Operators begin cleanup, repair from Katrina, Rita

Cost set at twice that of Sept. 11 attack

David Paganie

Senior Editor

Pam Boschee

International Editor

In less than 30 days, two of the strongest hurricanes to sweep through the Gulf of Mexico reached landfall and dramatically changed the GoM offshore operations scene. Offshore production facilities and refinery shut-ins were extensive enough to force the US government to tap into its emergency oil reserves. Internationally, other nations agreed to deliver additional oil and refined products to the US.

Given the extensive damage reported from early inspections, offshore contractors are expected to mobilize significant amounts of equipment back to the Gulf.

Current operational and design standards are being brought under scrutiny as a result of damage inflicted from the storms. The MMS has awarded $600,000 in contracts to analyze and assess the damage to structures and pipelines, determine the effectiveness of current design standards and pollution prevention systems, and develop recommendations for changes to industry standards and MMS regulations, if needed.

Offshore damage assessment

As a means of comparison, some 150 platforms and 10,000 mi of pipeline were in the direct path of Hurricane Ivan when it slashed through the GoM in September 2004. Ivan reached top sustained wind speeds of 165 mph, which designates it as a Category 5. It weakened to a strong Category 3 (winds of 111-130 mph) as it entered the eastern GoM.

As a result of that storm, seven platforms were completely destroyed and 24 sustained significant damage, while four mobile offshore drilling units (MODUs) were found adrift, two platform rigs were unfastened, one jackup was damaged, a jackup and platform rig were completed destroyed and a significant number of pipelines were damaged from mudslides and other factors.

Included in this count were five deepwater (greater than 1,000 ft of water) facilities that sustained significant damage to topsides and/or production equipment. The structures include Dominion’sDevil’s Tower spar, Murphy’s Medusa spar, Chevron’s Petronius compliant tower, Total’s Virgo platform and Shell’s Ram Powell TLP. Chevron’s Petronius and Total’s Virgo, which were producing a pre-Ivan combined rate of 42,791 b/d and 86.5 MMcf/d, remained shut-in for over six months. The other three structures were brought back online relatively quickly.

While the industry was still repairing the damage from Ivan, Hurricanes Katrina and Rita struck, bringing even more Category 5 level winds (155 mph).

Katrina, which contained top winds of 185 mph, made landfall on the Gulf Coast as a Category 4 (131-155 mph) on Aug. 29. Shortly thereafter, Hurricane Rita followed with maximum winds of 175 mph and reached landfall on the Gulf’s coast on Sept. 24 as a Category 3.

Early assessments from the MMS indicate that from Katrina, 46 structures were destroyed (some of which were single-well caissons), 20 production platforms have extensive damage, four drilling rigs were destroyed (one jackup and three platform rigs), nine rigs sustained extensive damage (four from broken anchor patterns), and six drilling rigs were set adrift. All loose rigs have been relocated, remanned and repowered.

Shell indicated that the hurricane impacted itsMars TLP, Ursa TLP, Cognac platform, and West Delta 143 platform. The operator says that the damage appears to be limited to topsides equipment and that it may not be feasible to restart the facilities in the fourth quarter, depending on options available for recovery.

According to Helmerich & Payne, its platform rig H&P 201, which is installed on theMarsTLP in Mississippi Canyon block 807, lost its derrick completely and sustained damage to its floor and substructure.

A number of MODUs broke free from their moorings and drifted several miles, according to rig owner reports. Diamond Offshore says its jackupOcean Warwickdrifted 66 mi northeast of its initial location in Main Pass block 299 to Dauphin Island off the coast of Alabama. Transocean reported that its semisubmersibleDeepwater Nautilusdrifted 80 mi from its pre-storm location, sustained significant damage to its mooring system, and lost approximately 3,200 ft of marine riser and a portion of its subsea well control system.

The MMS estimates that approximately 2,900 platforms and 19 floating production installations were located along the paths of Hurricanes Katrina and Rita. Owners of 18 of the floating units located along the hurricane impact path reported no significant damage.

Stone Energy Corp. has indicated that three of its fixed platforms disappeared in the wake of Hurricane Rita. The operator’s displaced platforms include South Marsh Island block 180 Platform D and Vermilion block 255 Platforms A & B.

Chevron reported damage to one of its major assets when itsTyphoonTLP in Green Canyon block 237 in 2,000 ft of water was severed from its mooring and suffered severe damage.

