Gulf of Mexico

Proposed rule would extend royalty relief

The Department of the Interior's Minerals Management Service (MMS) has proposed a rule to amend regulations on discretionary royalty relief for leases in the Outer Continental Shelf of the Gulf of Mexico. The discretionary relief rule applies specifically to marginal oil and gas properties on offer that might otherwise be considered uneconomic to develop.

The proposed rule makes holders of leases in 200 meters and greater water depth sold after 2000 in authorized parts of the Gulf of Mexico eligible to apply for discretionary royalty suspensions. The rule coincided with the announcement of the Central Gulf of Mexico Lease Sale set for March 28, 2001.

BP names project contractors

BP hired J. Ray McDermott to make the topsides for the Holstein, Mad Dog, Atlantis, and Crazy Horse deepwater projects in the Gulf of Mexico. Fabrication for the developments is set for the second half of 2001. Three of the four will be spar developments, while options for Crazy Horse, in 6,000 ft water depth, are still being evaluated. The contract is expected to bring in up to $600 million in revenues to J. Ray McDermott, and it should create 400-500 jobs for fabrication workers in Louisiana.

Also, BP has signed a deal with Heerema Marine Contracts to install facilities and associated pipelines and gathering lines. Heerema Marine deepwater construction vessels Balder and Thialf will undergo upgrades for the installation, which could cost up to $400 million. BP plans to begin installation of the facilities in 2002 or 2003.

MMS awards 219 leases out of Sale 177

The US Department of the Interior's Minerals Management Service said it has completed the evaluation process for bids in the Western Gulf of Mexico Lease Sale 177 held last year. Of the 226 tracts receiving bids, MMS rejected 7 high bids totaling $4.63 million as insufficient for fair market value. MMS awarded 219 leases involving $149.03 million in high bids.

In all, 57% of the winning bids were in 0-200 meters water depth. The highest bid accepted on a tract, $10.5 million by CXY Energy Offshore for Garden Banks 624, was in deepwater. The second and third highest winning bids were also for deepwater tracts.

Boomvang-Nansen Sparwork continues

Mustang Engineering will provide topsides design and procurement assistance for two spar facilities for deepwater Gulf of Mexico fields Boomvang and Nansen in the East Breaks area. Operator Kerr-McGee has 50% interest in Nansen and 30% interest in Boomvang. Other Boomvang partners are Enterprise Oil with 50% and Ocean Energy with 20%. Ocean Energy also holds the remaining 50% interest in Nansen.

US Gulf to meet most incremental need

The Gulf of Mexico will be one of three areas responsible for providing incremental natural gas production for the US through 2015, according to a Gas Technology Institute study. The three are the US Gulf of Mexico, western Canada, and the Rocky Mountains. The long- term trends in the "US Gas Supply and Prices" report said gas production will increase in the Gulf of Mexico from 4.9 Tcf in 1998 to 81.1 Tcf by 2015, representing the largest single source of incremental gas supply in the combined US and Canadian markets.

Allseas lets contract

Halliburton Subsea, a division of Halliburton's Brown & Root Energy Services, won an Allseas contract for ROV and survey deepwater pipelay support services in the US Gulf of Mexico. The work, which includes a number of separate deepwater pipelay contracts in the US Gulf and off Trinidad, was to begin in late 2000 with the ExxonMobil Mica and BP Destin projects and run through July 2001. Halliburton Subsea will provide an Examiner HD deepwater ROV system and a Centurion HD ROV system on Allseas' Trenchsetter.

Hvide buys crewboats

Hvide Marine Inc. is buying two 152-ft crewboats from Crewboats Inc. for $5 million. The vessels will join HMI's Seabulk Offshore fleet in the Gulf of Mexico. The company was to take delivery of one vessel in December 2000 and expects delivery of the second in May 2001. President and CEO Gerhard E. Kurz said he expects day rates of $3,500 and up for the vessels. "The advantage of this transaction is the prospect of immediate earnings in a rising market, rather than waiting the 12-18 months it takes to deliver the average newbuild," he said.

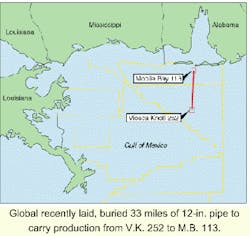

Global completes pipelay

Global Industries Offshore used automatic welding with its Mudbug pipe bury technology to lay and bury 33 miles of 12-in. pipe for Williams Field Services Gulf Coast Co. The sour gas line will gather production from Viosca Knoll 252 and transport it to a gathering system at Mobile Bay 113. Global pipelay/bury barge Sea Constructor installed it in water depths to 120 ft.

Atwood rig upgrades

Following completion of its contract with British-Borneo this month (January), the Atwood Hunter was set to move to a US shipyard for an increase in its water depth drilling capacity as well as other upgrades. The upgrades are expected to take four or five months to complete. Upgrades continue on the Atwood Eagle, which will be able to work in 5,000 ft water depth on completion of the work. The $80 million in upgrades to the Eagle should take five or six months to complete, Atwood said.

Rowan Gorilla upgrade

The Rowan Gorilla III is set to begin work in the Gulf of Mexico this month after having its legs extended from 343 ft to 504 ft. The vessel was previously under contract to PanCanadian.