Barents Sea drilling nets third reward

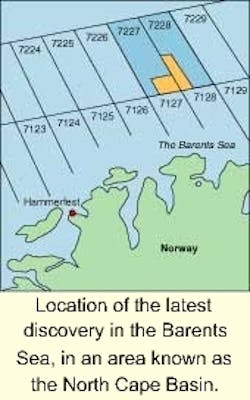

The freezing waters of the Barents Sea are emerging as the hot spot for European exploration. The semisubmersible Transocean Arctic recorded a third successive discovery from its current campaign in this sector. This time, it is Statoil in production license 202, 130 km northeast of Hammerfest on the north Norway coast.

The well, drilled in 288 meters of water, was probing a structure close to a salt diapir, a model previously not explored in the Barents Sea. Oil and gas were found in Triassic sandstone. No reserves estimate has been issued.

Statoil will analyze the logging data and 100 core samples taken before committing to appraisal drilling. However, it has secured the same rig for a fifth well before the Barents Sea drilling season closes, this time on the promising Delta structure, situated in between the Sn hvit and Goliath fields.

The latter was one of the other discoveries drilled by the Transocean Arctic in the fall, both operated by Norsk Agip. Goliath's reserves were recently downgraded by the Norwegian Petro-leum Directorate to 75-105 mm bbl. Snohvit is primarily a gas field, but with 130 mm bbl of oil in thin layers. The right result on Delta could open the way to a coordinated development of all three, via a floating producer.

Statoil also has a lot riding on another current well in the Norwegian Sea, drilled by semisubmersible Scarabeo V. This is targeting the high-pressure, high-temperature (HP/HT) "M" structure, 5 km northwest of the Kristin gas-condensate field. A favorable result could be factored into the development plan for Kristin, which is expected to be submitted in May. Kristin will act as a hub for several other HP/HT developments.

In the North Sea, Statoil also found hydrocarbons within numerous Mid-Jurassic sandstone intervals on the "C" prospect, drilled from the Veslefrikk A platform. Around 8 km north of the Heidrun Field TLP (another Statoil operation), Conoco reports a small Jurassic oil find following a well drilled in 380 meters water depth by the Mærsk Jutlander. The accumulation lies close to subsea facilities installed recently for the Heidrun North tieback.

DONG, Mærsk consider options

Two new platforms are in prospect in the Danish sector. One location could be Dong's Nini oilfield, discovered mid-2000. Two recent app-raisal wells a short distance southwest and northeast of Nini-1 have both proven oil in Paleocene sands. Neither was production tested. The jackup Ensco 70 then moved on to drill another prospect west of another recent find, Denerco's Cecilie.

Nini is somewhat remote from Danish infrastructure. The nearest is Statoil's Siri complex, 50 km distant. A dedicated platform seems probable. Mærsk is reportedly considering its favored STAR-type platform for the Tyra Southeast development, but may settle for the subsea route, due to the nearness of the Tyra East platform.

Mærsk is also pursuing second-phase work on its Halfdan Field, where eight producer and seven injector wells will be drilled to raise output from 33,000 b/d to 40,000 b/d. Halfdan's platform is designed to accommodate two drilling rigs simultaneously.

In the Dutch North Sea, two newly installed platforms have begun producing gas. The installation on Clyde's Q4-A Field had previously done duty for Wintershall on a field now decommissioned. Clyde claims that this is the first such refurbishment/relocation exercise offshore The Netherlands. Output will build from the initial 48.5 MMcm/d as two further development wells are brought onstream. Clyde will then turn its attention to exploiting the Q4-B platform, 7 km to the southeast, as a tieback.

Wintershall Noordzee opted for a totally new platform on L8-P4, situated 80 km offshore Den Helder. The gas is being piped to Uithuizen via existing pipelines. Field life is estimated at eight years.

Clair contract awards "not imminent"

Britain's beleaguered fabricators will have to wait till next year before starting work on Clair, the only UK field with a major platform pending. At a recent presentation in Aber-deen, operator BP told suppliers that sanction for Clair, a complex field in shallow waters off the Shetlands, was not expected before the third quarter. A long discussion process would then ensue, meaning that main development contracts would not be issued before 2002. The platform will be a simple steel installation with an oil processing requirement of around 60,000 b/d.

BP is expected to invite bids shortly for a much smaller platform for its Hoton development in the UK southern gas basin. This will be a minimal facility platform with produced gas piped to the West Sole Alpha complex.

At SMi's recent Offshore Production Technology conference in London, Gran-herne's Bob Robinson said his company had devised an ultra-minimal concept weighing only 200 tons, for this field in 1999. He added that future development costs for new platforms in the southern sector could be reduced further by cutting out helicopter flights, claiming that 70% of risks in this location are helicopter related.

Granherne has been looking at new ways of bringing maintenance crews in and away from minimal platforms, either by fast rescue craft or via hoists operated from supply boats. "We could get two orders of magnitude less risk by not flying people in," he suggested.

Surge in reported safety incidents

Safety has re-emerged as a major concern of late, with regular incidents being reported off Norway and the UK. Among the most notable are:

- Weaknesses discovered on 80 welds in the pipes connecting the Midgard and Sm r-bukk reservoirs to Statoil's Åsgard B gas platform

- The shutdown since mid-November of Shell's Shearwater HP/HT gas/condensate field, following detection of unusually high pressure in well SW08.

- BG prosecuted by the UK's Health and Safety Executive for contravening rules concerning change-out of a pressure-relief valve on the Rough offshore storage facility in the southern gas basin. A year earlier, BG was fined $440,000 for a gas leak on the same facility.

Norway's Petroleum Directorate, in its review of the Norwegian sector safety performance in 2000, compiled 514 reported incidents, compared with 139 in 1996. At least 15 could have had serious repercussions. Crane operations were high on the list of fallibility. Norway's government recently established an industry-wide safety forum and is due to publish a white paper on safety this fall.