Vanguard Bank area is characterized by overlapping oil exploration concessions and is the focus of Sino-Vietnamese rivalry over resource jurisdictional issues in the South China Sea. The oil exploration concessions are at least partly designed to underpin national jurisdictional claims rather than simply to realize successful oil and gas exploration and exploitation.

Attempts by either side to encourage exploration activity such as seismic surveys and test drilling have been stymied by the fierce and direct warnings issued by both claimants in relation to the dire consequences of undertaking such activities in the disputed areas. Survey ships have reportedly been chased away and drilling rigs blockaded.

The oil and gas potential of the Vanguard Bank is therefore still very much open to question. At least one senior oil company executive has stated that while there was enough prospectivity to warrant exploration, including drilling, the basin is generally regarded as significantly less promising than the Sarawak basin and well below the Nam Con Son basin.

Mixed potential

Why is it that estimates of oil and gas potential of the Spratlys and the South China Sea vary so wildly? Essentially, this is because of insufficient data. However, one must also look towards the interests of those providing the estimates. Government estimates tend to err towards the optimistic in order to attract international interest. Bold estimates regarding potential oil wealth also serve to underpin aggressive and/or inflexible positions on questions of national policy relating to sovereignty and jurisdiction. By contrast, oil companies tend to downplay an area's given potential in order to secure more commercially favorable contractual terms.

However, it should be remembered that independent scientific institutions such as the Lamont Doherty Geological Observatory and the German Geological Survey are also optimistic about the area's oil and gas potential, as are non-regional players including the US and Russia.

Oil and gas is almost certainly present in the Spratlys area, particularly underlying the Reed and Vanguard Banks. Whether in sufficient quantities, appropriate water depths and in technically manageable situations is another matter. Depth has been cited as a negative factor counting against oil exploration in the region. However, much of the area is actually shallow and as is well known, deepwater drilling technology is advancing rapidly. Approximately 10,350 sq km of the seabed lies under less than 200 meters of water on the Reed Bank and associated banks.

Editor's Note: This is an edited version of a paper presented at the Resolving International Border Disputes conference in London, July 2000, organized by Global Business Networks.