GULF OF MEXICO

David Paganie • Houston

StatoilHydro, W&T make deepwater discoveries

StatoilHydro and W&T Offshore both reported discoveries in the deepwater Gulf of Mexico in early 2008. StatoilHydro and partner ExxonMobil (operator) struck oil on the Julia prospect in the Walker Ridge area. The discovery well was drilled in 2,000 m (6,562 ft) of water to 9,500 m (31,168 ft) TD. The companies plan to delineate the well this year to determine the field’s commercial extent.

Julia is the first well drilled under a 2005 exploration agreement between StatoilHydro and ExxonMobil in the deepwater GoM.

StatoilHydro also participates in developing two additional discoveries in the same area, Jack and St. Malo. Both are scheduled for first production post 2013.

W&T Offshore says it made a discovery with well No. 4 on the Healey prospect in Green Canyon block 82 in 2,420 ft (738 m) of water. At print, official well results had not been released. SemisubmersibleNoble Lorris Bouzigard drilled the well.

In other drilling news, McMoRan Exploration Co. says its Flatrock No. 2 delineation well found four hydrocarbon bearing sands in the Rob-L section. Results were logged at 15,500 ft (4,724 m) deep. The company is deepening the well to 18,100 ft (5,517 m) proposed depth to evaluate additional targets in the Rob-L and Operc sections. At print, a third appraisal well, Flatrock No. 3, was drilling towards 18,800 ft (5,730 m) proposed depth and targeting sands 3,000 ft (914 m) south of the Flatrock discovery well.

Flatrock is on OCS 310/Louisiana state lease 340 at South Marsh Island block 212 in 10 ft (3 m) of water. First production is expected in 1Q 2008.

Technip wins Shell Perdido installation contract

Shell has awarded Technip a contract for installation work on the Perdido oil field. The contract covers engineering, fabrication, and installation of one flowline and one steel catenary riser, with a total length of 8.24 mi (13.2 km). The pipelines will reach a maximum water depth of 9,700 ft (2,955 m) along the route.

Technip’s Houston office will execute the contract. The pipelines will be welded at the group’s spoolbase in Mobile, Alabama. Installation will be carried out by Technip’s pipelay vesselDeep Blue.

Operators approve budget increases

Operators on the shelf are allocating more resources to drilling in 2008 versus 2007. W&T Offshore’s board has approved an $800-million (41% exploration, 56% development, 3% seismic) budget for exploration and development in 2008, up 77% from 2007. The budget includes capital to drill 50 wells, including 44 exploration and six development wells. Of those wells, 40 are on the conventional shelf and 10 are in the deep shelf or deepwater.

“As I’ve mentioned before, it takes around two years to review and evaluate a transaction of the size of Kerr-McGee and our 2008 budget is consistent with that statement,” says Tracy Krohn, chairman and CEO of W&T Offshore. “In 2008, over half of the wells budgeted to be drilled are on the former Kerr-McGee properties. The company is clearly committed to drilling in 2008 and we look forward to an exciting year with the drill bit.”

Bois d’Arc also intends to pick up the pace on exploring the shelf in 2008, with $250 million budgeted for exploration and development, up from $214 spent in 2007. The company has allocated $139 million of the budget to drill 21 wells; 11 of those will test the deep shelf. In addition, spending will include $19 million on seismic acquisition and $92 million on production facilities, recompletions, and abandonment work.

At print, the company was drilling its first shelf well of the year on the Chinook prospect in South Pelto block 21. The well is expected to reach 18,500 ft (5,639 m) proposed depth in February.

“In 2008, we will direct more of our resources to increasing our production rate than we have in previous years,” says Gary W. Blackie, president and CEO of Bois d’Arc. “We are targeting production growth of 10 – 15% in 2008. Our 2008 drilling program also includes 11 higher potential deep prospects that expose the company to significant reserve growth if they are successful.”

Meanwhile, McMoran has approved $225 million for capital expenditures in 2008, up from $153 million spent in 2007. A portion of the budget will be allocated to the Blackbeard project in 70 ft (21 m) of water on South Timbalier block 168. The company is working on plans to re-enter the Blackbeard No. 1, which was drilled to 30,067 ft (9,164 m) in August 2006, and temporarily abandoned before reaching the primary targets. McMoran plans to begin drilling on the project in mid-2008.

WorleyParsons wins SSP-320 detailed design

OPE Inc. has awarded WorleyParsons SEA Engineering the detailed design of the SSP-320 hull. The Satellite Services Platform (SSP) is a patented spherical shaped floating vessel with a center column, which provides measurable advantages over ship-shaped vessels and traditional platforms, according to OPE.

“The SSP offers the oil and gas industry an exciting opportunity to significantly reduce capital costs and increase performance in a wide range of applications, including FPSO vessels,” says Gary Quenan, OPE president. “This step-change solution is extremely stable in the roughest seas.”

The SSP-320 has been model tested. Its operational equivalent has capacity to store 1.25 MMbbl of oil and process 80,000 b/d of oil. The SSP project engineering team is expected to deliver the specified material and fabrication packages in 3Q 2008 to obtain accurate construction quotes and shipyard availability, OPE says.

Shelf assets change hands

W&T Offshore has agreed to acquire Apache Corp.’s interest in Ship Shoal 349 field offshore Louisiana for $116 million, pending closing conditions.

