Pan-African independent builds base in Nigerian marginal fields

Jeremy Beckman - Editor, Europe

Recent events have confirmed Afren’s credentials as an emerging force in West Africa. Over the past year, the company has:

- Achieved first production as a technical operator in the Okoro Setu field off Nigeria

- Signed further partnerships with indigenous companies to develop projects in Nigerian concessions

- Extended its operated exploration and production asset base into waters off Ghana and Cote d’Ivoire

- Struck accords with major European energy companies to pursue and monetize stranded gas throughout the region.

Afren, based in London and Lagos, was formed in late 2004 with the declared aim of becoming the leading pan-African independent. That confidence was based largely on strong connections at industry and government level.

Among the founder members, chairman Dr. Rilwanu Lukman was formerly head of Nigeria’s Petroleum Resources Ministry. Chief executive Osman Shahenshah was an influential figure in oil and gas finance in West Africa for 15 years, working with NNPC and various major oil companies. Afren Nigeria’s executive chairman, Egbert Imomoh, had 30 years’ prior experience with Shell in Nigeria and western Europe, as did Okoro field development manager, Alan Hunt.

Nick Johnson, Afren’s head of exploration and new ventures based in London, previously helped develop business opportunities for OMV in North Africa and elsewhere. From the outset, he says, part of Afren’s strategy has been to access portfolios of the majors, “particularly in Nigeria, where there are a whole bunch of undeveloped fields held by the majors that are not being progressed.

“The fast-track development of the Okoro field in Nigeria allowed us to demonstrate that we could operate safely and to high technical and environmental standards. This has given us a proven track record technically and commercially. We have also shown that we can complete deals in Nigeria and elsewhere.

“Under the country’s new president, Umaru Yar’Adua, there has been a real change in terms of the government wanting to push new activity. Everyone there is aligned now in wanting to see undeveloped fields taken forward.

“However, one of the real challenges for an E&P company across West Africa as a whole is completing asset deals. This is where the connections of our founders are extremely advantageous. If you look at our recent acquisitions in Cote d’Ivoire and Ghana, our deal with Devon Energy was done many months ago, but completion had to wait on final government approval and signature. Having access to the right people helps to expedite this process, otherwise a lot of these deals can fail to make the finishing line.”

Access to secure finance also is critical, given the ongoing turmoil in the banking sector. “Afren is doing outstandingly well in this regard,” Johnson says, “with all our forward exploration and development programs fully funded.” That includes the $300 million committed to the various phases of Okoro Setu. “Much of the support is coming from banks in Nigeria,” he adds, “and we will continue to seek further participation from the growing capital base in African markets.”

In October, the company strengthened its hand further by forming an alliance with Japanese industrial/investment group Sojitz to pursue oil and gas opportunities in Africa. Sojitz will provide finance for acquisitions, partly through securing funding support from the Japanese government.

“This deal also demonstrates to the market that we can raise real money right now,” Johnson says. “We don’t know at this stage exactly what projects it will lead to, but the combination works for both parties, with Sojitz seeing Afren as their partner of choice in West Africa. The alliance will be directed more at appraisal and development projects. Hopefully this won’t be the last such deal Afren enters.

“Since mid-summer, we have also had our first real cash flow coming in from Okoro, which makes a change for our bankers. We are currently listed on Britain’s Alternative Investment Market, and ultimately we would like to go onto the main market. We had planned to do that this year, but the company is growing very quickly – if we had applied for a main listing, we would have had to freeze our asset base to undergo due scrutiny. We didn’t want to end up doing nothing for three months.”

Local content

Afren is recruiting more staff to manage its growing numbers of projects and operational centers – not just technicians, but also administration personnel in Nigeria and Cote d’Ivoire to manage its production cash flow. The London operation has grown to 50 employees, with 20 Nigerian nationals in place in Lagos and 120 in Cote d’Ivoire, 99% locals and all inherited from Devon. “Our business model is to staff local offices with indigenous people, ideally with no ex-pats at all,” Johnson explains.

Initially, Afren outsourced much of its technical engineering and design work. However, the arrival of new COO Shahid Ullah in July with the technical team from Jefferies Randall and Dewey, which have worked on numerous projects throughout the Gulf of Guinea, has strengthened in-house capability in many areas, notably in reservoir modeling and geoscience.

“Going forward, another area under discussion is how we manage our drilling requirements, which we have also outsourced until now, although we do employ a drilling manager in Lagos. Our forthcoming deepwater exploration well off Ghana, for example, is being managed by SPD in Aberdeen. But if we are to drill a significant number of wells in the next few years as operator, as planned, we have to review how best to do this. It’s a fact of life that we have to stay pretty flexible.”

