Six UK plays hold potential opportunity

The recent PanCanadian Buzzard discov-ery in the North Sea demonstrates that giant oilfields can be discovered in mature areas. Around 4,000 exploration and appraisal wells (including respuds and sidetracks) have been drilled on the UK Conti-nental Shelf (UKCS) over the past 37 years, resulting in more than 235 producing fields and 250 significant discoveries. The peak of explora-tion and appraisal activity occurred in 1990 with over 200 exploration and appraisal wells drilled.

The success rate over the last 30 years has been a robust 35%. This includes several significant discoveries made in 2001. Of these 2001 finds, PanCanadian’s Buzzard discovery is the largest with announced reserves of 300-400 MMBOE. Buzzard is the biggest find on the UKCS since the Schiehallion Field was announced in 1993 and the largest in the UK North Sea since the Nelson Field, discovered in 1988.

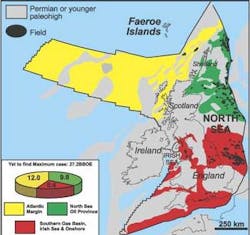

The maximum case ultimate recoverable reserves in the UK sector are estimated at 80 BBOE. By end 2000, cumulative production measured 30 BBOE. The estimates of yet-to-find reserves are 4-27 Bboe, according to "The Development of the Oil and Gas Resources of the United Kingdom" a government publication. These government figures appear to be consistent with industry thinking.

Geology

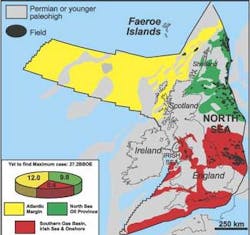

The geological evolution of the North Sea area is complex. The UK and the North Sea have largely lain in an intraplate setting from the Permian to present day. Nevertheless, the area has been far from quiescent. Glennie and Underhill (1998) identify five main tectonic events that control present day hydrocarbon occurrence, resulting in a variety of hydrocarbon-rich basins with significantly different geological histories. The first of these tectonic events was the Permo-Triassic rifting and thermal subsidence. This was possibly coeval with the initiation of subsidence in areas that were later to become the Viking and Central Graben systems of the North Sea. The Permian dune belts of the southern North Sea developed in an area to the south that was little affected by later Jurassic tectonic events.

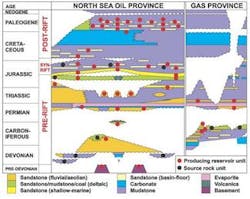

Then came the Middle Jurassic domal uplift. This uplift led to widespread volcanism and the subsequent development of a trilete rift system (failed triple-junction) in the northern and central North Sea. The Late Jurassic to Early Cretaceous crustal extension resulted in the formation of major rotated fault blocks within the Viking and Central Grabens, which contain many of the largest North Sea oilfields. The North Sea is then characterized by post-rift thermal subsidence during the Late Cretaceous and the Tertiary. The North Atlantic rifting effectively superseded thermal subsidence to the west of the UK mainland. Significant deepwater sands were deposited during the Tertiary and form the main reservoirs of the Foinaven and Schiehallion fields. Tectonic inversion of the Mesozoic basins was an inversion of former sedimentary basins which occurred across northwest Europe during the Tertiary.

The petroleum systems of the main basins are well documented. The vast majority of the reserves found lie within the areas defined by mature source rocks. Vertical migration of hydrocarbons along fault conduits appears to be the mechanism for reservoir entry.

The bulk of the oil and gas in the northern and central North Sea basins is derived from a single source rock, the Late Jurassic Kimmeridge Clay. In contrast, the southern North Sea gas province has been charged almost entirely from the Carboniferous Coal Measures.

The combination of progressive latitude migration of the UK to the north and attendant climatic variation, structural deformation, erosion, and sedimentation is responsible for oil and gas being found in reservoirs that range from the Devonian to the Cainozoic. At one end of the stratigraphic column is the Clair Field, located on the Atlantic Margin to the west of Scotland. Clair field produces from reservoirs in fractured Devonian sandstones, while the giant Forties Field in the Central North Sea is contained in sandstones of Paleocene age. There are oil and gas pools in virtually every stratigraphic interval in between.

The majority of the more than 235 producing offshore fields are located in structural traps. This probably reflects the maturity level of exploration and appraisal drilling on the UKCS, as wildcat wells specifically targeted at stratigraphic traps have been rare.

The UKCS is ripe for innovation. Modern seismic technology resolves subtle traps, e.g., shear wave acquisition techniques and pore fluid prediction processing techniques.