The field covers two federal lease blocks, Ship Shoal 349 and 359. The effective date of the sale is Jan. 1, 2008, and closing is expected by April 30, 2008.

Also, Mariner Energy Inc. has agreed to acquire Hydro Gulf of Mexico LLC from StatoilHydro for $243 million. The acquired holdings include 9,600 boe/d of production and 8.3 MMboe in reserves, all in shallow water.

“StatoilHydro wishes to focus its strategy, operations, people, and capital in the deepwater acreage where our technology and skills as the world’s largest operator of deepwater fields are most advantageous to us,” says Øivind Reinersten, senior vice president of StatoilHydro’s North American region.

“We will keep all deepwater leases that were associated with Spinnaker and maintain our position as the fourth largest leaseholder in the deepwater Gulf of Mexico.”

Meanwhile, Contango Oil & Gas Co. purchased an additional 8.33% working interest in the Dutch discovery (Eugene Island block 10) and an additional average 9.11% working interest in the Mary Rose discovery (Louisiana state leases) from three companies for $200 million. The estimated proved reserves purchased were 29 bcfe; proved and probable were 38.2 bcfe. Contango plans to drill and complete two additional Mary Rose wells by mid-2008. Production will be directed through a platform in Eugene Island block 11 at an initial rate of 250 MMcf/d of gas.

Superior to plug wells, decommission platforms

BP Plc., Chevron Corp., and Apache Corp. have contracted Wild Well Control Inc., a subsidiary of Superior Energy Services Inc., to decommission seven downed platforms and related well facilities offshore Louisiana for $750 million.

The work will be done in water depths ranging from 85 to 135 ft (26 to 41 m) and is expected to take three years to complete.

Superior Energy says Wild Well Control has gained access to and plugged and abandoned more than 340 wells on 30 downed platforms in water depths of up to 340 ft (104 m), which required the removal of more than 15,000 metric tons (16,535 tons) of steel structure and more than 400 pressurized and unpressurized entries into wells, all involving more than 830,000 diving man-hours and almost 6,500 ROV runs.

Socotherm opens anti-corrosion plant

Socotherm Americas SA subsidiary Socotherm LaBarge officially has opened the doors of its anti-corrosion production and services plant in Channelview near Houston.

The plant is designed to manufacture and to apply anti-corrosion coating and thermal insulation on steel pipe for installation in the deepwater GoM. Products used at the facility include Socotherm’s five-layer syntactic polypropylene thermal insulation for pipe up to 48 in. (122 cm) diameter. Socotherm LaBarge is owned by Socotherm Americas SA (51%) and LaBarge Pipe & Steel (49%).

Defective mooring shackles alert regulators

According to a safety alert issued jointly by the US Coast Guard and MMS, a failure occurred in a portion of an anchoring system in two separate incidents. One component failed on a system in the GoM; the other was found during installation to be defective after a similar component failed overseas, according to the report. In the first incident, a 1-ton, 8-in. (20-cm) diameter shackle connecting a mooring system to anchoring pilings failed on an overseas floating production facility. Subsequently, an identical shackle scheduled to be used with a deepwater GoM production facility also failed below specifications under test loads. The report indicates that the shackles were possibly defective in both cases. In the GoM case, new shackles were ordered and the installation of new pilings and the replacement of portions of the mooring system that could not be recovered also were required. First production has been delayed by at least one year, according to the report.

In the second incident, the report says two sockets in a mooring system for a MODU failed under moderate loading. Testing of the remaining sockets found that others also were defective and a number of them failed at less than specification loading, according to the report.

The MMS recommends that operators do the following:

- Review specifications requirements to insure testing and manufacturing produces a product that will meet the usage demands

- Include sufficient Charpy testing requirements in the specifications to insure the materials and manufacturing process will produce a product of sufficient toughness

- Review requirements for both destructive and non-destructive testing of critical elements, and insure test coupons are properly representative

- Review requirements for equipment inspection and handling to insure no damaging techniques are employed in transportation or installation.

BP contracts Pride drillship

BP has contracted Pride International’s newbuild ultra deepwater drillship for five years starting in the GoM in 3Q 2010, upon completion of construction.

The drillship will be capable of drilling in 12,000 ft (3,656 m) of water but rigged for 10,000 ft (3,048 m) with a TVD capacity of 40,000 ft (12,192 m). The drillship is to have DP-3, deck load of 20,000 metric tons (22,046 tons), a 1,000-ton (907-metric tons) capacity top drive, and a 160-metric ton (176-ton) active-heave compensated construction crane.

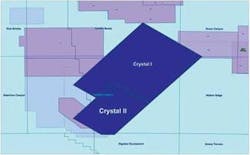

TGS-Nopec, WesternGeco start survey

TGS-Nopec Geophysical Co. and WesternGeco have started acquiring a multi-client, wide-azimuth 3D survey in the GoM. The mcWAZ Freedom Phase survey is to cover 650 outer continental shelf blocks in Mississippi Canyon and Atwater Valley.

The mcWAZ program will use WesternGeco Q-Technology and onboard Wave Equation depth migration to provide a quick-look migrated data volume. TGS recently created an anisotropic velocity model calibrated to over 280 check shot surveys in and around the program area. This model will be used in the onboard quick-look product.

null