OFFSHORE EUROPE: Recent UK North Sea drilling activity step change in exploration focus

During the first half of 2001, the oil price remained relatively stable with the average Brent Blend price fluctuating in the range of US$25-28/bbl. Despite the maintenance of relatively high oil prices during this year, drilling activity in the UK sector of the North Sea has seen very little in the way of an up-tick in activity.

In the UK, only 26 wells have been started in the first half of 2001, which compares with 29 wells started in the first half of 2000. These figures are broadly in line with Arthur Andersen's forecast at the beginning of 2000, that predicted a 23% drop in exploration and appraisal activity in the UK after each of the sector's operators were contacted for their views.

The low levels of activity for the first half of this year reflects a longer-term decline from the 243 wells completed in 1990 to a total of only 55 in 2000. The decline in drilling reflects the relative maturity of the UK sector of the North Sea, and is not reflected in drilling activity elsewhere in northwest Europe. Conversely, Norway, The Netherlands, Ireland, and Denmark have shown a sizable rise in exploration spuds in the first half of 2001, with a 66% increase on the number of wells started during the same period in 2000.

Exploration conducted in the mature UK is focused on testing lower risk prospects that have been enhanced by high quality 3D data sets and advanced seismic processing techniques. Many of the majors and some independents have become increasingly risk adverse and would not consider drilling exploration prospects that have less than a 35% chance of success.

As a consequence, the proportion of discoveries has increased with success rates in excess of 70% consistently being achieved on a quarterly basis. Exploration over the course of the previous 18 months has resulted in a number of notable discoveries being made.

Near-field exploration focus

Although the majors remain important in terms of exploration activity, a substantial proportion of recent exploration in the conventional North Sea has been carried out by the larger independents. Amerada Hess, Kerr McGee and Talisman are among the most active. The development of core areas for these companies has been of primary importance. Active portfolio management, often involving a series of targeted acquisitions, farm-ins, and swaps has helped to consolidate these discrete company positions.

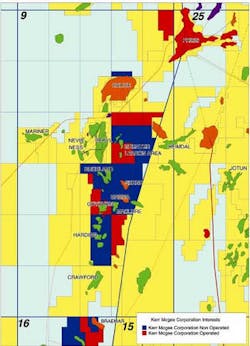

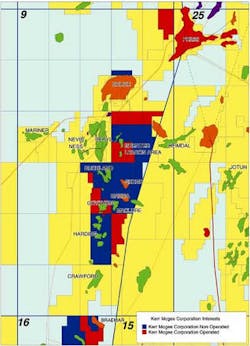

Examples of such focused acquisition programs have included Kerr McGee's acquisition of Gulf and Repsol assets to develop a Quad 9 core area, and Talisman's succession of deals to consolidate their position in the Fourth Round; Flotta Catchment Area of the Moray Firth. Recent drilling activity has reflected the importance of core areas and their associated infrastructure ownership and has been crucial in forming the characteristics of near-field and mature area exploration and development programs.

Talisman's recent Lucy discovery is located within their Outer Moray Firth core area which includes the Fourth Round; Flotta Catchment Area . The Lucy exploration prospect is located 8 km to the northeast of the Piper Bravo platform, and was successfully drilled by the 15/12b-4 well. The well discovered a 68-ft column of light oil in excellent quality Jurassic Piper sandstones. The oil-bearing sands had porosities in the range of 18-25% with very high permeability.

Preliminary estimates of reserves in the Lucy field are in the range of 20-50 million bbl. Development plans should be finalized later this year with first production from Lucy potentially in late-2002. It is anticipated that the discovery will be developed using one or two horizontal wells and produced via a tieback to Talisman-operated Piper Platform.

Tieback activity

A further example of successful near-field exploration was Talisman's 30/17b-A32 well. The well was drilled from the Clyde platform to investigate the Leven North Structure. The well tested at a maximum rate of 12,080 b/d of 39 degree API oil from good quality Upper Jurassic Fulmar sands. The well was rapidly tied back to existing infrastructure and is currently producing 10,000 b/d through the Clyde field facilities.

In 2000, Amerada's Rochelle prospect located in 15/27 was drilled on a Cretaceous aged Kopervik target. Amerada had a significant position along this play fairway and is capitalizing on their understanding of this subtle play. The discovery is located close by the Renee and Rubie fields, which are operated by Phillips and produced via a subsea tieback to the Amerada Hess-operated floating production facility, the AH001.

The drilling of this well followed an agreement to increase Amerada's interest in Block 15/27 to over 35%, and assume operatorship for the block. This emerging core area is becoming increasingly important for Amerada where offsetting interests include operated and non-operated interests in 16 blocks or part blocks including a 27.5% in Goldeneye and a 90% interest in the Cromarty gas discovery.

Quad 9 area

The Quad 9 area is an important area for Kerr McGee with their long established operating position in the Gryphon field, located in block 9/18b, and a non-operating position in the Skene, Brora, Buckland Maclure, and Harding fields. During 2000, Kerr McGee experienced considerable success in an exploration and appraisal program targeting the Quad 9 area. This resulted in the discovery of the Greater Leadon fields located in Block 9/14.

The development of the Leadon Birse and Glassel oil fields was approved late last year. These satellite fields are located about five miles from the Leadon field. The company now estimates reserves in the Greater Leadon area to be in the range of 120-170 million BOE.

Despite the maturity of the North Sea, the capability of the region to still deliver world-class strikes was recently attested by the Buzzard discovery. The discovery is within a block operated by PanCanadian, another senior independent and relative new entrant to the North Sea. The Buzzard prospect was identified on previously explored acreage in the recent 18th Round.

The discovery well 20/6-3 found some 250 ft of pay within the Jurassic Ettrick sandstones within a subtle stratigraphic trap. The sidetrack, which encountered the reservoir 4,400 ft to the east of the discovery well, has extended the oil column of the discovery to at least 750 ft. These two wells have established recoverable oil of 200-300 million bbl, the largest discovery since Foinaven was made in the West of Shetlands.

The senior independents are set to remain the principal explorers as they consolidate core area positions further. They are well positioned to benefit from the continuing phase of post-merger rationalization as the majors realign their portfolios.

Maturity coupled with the relative high cost nature of the North Sea may be luring exploration budgets of majors abroad with deepwater exploration in Africa and South America being the greatest beneficiaries. In addition, many of the emerging junior independents lack an appetite for exploration, as this new breed of companies, such as Venture, Highland, or Consort, are led largely by production.

Frontier exploration

Drilling activity in areas outside the conventional North Sea, such as the frontier areas West of Britain and Ireland, should see a resurgence of activity. A number of high profile wells are being drilled or have been completed on the Atlantic Margins. These wells are often drilled under technically challenging conditions. Included is Conoco's 132/6-1 well, drilled in water depths of 6,300 ft, and Enterprise's 5/22-1 Errigal exploration well located west of Ireland. Other wells include the recent test of a prospect in the under-explored Porcupine Basin and 63/4-2 exploration well operated by EDC in the Fastnet Basin.