Deepwater discoveries

Chris Oynes, regional director, Gulf of Mexico region, Minerals Management Service, updated the deepwater Gulf of Mexico activity at the Offshore Technology Conference in Houston.

“The deepwater Gulf of Mexico continues to be an expanding frontier with many new discoveries and new geologic plays,” he said.

Oynes also added three new deepwater oil and gas discoveries to the 2004 list, bringing the total to 15 discoveries last year. Newfield made one of them with its La Femme field well in Mississippi Canyon block 427 in 5,800 ft of water. Anadarko Petroleum Corp. made the other two discoveries, both in the Lloyd Ridge area. One is the Cheyenne field in Lloyd Ridge block 399 in 8,987 ft of water and the other is South Dachshund/Mondo Northwest in Lloyd Ridge block 2 in 8,340 ft of water.

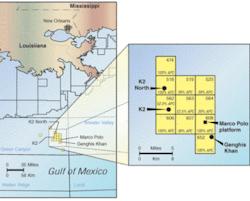

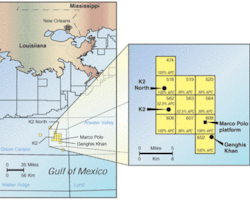

Anadarko has continued its successful run in the deepwater GoM in 2005. Its latest discovery is Genghis Khan on Green Canyon block 652 in 4,300 ft of water. Open-hole logs indicated about 110 ft of high quality net oil pay in the Lower Miocene formation and apparent additional pay uphole in the Middle Miocene section.

The operator drilled the discovery to 26,000 ft TD in approximately half the time originally forecast. Anadarko is planning a delineation well immediately.

“Our deepwater GoM program is set to be the largest single contributor to Anadarko’s growth strategy over the next four years,” Robert Daniels, senior vice president exploration and production, says. “Having the Marco Polo facility available to produce the Genghis Khan discovery greatly enhances the project’s returns, both by accelerating the development plan and leveraging off existing assets.”

First production is expected in 2006 through subsea tieback to the Marco Polo platform, 2.4 mi from the discovery.

Anadarko has a 100% working interest in the block.

Other Anadarko discoveries in the Green Canyon area are the Marco Polo field, which came online in July 2004, and the K2 and K2 North fields, which will begin production through the Marco Polo platform in mid-2005. Anadarko has a 100% working interest in the Marco Polo and K2 North fields and a 52.5% interest in the K2 field.

Anadarko plans to drill six more exploration wells in the GoM this year. The company owns an average 73% interest in 230 blocks in the Gulf.

First production

McMoRan started production of Hurricane Upthrown at South Marsh Island block 217 in the Gulf of Mexico on March 30, less than three months after reaching total depth. Current gross production is about 65 MMcf/d, 15 MMcf/d net to McMoRan. The company established production on a 42/64-in. choke with flowing tubing pressure of 7,650 psi.

The Hurricane well is using the Tiger Shoal facilities, which also produce the JB Mountain and Mound Point discoveries. McMoRan has rights to approximately 7,700 gross acres in the Hurricane prospect area, which is off Louisiana in 10 ft of water.

The Hurricane lease is eligible for royalty relief on the first 5 bcf of gross production. McMoRan is planning additional wells in this high-potential area.

Asset acquisitions

Statoil has agreed to acquire EnCana’s entire deepwater US Gulf of Mexico portfolio for $2 billion.

EnCana’s portfolio is comprised of high quality discoveries and exploration opportunities, with the potential to deliver 30,000 boe/d by 2008/9, increasing to more than 100,000 boe/d by 2012. The acquired properties contain expected discovered resources of 334 MMbbl and expected total resources of 500 MMbbl.

“The GoM has recently delivered several world-class discoveries, and there is a significant remaining potential. We have the skills, experience, and technologies that will contribute to efficient development of these complex deepwater projects and add value to the partnerships,” says Helge Lund, Statoil CEO.

This transaction makes the GoM a core area for Statoil, and expands its global deepwater position.

“This acquisition creates a new international core area for Statoil. It gives us the opportunity to utilize and further build on our capabilities in exploration, reservoir management, and subsea technology,” says Peter Mellbye, head of international exploration and production.

The portfolio comprises an average 40% working interest in 239 gross blocks, covering 1.4 million acres. The core of the portfolio is the Tahiti development and the Tonga, Fox, Jack, St. Malo, and Sturgis discoveries.

Statoil will hold a 25% interest in the ChevronTexaco-operated Tahiti development, planned to deliver first oil in 2008. A number of nearby prospects represent future tieback options to the Tahiti facility.

Jack and St. Malo lie in the Walker Ridge Area. A production test is planned for 2006 and first oil is expected in 2013. Sturgis lies in the Atwater Valley Area and appraisal drilling is planned this year. Clustered with other prospects, a Tahiti-type development is possible, with first oil estimated after 2011.

The sale was expected to close on or before June 1, and is subject to normal closing conditions.

Lease sale

The Minerals Management Service announced in the Proposed Notice of Sale 196, an offshore oil and gas lease sale in the western Gulf of Mexico, scheduled for Aug. 17.

The proposed Sale 196 encompasses 3,754 unleased blocks covering 20.3 million acres in the Western GoM Outer Continental Shelf planning area offshore Texas and in deeper waters offshore Louisiana. The blocks are 5-357 km offshore in water depths ranging from 8-3,100 m. MMS estimates the proposed sale could result in the production of 136-262 MMbbl and 0.81-1.44 tcf.