Semisub John Shaw on test recently for Amerada Hess with well 20/5c-6.

Neddrill 9 chalks up first for Dutch oil

RWE-DEA's recent oil discovery in the northern Dutch offshore sector could be the region's first to produce from an Upper Cretaceous chalk reservoir. Well F/2-5, drilled by jackup Neddrill 9, tested oil at 9,700 b/d at a subsurface depth of 1,400 meters. A delineation well is likely next year, but there is already talk of a subsea tieback to NAM's F/3 production platform. If the appraisal proves reserves well above 20MM bbl, a standalone FPSO might be warranted: water depth is 41 meters.

Elf Petroland wasted little time bringing its gas exploration well L7-15 into production. The deviated discovery well, drilled from the L7H satellite, came onstream six weeks after its completion at 2 million cm/d, with the gas tied in to the L7 central processing complex. Early this year NAM brought the J3 Charlie well online through the Markham facilities, just three months after discovery.

Dual success for Amerada

Amerada Hess has found small quantities of light oil in block 20/5c in the UK's Outer Moray Firth. Semisub John Shaw tested 8,647 b/d through a two-in. choke in the Lower Cretaceous. Further appraisal work has yet to be determined: if proven commercial, Amerada's Ivanhoe/Rob Roy floater 25 km north-east would be a candidate host for the tieback.

In the Danish sector, Amerada has completed a successful appraisal well on its South Arne prospect. RIGS-2, spudded in May and subsequently sidetracked as RIGS-2A, tested hydrocarbons from the chalk reservoir at 5,263 b/d on a 52/64-in. choke, yielding 35! API oil. The well is located in 61 meters of water, 240 km west of Esbjerg: it followed a declaration of commerciality for the field, but as yet no development solution.

Banff test under way

Conoco's early production test on the Banff Field in UK block 29/2a has started smoothly. Two early production wells drilled by semisub Glomar Arctic III tested at a cumulative rate of 17,735 b/d and 7 million cf/d. Each well encountered over 3,000 ft of hydrocarbon-bearing section in the chalk reservoir. A six-month early production program is now under way using a floating production unit with shuttle tanker offtake to assess the field's performance.

In the southern sector, Conoco plans to extend the producing life of its Viking B gas complex off the Lincolnshire coast by converting it to normally unmanned operation: currently 60 staff man the complex, which will cease to have a full-time resident crew by October 2000. Viking A production stopped in 1991: four platforms on this complex are currently being dismantled in northern England.

Elf Caledonia recently converted its Saltire production platform to mini-manned status under a move designed to save #4 million/year. There is now a minimum crew of seven on the platform which is linked to Piper B, 7 km away; maintenance is planned three times a year.

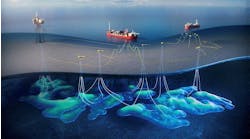

Aasgard workover vessel rejected

Statoil has canceled a provisional order for a new well workover/completion vessel for the mid-Norwegian Aasgard development. The small waterplane area twin hull vessel (Swath), due to be built by Smedvig, was found to be inadequate in model tank tests classified by DnV. Strengthening the hull to cope with the necessary deck loads and high seas would have made the project uneconomic.

Statoil and Smedvig are now working on an alternate concept to service the 120 subsea wells expected to be completed by 2000. A new semi purpose-built for DP workover and completion mode is one possibility.

Block bidding for Barents blocks

Eleven oil companies have nominated their favored blocks for the forthcoming southern Barents Sea licensing round. Seven groups of companies proposed six different areas: applications for acreage will shortly be invited, with new exploration licenses set to be awarded next April.

Award terms for this round, called the Barents Sea Project, are novel for Norway. The Ministry of Industry and Energy has imposed two `models': one involves awarding an area covering up to eight blocks. Alternately, companies may amass seismic in a defined area, for instance over three quadrants. Once the data is interpreted, licences can be secured in the area following consultation with the Ministry.

Statoil is thought to be the only operator planning a Barents Sea wildcat this year, in a Triassic subsalt play in the Nordkapp basin. Most of the 53 wells drilled there to date have been in the Hammerfest region, where gas has been the main discovery item. Roughly 5.9 billion boe are thought to reside in the southern part of the Sea.

Further south off mid-Norway, Statoil may be about to fast-track its Tyrihans and Trestakk developments following a recent appraisal well by Byford Dolphin in 330 meters of water. A positive result would likely bring in an FPSO - possibly one of Statoil's new multipurpose shuttle tankers - with subsea wells. Combined reserves are estimated at 46MM bbl of oil and 28.7 bcm of gas, which might be reinjected to aid liquids recovery.

Norsk Hydro has advanced its platform-based Oseberg East development by awarding fabrication contracts to Kvaerner Oil and Gas for the 6,600-ton topsides, and Aker Verdal for the 12,000-ton jacket and piles. Both should be delivered by May 1998 for a production start the following October.

Chevron pulls out of Ninian

Oryx Energy is buying Chevron's interests in the Ninian, Columba B, Hutton, Lyell and Murchison Fields for $140 million, and has also agreed to assign 35% of the interests to Ranger Oil. Oryx already operated three of the fields and will do the same with Ninian, with Ranger taking the reins at Columba B. The transaction includes Chevron's interests in the Brent and Ninian pipeline systems and the Sullom Voe terminal on Shetland.

Ninian has produced over 1 billion bbl of oil since 1978. Remaining reserves at the start of this year were 150MM bbl. Chevron has longer term projects to spend its money on such as Alba, Britannia and Clair and possibly Bressay, an old 1 billion bbl discovery with low gravity oil in UK block 3.2a. Recently Chevron established a small multi-discipline team to look at potentially economic development options.

In contrast, Oryx's avowed strategy in the North Sea is to add value to declining fields. Ranger is also an asset maximizer in the UK sector, with other old core area interests in the southern gas basin: Medan/Pierce, a new BP-led development, is an exception.

Other recent UK share deals have involved British-Borneo buying Unocal North Sea Exploration for $23.75 million; Oranje-Nassau acquiring Purbeck Petroleum, which had interests in British Gas' Millom and BP's Wytch Farm Fields; and Agip buying Sun Oil Britain for $260 million. The deal brings Agip operatorship of the Balmoral complex and a controlling stake in the Balmoral floating production unit. Agip gets to raise its worldwide production in a small way, while Sun can now concentrate on North American operations.

Copyright 1996 Offshore. All Rights Reserved.