New capabilities should ease E & P processes

Jeremy Beckman

Editor - Europe

Two of the companies in for the long haul are Neste and Kvaerner Masa-Yards, respectively Finland's oil company and one of its leading contractors. As Finland is a neighbor with strong historical ties to this part of Russia, the companies feel that an involvement here is only natural for them.

Activities are centered on field development, oil transport and environmental protection. Together with a number of Murmansk companies, Neste and KvMY are part of the Arctic Offshore Working Group which, among other activities, has carried out extensive environmental studies and established a baseline for monitoring the effects of future offshore activities in the region.

Neste has two licences in the area. One is for Yuzhno-Shapkinskoye, a medium sized onshore oil field discovered and appraised in the 1970s. Since the licence was originally issued, Elf has farmed in to take 30%, leaving Neste with 20% and the Russian partners with 50%. Activities are channeled through SeverTEK, the partners' joint operating company.

"Last winter we performed a successful re-entry and tested of one of the existing wells," says Kalervo Makinen, Neste's vice president for planning and finance. "We now plan to drill

a new well next winter." The working window in the region is wintertime, when the ground is hard.

Yuzhno-Shapinskoye lies some 80-90 km from the nearest road and pipeline, and before production can start, transport links to the field will have to be established so that personnel and materials can be moved in and oil out.

But a more fundamental problem, Makinen says, is the need for the country to decide its fiscal regime. More than a year and a half after it reached the Duma, proposed legislation on production sharing is still under discussion, and at present it is impossible to say when the field might be brought on stream.

Both Neste, with 39%, and KvMY, with 10%, have stakes in the Pechormorneft offshore licence. The remaining 51% is held by several Russian companies, mainly from the Murmansk area.

The licence contains the Pomorskoye discovery, which has yet to be appraised. Several other structures have also been identified. But again production can only been envisaged in the long term, and Makinen expects Pomorskoye to take even longer than Yuzhno-Shapinskoye to yield first oil.

Gas potential

On the gas side, Neste is involved with Conoco, Norsk Hydro, and Total in studying production scenarios for the giant Shtockman ovskoye gas field. Preparations for a secondfeasibility study are currently being made.

Here, the prospect of production is even further off, Makinen says. Not only is the market amply supplied from onshore fields in Russia and offshore fields in Norway, but a huge investment - around $20 billion - will be required to develop Shtockmanovskoye, which has reserves about three times as big as Norway's Troll Field (1.2 tcm).

For KvMY, the region represents challenges principally in the area of offshore loading and oil transport. Under previous ownership, the company's two yards supplied many Arctic vessels to the Soviet Union as part of the war reparation program and thereafter. It is the world's leading builder of icebreaker vessels.

Its expertise in ice technology is supported by state-of-the-art research facilities both at its own Arctic Research Centre and at the Helsinki University of Technology's Arctic Offshore Research Centre. KvMY's ice research facilities helped play a part in winning the group the contract for engineering and project management of Exxon's Arkutun Dagi Field off Sakhalin Island, according to Mikko Niini, the company's vice president of marketing and sales. He is also head of KvMY's representative office in Moscow.

The company has a contract, though financing is not yet confirmed, to build a supply vessel/icebreaker for a Russian owner. With the installation of a containerized seismic system, the vessel could also be deployed on seismic surveys during the summer.

Arctic tankering

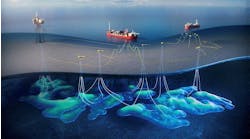

In 1993 KvMY and Neste jointly established a tanker company called Arctic Shipping Services in Murmansk, to ship oil products along Russia's Arctic coast to east Siberia, giving their captains and crews the opportunity to learn these routes.The potential prize for developing ice shipping expertise is a big one - once development activities get under way on the many discoveries made in the region, exports could rise as high as 500,000 b/d. KvMY has equipped Seiki and Lunni, two 16,000 dwt product tankers, with the Azipod propulsion system, which has proved its effectiveness in ice. Using this experience, it has developed the concept of the double-acting tanker, which goes ahead in open waters and astern in ice - the bow is an efficient open-water design strengthened for ice, while the stern is configured for icebreaking. The concept thus makes for an efficient overall performance for transport from Russia's Barents and Kara Seas coasts to west Europe.

"Even today we could carry condensate from Ob Bay on the Kara Sea to Europe," says Piini. "There is no other way of exporting the condensate produced in that area at present other than putting it into the oil pipeline system and losing some of its value." Hence KvMY is promoting the idea of installing temporary offshore loading facilities in the Ob river.

It has also suggested establishing a LNG trade with Europe, together with the building of an LNG plant on the Yamal Peninsula. Both KvMY and Neste are involved in the studies for the Northern Gateway Terminal for oil export. The choice between four proposed locations for the terminal is due to be made soon, Piini says.

In addition to involvement on the shipping side, Neste is also participating in the Baltic Pipeline project, an oil pipeline which would run from north-west Russia to a terminal in Karelia on the Baltic Sea.

Meanwhile, KvMY has used its ice laboratory for testing offshore development concepts, including a Russian designed production platform for the Prirazlomnoye Field. Despite the slow progress made in the region, Piini is optimistic that the effort the company is investing will eventually pay off. "While most other companies are losing interest, we still believe that Russia offers a big project potential," he says.

Copyright 1997 Oil & Gas Journal. All Rights Reserved.