Nick Terdre, Contributing Editor

The oil industry has great hopes for the arctic, which it sees as one of the final frontiers for offshore oil and gas exploration. But more research and careful planning are required if the industry is to come to grips with the challenges posed by the extreme conditions of this region, as was made clear at IBC’s conference on Offshore Oil & Gas Developments in Arctic and Cold Waters in Stavanger in June.

The potential prize offered by the arctic is a large one - 109.4 Bboe, according to Howard Wright, a senior analyst at Infield Systems. Four operators are particularly prominent, controlling two-thirds of the 98 fields discovered to date: Gazprom, with 20%, BP with 18%, Statoil with 16%, and ExxonMobil with 14%. In terms of reserves, Gazprom is the clear leader, potentially accounting for 87% of the total discovered resource, Wright claims.

Five arctic fields are under development: Statoil’s associated Snøhvit and Albatross fields in Norway, Eni’s Nikaitchuq and Pioneer Natural Resources’ Oooguruk, both in Alaska, and Gazprom’s Prirazlomnoye in Russia.

In the Norwegian sector, Statoil is set to play the dominant role. Its activities are currently concentrated in the southern Barents Sea, according to project manager Sigmund Helland. Here, investments could amount to NOK 70 billion ($12.21 billion) in 2007-15, not including the first Snøhvit LNG train, which is due onstream this year.

Production from this core area could reach 250,000 boe/d in 2011-13 and settle at 200,000 boe/d in the late 2010s/early 2020s, Helland suggested. This scenario is based on oil from Snøhvit, where a crucial appraisal well was completed in July, Eni’s Goliat field, expected onstream in 2010, and a second train at Snøhvit starting up in 2014.

A weighty contribution can also be expected from Russia, added Helland, quoting figures of 14 commercial discoveries - five in the Barents Sea and nine in the Pechora Sea - plus a further 73 prospects, of which 34 are ready for drilling. In production terms these fields could yield up to 1 MMboe/d.

Environment strategies

As the planet warms, the arctic environment is inexorably changing. Sea ice is the canary of the ice system, providing early warning of change, according to Dr. Birte Gerdes of the biosciences division of the Alfred Wegener Institute for Polar and Marine Research in Bremerhaven, Germany. Ice has high albedo, or reflectivity of solar radiation. As ice melts, the albedo is reduced, and the ocean warms, which in turns leads to reduced ice formation.

Since 1960, the warming of arctic regions has been twice that of the globe as a whole. The area covered by sea ice has been substantially reduced and is now decreasing at a rate of 2.7% a decade, Gerdes says.

Eventually, the ice could disappear to such an extent that navigation through the Northwest Passage in Canada’s Arctic Archipelago will be straightforward. But at present, the effect is to increase the movement of ice floes so that navigation remains difficult even though the presence of year-round ice has fallen.

Strategies for minimizing contamination of the arctic environment and dealing with contingencies such as oil spills are needed as the oil industry’s presence in the arctic grows. It is not only exploration and production activities that are set to increase, but also tanker traffic, given the growing interest in developing northern routes for transporting oil from the Russian arctic to consumers in Europe and other markets.

Ice and oil spills are not a welcome combination. Oil on the surface of sea tends to slip under the ice and become encapsulated in it, making removal a major challenge. But oil is a rich source of carbon and therefore a nutrient for forms of bacteria, which are attracted to the oil and absorb oil molecules. Hydrocarbon-degrading bacteria are ubiquitous in the marine environment, but in the presence of oil, the proportion of the local bacterial population expands from 1% or less to more than 10%.

This process - bioremediation - offers a natural solution for disposing of spilled oil. But it is a slow one, virtually coming to a standstill in the winter months. Experimental work by Gerdes and others, including field trials on Svalbard, have found promising results for methods of speeding up the process, such as adding nutrients like phosphate and nitrate (fertilization).

Metocean monitoring

Reliable metocean data delivered in real time is available for companies operating in Arctic waters. Fugro Oceanor has been using metocean buoys to collect data in the Barents Sea since 1976, starting on the Tromsø Patch and extending its activities to several strategic locations in the Norwegian and Russian sectors, including the Shtokman area, according to Jan Petter Mathisen, manager for Seasense/Seadata activities.

Companies wishing to monitor specific areas more closely can also acquire their own buoys. Recently, Statoil deployed two Wavescan buoys in the Norwegian Barents Sea, while the Norwegian Coastal Administration has one buoy deployed on the route used by Russian shipping around the North Cape of Norway. Data from these buoys can be viewed on Fugro OCEANOR’s website (www.oceanor.com/barents_sea).

Metocean data provide various benefits, such as improving the quality of weather forecasting and making it possible to forecast such extreme events as polar lows. They are also valuable when planning response operations during emergency events such as vessels drifting after losing power or in the case of oil spills. Long-term weather statistics are also a vital tool in designing facilities for permanent installation.

Pipeline challenges

Designing, constructing and operating pipelines in an offshore arctic environment is a more complex task than in warm-water environments, according to Glenn Lanan, pipeline engineering manager with Intec Engineering.