Future activity

The future for UKCS exploration and development activity is projected to follow two strategic themes. There are opportunities for wildcat exploration in both genuine frontier areas such as the Atlantic Margin and in the more mature North Sea basins. The second strategic theme is the "niche developer." There are over 250 undeveloped discoveries on the UKCS that represent a significant resource. Approxi-mately 150 of these are within 10 km of existing infrastructure and few are more than 50 km away.

Another opportunity lies in the exploitation of heavy oil. There are five heavy oilfields in production with a further 2-4 BBOE in place awaiting development. The heavy oil play is relatively underexplored.

The two areas identified as having the greatest potential for major new discoveries lie along the Atlantic Margin and in the high-pressure/high-temperature (HP/HT) play in the Upper Jurassic of the North Sea.

New plays

Six plays appear to offer significant exploration potential on the UKCS. Technical uncertainties need to be addressed, as several are non-conventional and require significant pre-drill technical analysis.

Atlantic Margin Tertiary: Following the discovery of the giant Foinaven and Schiehallion fields in the early 1990s, there has been significant industry focus in the area. The fields are combination traps contained in Paleogene, deepwater sandstone reservoirs. Trap definition is complex and reliant on modern seismic analysis such as amplitude versus offset analysis.

The spatial extent presents a technical challenge due to the presence of Upper Paleocene-Lower Eocene volcanics that mask the pre-Eocene geology from effective seismic imaging.

Upper Jurassic/Lower Cretaceous: This stratigraphic play is the lateral basinward pinchout of deepwater sandstones preserved in the hanging wall of major basin-bounding faults or flanking large intrabasinal highs. The play is located along the rift-bounding faults of the North Sea.

Mesozoic Basin Margin: The recent giant Buzzard oil discovery in UK Block 20/6 highlighted the potential for traps along the basin margins of the North Sea. These are likely to be subtle combination and stratigraphic traps.

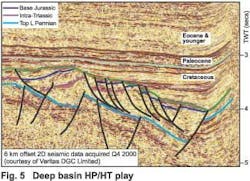

Deep basin: Located in the central and northern North Sea, the HP/HT plays exist along the axis of the rift graben and in the hanging walls of major basin bounding faults. A number of reservoir targets are both above and below a detachment surface at the Top Permian due to the presence of salt.

Conventional pre-rift fault blocks are present in the Permian with rotated slivers of Jurassic and Triassic section exhibiting basinward gravity gliding into the hanging wall of the large fault to the east. In the deeper parts of the Northern and Central Grabens reservoir rocks are found with up to 25% porosity preserved down to 15,000 ft or more.

Lower Permian: This play in the southern North Sea is defined by the updip pinch-out of the prolific Permian Leman Sandstone as the dune belts interdigitate into contemporaneous lacustrine shales at the basin margin.

Paleogeomorphic traps: This Late Paleo-cene to Early Eocene age play is around the shelf margin in the northern and central North Sea and the Atlantic Margin.

Summary

The UKCS has proven to be a successful exploration province over the last 35 years, with a success rate of 35% for its 4,000 exploration and appraisal wells. Recent successes have demonstrated that substantial reserves remain to be discovered in the mature North Sea.

Reference

Glennie, K.W., and Underhill, J.R. (1998); Origin, Development, and Evolution of Structural Styles. In: K.W. Glennie (ed.) Petroleum Geology of the North Sea: Basic concepts and recent advances.

Author

Jim Munns is a Senior Geoscientist with the UK Department of Trade and Industry with responsibility for promoting the UKCS internationally. He joined the DTI in 1999 following 20 years with Amoco UK in technical and managerial positions, working the North Sea and West Africa.

A recent focus for the DTI has been to attract "new entrants" into the UKCS. In May 2001, the DTI set up a small marketing team to broaden the company base in exploration and develop-ment activity on the UKCS. The marketing strategy identified two types of new entrant company that the UK is keen to attract:

- Independent oil companies, particularly those with the resources to drill wildcat exploration wells that are not currently represented in the UK North Sea

- Niche developers, particularly those with Gulf of Mexico experience, to develop pre-viously undeveloped discoveries by utilizing technically innovative and best cost solu-tions.

Megamergers in recent years have resulted in fewer major operators active on the UKCS, resulting in smaller overall exploration and appraisal budgets. Oil and gas production in the UK peaked in 2000, and remains close to record levels at 5 MMboe/d, but decline is projected to start in the near future. An initiative to attract investment from a large number of smaller players will help to arrest this decline.