Production path

Afren is targeting output of up to 50,000 b/d of oil from its current interests within the next three years. “When we started,” says Johnson, “our main aim was securing a revenue stream from production. Now we have assembled a more mixed portfolio, and going forward, high impact exploration will have a bigger part to play in reaching our goals.”

Okoro is on target to contribute 20,000 b/d by year-end. Japan Petroleum discovered the field in the eastern part of the offshore Niger Delta in 1973; 20 years later, operatorship passed to Amni International as part of offshore mining lease OML 112, under the Nigerian indigenous licensing program.

In mid-2006, Afren formed a production sharing and technical services agreement with Amni to appraise and develop Okoro and Setu, an accumulation 7 km (4.35 mi) to the north which Amni had drilled four years earlier. After a successful appraisal well and sidetrack on Okoro, which encountered low viscosity oil in the upper and lower hydrocarbon sands, Afren issued a development plan which the government approved in March 2007.

The first-phase development was based on five high-angle/horizontal wells into both sets of sands, with completions up to 1,500 ft (457 m) long. An additional two wells were completed in November as part of the development drilling program, so seven producers now are available.

These have been drilled by the jackupAdriatic VI from a subsea template to a nine-slot wellhead platform in 13 m (42.6 ft) of water, a conductor-supported minimum offshore structure designed by UK contractor UWG. Both facilities were fabricated by Nigerian contractor CMES at a naval dockyard in Lagos.

A three-phase flexible pipeline transports produced well fluids to the 211-m (692-ft) long, 33,080-ton (30,010-metric ton) FPSOArmada Perkasa, spread-moored 800 m (2,624 ft) southeast of the field. The vessel, a former tanker now owned and operated by Malaysian shipping group Burmi Armada Berhad, has an effective oil storage capacity of 200,000 bbl, constrained by the shallow water depth, and a liquids processing capacity of 27,000 b/d. Two gas-lift compressors can also send 20 MMcf/d of gas to the platform wells via a separate flowline. DeepFlex in the US manufactured the polycarbonate flexible lines for installation via the reel-lay method from the back of a work boat.

Afren is working on a potential solution for a tieback of the smaller Setu field to the Okoro facilities, and there are various infill drilling opportunities close to Okoro, according to Johnson. Afren estimates a productive life of 10 years, with potential recoverable reserves on the two fields of around 42 MMbbl.

The company’s next offshore development project could be Ebok in OML 67, 50 km (31 mi) off southeast Nigeria in 135 ft (41 m) of water. The ExxonMobil/NNPC joint venture discovered the field in 1968, drilling two further wells in 1970. Last year, the JV awarded a 100% interest and operatorship to Abuja-based E&P company Oriental Energy Resources, which also operates the nearby offshore concession OML 115.

In September, Afren secured approval to take a 40% equity interest in Ebok, and the partners contracted the jackupTrident IV for an appraisal program that started in November. The main aims are to determine the areal distribution of the reservoir properties – “the range of field size is quite big,” Johnson explains – and to acquire a comprehensive data set, including fluid samples, to aid development planning. The rig will perform up to two drillstem tests with full sand control and extensive wireline logging.

Afren estimates recoverable reserves from two fault blocks tested by the first two Ebok wells could exceed 25 MMbbl, with further appraisal/exploration potential in an adjacent undrilled fault block and a prospect to the north. Subject to results, it aims to issue a development plan during spring 2009, leading to first oil in 2010.

Options at this stage involve either two wellhead platforms with deviated wells exporting to an FPSO, or a single wellhead structure linked to a nearby platform operated by XOM and a third-party FPSO. Following cost recovery, the NNPC/ExxonMobil JV would receive a net profit interest, with Afren and Oriental sharing net production revenues.

Afren also has a production sharing agreement with Bicta Energy and Management System to develop Ogedeh in OML 90 close to the western Niger Delta. This 1993 Chevron discovery has estimated oil in place of up to 15 MMbbl, with further potential at several shallow levels. It could form part of a cluster development with the marginal Ajapa and Akepo fields in the adjoining OML 90.

Ghana targets

During the course of this year, Afren completed negotiations to purchase Devon Energy’s E&P interests offshore eastern Ghana and Cote d’Ivoire. The US company concurrently sold its stakes in projects in Equatorial Guinea and Gabon, preferring to focus on its holdings in the Gulf of Mexico and Brazil.

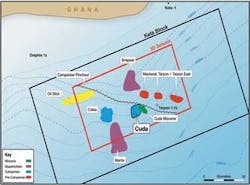

The Ghana interests comprise 88% of the 5,500-sq km (2,124-sq mi) Keta block in the Volta River basin, the remainder held by Ghana National Petroleum Corp. (GNPC) and local company Gulf Atlantic Energy. Devon had identified prospective drilling targets in Upper Cretaceous deepwater sandstone reservoirs, similar to the play type that yielded the Jubilee and Odum discoveries in Ghana’s far west. Previous exploration in the block had focussed unsuccessfully on shallow water and onshore Tertiary plays.