Several MODUs were found adrift from Hurricane Rita, as well. Transocean reported that its semisubmersibeTransocean Marianaswas grounded in shallow water after being forced off its location by the storm and drifting 140 mi northwest of its pre-storm location. Noble Corp. indicated that four of its semisubmersibles operating in the Green Canyon area broke away from their mooring lines as Hurricane Rita passed. The rigsNoble Therald Martin,Noble Paul Romano,Noble Amos RunnerandNoble Max Smithmoved approximately 89 mi, 118 mi, 75 mi, and 123 mi, respectively, off their original locations.

The US Coast Guard Marine Safety Unit (MSU) of Morgan City says it continues to conduct offshore pollution assessments and damage caused to facilities as a result of Hurricane Katrina. To date, the organization’s National Response Center (NRC) has received 101 reports, of which 74 were for pollution and 27 associated with damaged or lost offshore facilities.

MSU Morgan City’s outer continental shelf (OCS) zone is comprised of approximately 1,400 fixed platforms, 100 MODUs, and 21 floating offshore installations.

At press time, the MSU Morgan City issued a Marine Safety Bulletin due to the massive response to oil and HAZMAT spills in the coastal waters of the GoM. The bulletin says that the captains of the ports may temporarily exempt specific performance requirements reflected in the vessel response plans on a case basis in accordance with 33CFR 155.130. In addition, authority to grant temporary exemptions was set to expire Oct. 15.

Port damage extensive

Several Gulf Coast ports located in the paths of Hurricanes Katrina and Rita sustained significant damage. Gary P. LaGrange, president and CEO of the Port of New Orleans and chairman of the American Association of Port Authorities (AAPA), told the Senate Finance Committee that over 20 ports that belong to AAPA were impacted.

Some of the facilities that sustained severe damage may need to be relocated, LaGrange said, and it will take others several months, maybe years to fully recover. The Louisiana Department of Transportation & Development - Office of Public Works and Intermodal Transportation estimated that the southwest ports of Louisiana sustained over $1.7 billion in damage. The Port of New Orleans was one of the hardest hit by Hurricane Katrina. At press time, it was operating at 20% of its pre-Katrina level.

Given the extensive damage to ports along Louisiana’s coast, many in the industry speculated that the Port of Morgan City, which had minor damages, would be the site for port entities to temporarily relocate. According to local realtors, a number of companies plan to move there on a temporary basis.

Baton Rouge-based Shaw Group Inc. says it will undertake activities associated with two major contracts at Morgan City’s port facilities. The company says it was awarded a contract from the US Army Corps of Engineers to aid in the recovery and rebuilding efforts worth $100 million for one year, with an additional one-year option. Shaw was also awarded a $100 million contract from the Federal Emergency Management Agency (FEMA) to provide support service in the aftermath of Katrina.

Government grants aid

Michael J. Olivier, secretary of the Louisiana Department of Economic Development, toldOffshoreshortly after Katrina hit, “We’re slowed down, but we’re operational” in response to the extent of damage inflicted on the state’s production facilities and refineries. “Venice could be identified as key launching location for servicing the eastern Gulf, including exploration below Mississippi, Alabama, and the Florida panhandle,” he said. “And the ports of Fourchon and Morgan City are excellent locations to serve the central Gulf area.”

Olivier said that they were joining with the states of Mississippi and Alabama to propose federal legislation for an Economic Recovery Act of 2005 for the Gulf Coast states.

US economic impact

The greatest impact to the US economy as a result of the damage from Hurricanes Katrina and Rita may be the shortage of gasoline and other refined products, due to extended shut-ins and damage to the Gulf Coast refineries.

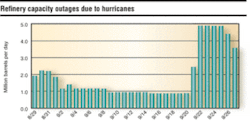

One day after Katrina made landfall, the US Department of Energy (DOE) reportedthat 17 refineries, equivalent to 3,657,400 b/d, located along the Gulf Coast were impacted. About half were shutdown, equivalent to almost 2 MMb/d; others reduced their runs or reported some level of loss of supplies.

At press time, the Energy Information Administration (EIA) estimated that the refinery outages have resulted in 1.3 MMb/d of lost gasoline production, over 700,000 b/d of lost distillate fuel production and nearly 400,000 b/d of lost jet fuel production.