Among the risks posed to offshore pipelines in some parts of the arctic is ice-gouging, where a trail is gouged through the seabed by the keel of a moving ice mass. To avoid this danger, pipelines can be trenched to a depth beyond any likely scouring, typically 1-3 m (3-10 ft) deep. But, depending on the circumstances, deeper trenches could be called for, possibly as deep as 6 m (20 ft), in which case trenching would become an expensive operation.

Strudel drains - whirlpools created as springtime river water flowing over near-shore sea ice enters cracks through which it can funnel down - can also create problems for pipelines. The swirling waters at the seabed can scour away the pipe-trench backfill, sometimes leaving unsupported pipeline spans. Heat from the pipeline contents can help facilitate the creation of strudels by weakening the ice above the pipeline.

The interaction between a pipeline and its surroundings is also important when installation is being planned in an area of subsea permafrost. Heat from the pipeline contents can melt the ice crystals in the soil matrix, leading to consolidation of the soil and subsequent settling of the pipeline.

Upheaval buckling can also result when a pipeline warms up and expands during operation. Vertical pipe movement may not in itself damage the pipe, but can expose it above the seabed to other hazards, such as ice-gouging.

Various technologies exist for monitoring leaks in pipelines, clearly a sensitive issue for oil and gas activities in the arctic. Fiber optics is an interesting new technology that can be applied for this purpose; it does not directly detect a leak, but anomalies in the cable signal properties can indicate that an environmental loading or leak may have occurred, which can help to pinpoint the leak location.

Despite the many challenges posed by offshore arctic conditions, pipelines can be safely installed and operated, Lanan says. Intec has considerable experience with arctic pipeline projects, including the design of BP’s Northstar pipeline, which has been in operation for six years, and Pioneer Natural Resources’ Oooguruk line, installed earlier this year, both in the Alaskan Beaufort Sea.

Ice-strengthened spar

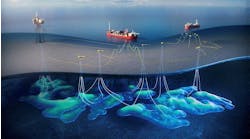

Subsea production facilities avoid the ice in ice-laden areas, but surface facilities also have benefits to offer, even if they must overcome the ice challenge. The merits of both solutions are under study for Gazprom’s Shtokman field, with much attention being paid to the proposal for a direct subsea tieback to shore over 560 km (348 mi).

Norsk Hydro, in addition to its work on a subsea-to-shore solution for Shtokman, is developing the concept of an ice-strengthened spar platform. A platform figures in both of the main development scenarios for Shtokman on which work has focused since 2004, according to Dagfinn Sveen, chief engineer, marine structures, who is involved in development of the platform concept.

In one scenario, a platform would be installed on the field to provide water separation and pressure boosting facilities. The other scenario involves the direct transport of production to shore through multiphase pipelines. Even in this case, however, a platform is likely to be needed at a later stage to house pressure boosting facilities.

The spar was chosen after a screening process that also evaluated TLP and buoy platform concepts. In 2005, Hydro engaged Technip Offshore to further develop the spar concept and to prove the design principles and technical feasibility.

The water depth at Shtokman, which is in the Russian Barents Sea northeast of the Kola Peninsula is around 330 m (1,082 ft). Ice conditions are variable, with little or no ice in some years, but at times multi-year ice with heavy ridges. In recent years, icebergs have sometimes been observed in the area.

One of the main design challenges, therefore, is to produce a platform that in extreme cases can disconnect, but for which the probability for disconnection would be minimized.

The platform has 70 MMcm/d gas processing capacity and a topside weight of 30,000 metric tons (33,069 tons). It has a deep draft, with a total hull length of 188 m (617-ft). This, together with a high volume of fixed ballast - 65,000 metric tons (71,650 tons) - and water in the soft tank make it about twice as heavy as any existing spar platform, which in turn means that in the event of ice impact, heeling will be minimized.

The normal operational draft is 158 m (518.4 ft) with an operational displacement of 229,300 metric tons (252,760 tons). In the event of heavy ice conditions, the platform would be ballasted down to an ice-breaking draft of 173 m (568 ft), raising its displacement to 238,000 metric tons (262,350 tons).

The first line of defense against ice, however, is the mooring system, which consists of 36 lines arranged in four groups. The mooring system is dimensioned to withstand the most extreme loads from ridges and also has the capacity to absorb the kinetic energy of icebergs. Calculations show that it would be sufficient to stop virtually all sizes of icebergs that could be expected, Sveen says.

Though the chance of an iceberg breaching the mooring lines is a very low-probability event, the platform is designed to withstand an impact. The hull would be likely to suffer plastic deformation while maintaining its integrity,.

In the case of collision with an iceberg that causes breakage of mooring lines, the risers would be disconnected to avoid the risk of accidental spillage of hydrocarbons into the sea. Various options for riser disconnection are being considered.

Re-connection is likely to be a lengthy process, involving the replacement of damaged mooring lines and risers, Sveen says.