“We bid for Keta before the Jubilee discovery,” Johnson explains. “Deepwater exploration was not really our primary focus – our main goal was to access production in Cote d’Ivoire, but it was more attractive for Devon to sell a package that included its assets in Ghana, besides which we saw strong exploration potential in the Keta block.” One commitment well had to be drilled on Keta by year-end under the terms of the current license period.

As part of the transaction, Afren secured a drilling slot from Devon for the drillship TransoceanDeepwater Discovery which spud a 50-day well in November on Cuda, a potentially large prospect in a structural stratigraphic play in 1,700 m (5,577 ft) of water. Afren has eased the burden of the $65 million well cost by farming out 20% of the block to Mitsui.

“The prospectivity of the license, we think, is very high,” says Johnson. “There are a lot of prospects in the block which we are screening in-house, using a large 3D dataset that came with the deal. Many of these are independent of the Cuda prospect and a decision as to whether to enter the next exploration period is due at the end of this year.”

The $164-million Cote d’Ivoire package, funded through debt financing provided by BNP Paribas, comprises shared operatorship of offshore block CI-11 with national oil company Petroci; majority ownership and operatorship of block CI-01 to the east, bordering Ghanaian waters; and 100% ownership of Lion GPL, Cote d’Ivoire’s sole onshore gas processing plant. The various interests also give Afren net daily production of around 5,300 boe/d and net reserves of 28 MMboe.

All operated production comes from the Lion and Panthere fields in CI-11, developed by UMC in 1995, later acquired by Ocean Energy which itself went on to merge with Devon. The two fields are produced through a mobile offshore production platform and four tethered caissons in 246 ft (75 m) of water, 13 km (8.1 mi) offshore. The oil and gas is sent through pipelines to Abidjan, the gas being processed at the Lion plant for domestic use.

Afren plans a series of workovers and wireline work next year in an attempt to lift production to 400-500 boe/d. “This could be seen as a small increase and a modest return for larger companies,” says Johnson, “but for us an extra 500 boe/d would be extremely worthwhile.” There could be additional upside in Turonian and Senonian intervals and Foxtrot sands.

The next priority will be to formulate development plans for the Eland, Ibex, and Kudu accumulations in block CI-01, drilled by Esso and Agip between 1964 and 1985. Combined reserves are estimated at 105 bcf of gas and 8 MMbbl of oil.

“These are small fields which will require a creative cluster development. We want to work on this solution initially in-house; facilities engineering, however, will probably be outsourced.”

Afren sees a market for the gas emerging from 2010 onwards: one possible solution involves an offshore processing platform on Ibex, with a 98-km (60.9-mi) subsea oil pipeline terminating at a refinery close to Lion, and an 8-km (5-mi) pipeline taking produced compressed gas to a minimal facility platform on Eland. The latter would be linked to another minimal facility on Kudu exporting gas and condensate through a 72-km (44.7-mi) subsea line to Lion.

The gas plant also handles volumes from CNR’s Espoir and Baobab fields in adjacent offshore blocks CI-26 and CI-40.

“It works, is in good shape, and the maintenance is very good, although some de-bottlenecking could be needed if we produce extra gas. There could also be scope for bringing in gas from other third party fields.”

Elsewhere, Afren is a minority partner to Chevron in the Nigeria-Sao Tome & Principe Joint Development Zone offshore block 1. Chevron drilled the Obo oil and gas discovery in 2006, but it was not large enough to warrant standalone development. The partners are waiting on the results of wells planned by Addax and others in adjacent blocks before committing to further drilling.

Afren has more ambitious plans in the longer term to monetize West Africa’s huge resources of undeveloped gas, which include building new LNG centers. Two years ago it formed a joint venture with African Gas Development Corp and Equatorial Guinea national gas company, Sonagas, to develop supplies throughout the Gulf of Guinea via facilities in Equatorial Guinea. One project the partners are monitoring is the proposed Zafiro associated gas development.

This year, Afren entered another agreement with German utility EON Ruhrgas to pursue opportunities in Nigeria where Afren has prospective gas exploration acreage in the onshore Anambra basin. More recently, it signed a memorandum of understanding with France’s EDF to identify and develop offshore and onshore stranded gas assets in Congo and Gabon.

“Both these companies are major players,” says Johnson, “with very attractive reputations and financial positions. They in turn see Afren giving them a strategic uplift to access local African markets.”