Victor Schmidt

Houston

Latin fever could impact leasing

The "Asian contagion" finally overwhelmed Brazil forcing the country to float its currency, the real. In the process, the real bounced from a +40% drop in value and remains unstable. What happens now to all those big offshore oil deals? Dropping the import tax on rigs and equipment will surely help attract companies. But, major companies cannot be expected to pay top dollar for leases in the current environment.Venezuela's President Hugo Chavez has backed away from his earlier statements and now supports production restraint, however, he is quiet on general oil policy. He engineered the resignation of Pdvsa President Luis Guisti, and must now chart a new course for the nation's jewel. Continued low oil prices will likely force significant cost-cutting, even partial sale of Pdvsa. With cashflow diminished, the Lake Maracaibo redevelopment projects could be delayed or deferred.

Argentina is showing Brazil and Venezuela the way. The state garnered a US$2 billion plum by selling 14.99% of YPF to Spain's Repsol for a 22% premium. Brazil is Argentina's largest trading partner,though its currency is locked to the US dollar. To combat rising interest costs, Argentina is considering replacing the peso with the US dollar. Malvinas Shelf plays will be hard to sell until improved oil prices and financial stability make the South Atlantic frontier attractive.

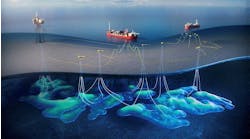

The bright lights for 1999 offshore activity continue to focus on the deepwater in West Africa and the Gulf of Mexico. Both regions have good investment underpinnings and very large potential reserves. Brazil will take a little longer.

Expand fuel options with gas transition

Arco's Chairman & CEO, Mike R. Bowlin has suggested that natural gas will become even more important to the world's energy mix in the coming years. He said that the future will require a wider variety of motor fuel options that will include natural gas, LNG, electricity and fuel cell technology. He was a speaker at the 18th annual Cambridge Energy Research Associates (CERA) conference in Houston.This expansion is driven by environmental concerns over air quality in the world's major cities and in the developing world. Bowlin said, "Embrace the future and recognize the growing demand for a wide array of fuels; or ignore reality and slowly, but surely, be left behind." On other topics:

- Simon Kukes, CEO and President of Tyumen Oil Co of Russia, focused on the future. He is aiming his company toward areas of oil demand growth in the developing countries of China and India. "One problem we see in the industry today is that the focus on markets in the OECD countries is not helping to create new markets for oil."

- Adrian Lajous Vargas, General Director and CEO of Pemex, identified the general drop in all commodity prices worldwide as the source of the financial distress in the developing world. He called for continued restraint in oil production adding, "Economic rent is lost through lose of control over supply."

- Chris Gibson-Smith, Managing Director of BP Amoco, called for a the oil industry to take on a greater political role working to build political infrastructures that expand the customer base for energy. He noted, "Energy is the foundation of all economic progress." He encouraged the industry to listen the industry's critics for opportunities to change the world's perception of us while we solve problems and address their expressed needs.

Market power

With abundant supplies of crude and refined products available, it is even more difficult for companies to differentiate their products and command a premium price for their efforts. This is the basic reason that major oil companies are merging again.At present, petroleum's largest use is as a transportation fuel. Natural gas is best for fixed installations: homes, industrial energy, or power stations. In its natural form, it is limited as a transportation fuel because it must be confined under pressure, a safety hazard.

The only way for petroleum to further enhance its value as a transportation fuel is to pack more energy in to a smaller package providing a longer driving time between fill-ups. This is a very difficult task. Mobil Oil tried to differentiate itself on service, but could not convince the consumer to pay a higher price for it. So, to enhance shareholder value as a commodity supplier, Mobil is merging with Exxon.

Now national oil companies are feeling the power of the market. The consumer wants energy products at a commodity price, even in-country. National oil companies continue to restructure, sell operations, and reduce their overhead. Commodity providers can only meet the market by being very efficient organizations, owned by the public.

Copyright 1999 Oil & Gas Journal. All Rights Reserved.