The MMS reported that total cumulative shut-in of oil production at the end of September was approximately 39.4 MMbbl, equivalent to 7.189% of the yearly production of oil in the GoM (approximately 547.5 MMbbl). The cumulative shut-in of gas production was 188.540 bcf, which is equivalent to 5.165% of the yearly production of gas in the GoM (approximately 3.65 tcf).

To put things into perspective, according to the EIA, the US consumes over 20 MMbbl of petroleum products each day; almost half of it is used in the form of gasoline. The US refines almost 50% of each bbl (42-US gallon equivalent) into gasoline.

Design criteria

Based on early damage inspections from Hurricanes Katrina and Rita, damage to the Gulf’s infrastructure may be much greater than from Hurricane Ivan. Last year in an MMS presentation to the American Association of Professional Landmen, Chris C. Oynes, regional director of the GoM OCS region for the MMS, said that one of the industry’s challenges is to address the Gulf’s aging infrastructure. According to statistics within the presentation, almost 75% of the existing offshore platforms are at least 10 years old. The MMS requires operators to follow assessment processes outlined in NTL 2003-G16 for all platforms over five years old.

Construction demand

Offshore construction contractors experienced strong demand for their recovery services as a result of damage inflicted by Hurricane Ivan. That trend has increased significantly following Katrina and Rita.

Shortly after Hurricane Katrina passed through the Gulf, the MMS issued a notice to lessees and operators and pipeline right-of-way holders in the federal waters, OCS region, requiring the timely inspection of all facilities located along the path of Hurricane Katrina. According to the published notice, all facilities require an above-water visual inspection, a general underwater visual inspection, and an additional underwater inspection of areas of known or suspected damage.

The regulatory agency requires the inspection of all facilities beginning with those closest to the eye of the storm path and then moving outward. Inspections must be completed by May 1, 2006, with repairs expected to be completed by June 1, 2006. The requirements are adding to the demand for offshore inspection and repair.

Global Industries, for example, is mobilizing vessels into the GoM to perform hurricane work. The vessels nominated for transit include Global-owned and operated derrick/pipelay bargesCherokee,Iroquois,Titan II,Sea ConstructorandPioneer.

Cal Dive International attributed its considerable increase in 4Q 2004 revenues from the preceding quarter and year over year to increased demand for its services as a result of damage from Hurricane Ivan. The company also recognized a record utilization level for its vessels during the same quarter, during a given fourth quarter period, which is typically the slow season for most construction contractors.

Now, Cal Dive says it expects that one of its key near-term growth-drives for the subsea division of its Marine Contracting group is additional inspection, repair, and cleanup work from the latest two hurricanes. The contractor says its recent asset purchase from Torch Offshore will likely be allocated for work associated with storm damage.

“We are very pleased to have concluded this complicated transaction and are now focused on getting the acquired assets back to work, especially given the extra demand generated by Hurricane Katrina,” said Martin Ferron, president, Cal Dive International. Owen Kratz, chairman and CEO, said “Hurricanes Katrina and Rita have added meaningfully to the already robust demand for marine contracting services, offsetting impact on our oil and gas production and production facility businesses.”

Horizon Offshore says it is currently working with oil and gas companies in the GoM to assess the damage to offshore platforms and pipelines caused by Katrina. The contractor expects its EBITDA for 2005 to reach record levels, due in part to the increase in demand for services. In addition, the company expects the high level of demand for their services to continue for the remainder of 2005 and into 2006.

Oceaneering says its six multi-service vessels:Ocean Intervention I,Ocean Intervention II,Ocean Quest Ocean Service,Ocean ProjectandOcean Inspector, are currently working at a 100% utilization rate on activities associated with inspection services from hurricane damage.

In addition, the company’s dedicated inspection division is anticipated to secure a large amount of the additional work required to assess damage. Oceaneering just ccompleted a 132-day Level 1 inspection program to examine the coatings and structural integrity of 1,531 GoM platforms, including over 5,000 risers for 21 companies. At press time, the company was awarded inspection of 600-700 platforms located in the path of the hurricanes. The contractor says it anticipates picking up contract awards to inspect an additional 200-300 facilities.

Insurance premiums outlook

Included in the aftermath of Katrina and Rita are the financial hits taken by the insurance industry. As the claims tally progresses over the next few months, some insurers and reinsurers may find themselves staggering from their own damages.

Although estimates of overall insurance losses at press time ranged from $35 billion to $60 billion, it’s uncertain what the final sum may be.

Standard and Poor’s (S&P) credit analyst, Thomas Upton, says, “Even the low side of loss estimates place it at almost twice the cost of the Sept. 11, 2001 attacks and more than Hurricane Andrew with insured losses of about $22 billion and the 2004 hurricane season with combined losses of $22.7 billion.”

Several reported offshore losses illustrate the extent of the damages incurred. For example, Rowan located the wreckage of theRowan-New Orleans, its LeTourneau 52-class slot jackup rig, which capsized and sank in 155 ft of water in Main Pass block 185 offshore Louisiana during Hurricane Katrina.

The rig was insured for approximately $1.1 million more than its carrying value. Removal of the wreckage is expected to exceed Rowan’s $5 million annual insurance deductible.

GlobalSantaFe reported severe damage to two of its rigs,GSF Adriatic VII and GSF High Island III. All of the company’s rigs are insured under a hull and machinery policy subject to a total deductible of $10 million for this event. The two rigs had a combined net book value at June 30, 2005, of $22.2 million and are insured for a total of $125 million. The rigs contributed $5.3 million of the company’s total $135.3 million of net income for the first six months of 2005.

Noble maintains a deductible of $10 million per any one occurrence, with a $40-million annual aggregate deductible in the company’s marine package insurance program. Based on current information, it expects hurricane-related claims under its insurance program to exceed the $10 million deductible.

Because of the catastrophic losses, there will undoubtedly be a shake-up among the insurance providers as their resources are put to the test.

John Keely, senior VP of AON Natural Resources Group, says, “This is by far the biggest loss that the energy market will have ever sustained. Lloyd’s of London syndicates submitted estimates of what the loss would cost them on a net basis. The figure is $2.2 billion for on and offshore losses for those syndicates that underwrite an energy book. In offshore terms, Hurricane Ivan in 2004 was the biggest loss prior to this at $1.4 billion.

“Lloyd’s is saying that their offshore premium income is around the $500 million mark - their point being that their rating levels are unsustainable.”

Reinsurers, which provide insurance to the insurers themselves, may face a bigger risk as they bear most of the costs associated with catastrophic claims. In essence, the primary insurance outfits spread their risk among the reinsurers.

The determinant of many of the reinsurers’ fate will be whether these hurricane losses, particularly Katrina, are payable from reinsurers’ earnings or if the losses eat into the reinsurers’ capital. Right now, the capital markets appear to be accepting the view from insurers and reinsurers that they can manage this loss within their existing capital base or will raise new capital to take advantage of increased premium rates that they believe will follow.

“There are underwriters currently saying that they may be cutting back the amount of aggregate or amount of capacity that they will make available for Gulf of Mexico exposures,” Keely says.

Keely points out that because there is insurance capital that has not been affected by this loss, there are going to be individual underwriters that aren’t necessarily impacted that badly by this loss. But not every underwriter writes every particular energy package. “You’ll find there will be certain companies who bring a far greater share of loss to the market than others. There are plenty of operators in the GoM who had no Ivan loss and have had no Katrina loss.”

Insurers are starting to look at the U.S. Gulf Coast as its own special case. Some insurers are already talking about segmenting their businesses in each of the Gulf Coast states in separate subsidiaries, much as some already do for Florida.

Keely says, “Those clients who have suffered catastrophic losses have a bigger challenge ahead of them, so their strategy for going forward in terms of how they approach their insurance and how they buy their insurance is going to be a greater challenge for them.”

Words of advice for future insurance planning? This may be the time to shop aroundas many policies are up for renewal by Jan. 1. Pay attention to the credit agencies’ ratings of your current and/or prospective insurance providers. Also, inquire about the insurer’s own reinsurance provider. The ratings provide an indication of the insurers’/reinsurers’ access to capital in the event of additional catastrophic events.

At press time, S&P had already put the global reinsurance industry on negative outlook. This implies that downgrades are expected to outnumber upgrades in the remainder of 2005, although the number of downgrades is expected to be modest.

Currently, plenty of insurance market experts are describing the Katrina-Rita destructive duo as a market-changing event with anticipation of across-the-board premium increases. However, actual renewals, at least in the short term, do not uniformly reflect such a trend. But anyone looking for major savings on renewals between now and Jan. 1 will most certainly be disappointed.•