Rig contracts, however, indicate recovery may be in sight

Simon Robertshaw

Hannon Westwood

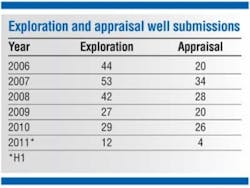

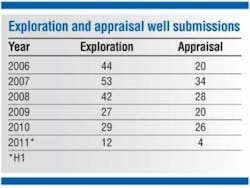

Halfway through 2011, just 19 exploration and appraisal wells had started on the UK continental shelf this year. Twelve of these wells were new spuds and the remaining seven mostly intentional geological side tracks.

This level of activity is in marked contrast to the first half of 2010 when 32 exploration and appraisal (E&A) wells were drilling (25 spuds and seven side tracks). The total number of well spuds for the first half of 2011 also represents the lowest level of drilling activity since 1966 – 45 years ago – when just nine wells were spudded in the first half of that year, albeit in the infancy of the UK offshore oil industry.

So far in 2011, the central North Sea has dominated new activity with eight E&A wells, followed by the northern North Sea where five wells have started, with three each in the southern North Sea and in the west of Shetland/Atlantic margin. There has been no drilling activity at all so far in the East Irish Sea (Morecambe Bay).

Investment issues

There is probably no single underlying cause for this alarming decline in E&A activity; rather, a multitude of factors have come into play. The artificially inflated oil price experienced in 2009 aided the speculators but was unsustainably high and gave the oil industry the jitters and introduced instability. Although the oil price has come back a bit, it appears to have stabilized at what is a historically healthy level, and against this price background, the disparity in activity levels in the UK sector seems all the more shocking.

Much concern has been voiced by the UK oil industry over the UK government's budget changes. It is estimated that potential rates of return for the larger players in the sector will have been significantly reduced. These large companies typically allocate resources to competing areas of the world and this is increasingly seen as a trend away from the UK sector. However, to be clear, it is not in fact a very recent trend. The UK sector has seen a change over the last decade or so from the presence of a relatively small number of mega-companies to a large number of smaller players now endeavouring to eke a living from what remains a considerable oil and gas resource.

Another negative factor is the fallout from the US Gulf of Mexico Macondo disaster and the fact that the UK authorities are compelled to pay closer attention to both site survey applications and well applications ahead of any drilling activity. Not only can this delay the approval of applications but the rate of submission to the Department of Energy and Climate Change also appears to have slowed, while applicants apply and re-apply due diligence to their plans to ensure that all their safety checks and routines are firmly in place.

The 16 E&A drilling applications submitted this year (12 exploration and four appraisal wells) have resulted in just four exploration and two appraisal well approvals. Two exploration submissions that have been "withdrawn" are Cairn Toul (block 16/27a) and Carnaby (block 28/9) exploration submissions, presumably by their respective operators, Dana Petroleum and EnCore Oil.

Funding troubles

Many of the smaller companies in the sector have demonstrated an appetite for and commitment to nurturing a business on the UKCS that promised to revitalize the sector. This same pool of players now has an uphill struggle amidst an environment of diminished corporate value brought about by the government's recent budget supplementary corporation tax (SCT) changes.

One direct repercussion of these changes is the reduction in operators' ability to borrow funds in pursuit of their goals, be it within their own license areas or via a myriad of farm-in opportunities available on the UKCS – some 50% of the forecast E&A well pool. There are 100 or so smaller companies in the sector currently without cash flow from production, and many of these may now be unable to progress their E&A drilling plans.

For the larger players with UK cash flow, the rate of return from the UK sector has decreased and with it comes the increased likelihood that some of these middle-to-super majors will shift new investment elsewhere, reducing the UK portfolio to harvest-mode.

Fallow Initiative

The Fallow Initiative was established by the previous administration to inject some pace into the UK's exploration and appraisal process and to discourage companies from sitting on moribund acreage and discoveries. Over the years, it has served its purpose in that wells have been drilled and acreage has been recycled that might otherwise have remained stagnant. That said, the number of wells being drilled on fallow acreage or discoveries has waned in recent years and current activity levels are no longer bolstered by this initiative to any great extent. It appears to have made an impact, but now leaves a void. This year, just one fallow well is so far recognized in contrast to the 10 and 13 wells drilled as a direct outcome of the Initiative during 2010 and 2009, respectively.

Corporate acquisitions may impact drilling levels, but the picture is not quite as clear cut as we might expect. There has been no particular evidence of reductions or increases in drilling following recent takeovers. As examples of where E&A activity may have been reduced, both Venture Petroleum and Oilexco were extremely active prior to their acquisitions by Centrica and Premier, respectively. A period of inactivity might reasonably be expected whilst the acquisitor integrated and assimilated the assets before re-emerging with a forward plan, but nevertheless the resultant activity set is diminished when compared with activity levels conducting business as separate entities.

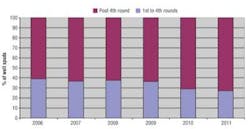

Between 2006 and 2010, first and second round acreage accounted for 10-25% of the UK's E&A drilling each year. Up to midway through 2011, however, there had been no activity on any of this acreage.

Other priorities, such as development and large-scale investment, may take precedence over yet more E&A. In fact, it may be the case that, while E&A is one measure of activity, the UK holds a material backlog of development opportunities that may be better financed and accelerated in the hands of majors, and it is this ability to transform discoveries into cash flow that eludes the smaller company, but is the driver for the acquirer. The more recent acquisition of Dana by KNOC has yet to confirm any new operated E&A drilling, but again may be the consequence of work on more focussed investment in projects.

License commitments

In September 2010, the UK sector saw the ultimate expiry of licensed acreage awarded in the 1960s, namely first round licenses from 1964, with second round licences reaching the end of their full license terms in November this year. In anticipation of these expirations, a mild flourish of activity took place. First and second round acreage was under the spotlight; and from 2006 through 2010, this acreage accounted for 10-25% of E&A drilling each year – although, halfway through 2011, no activity had occurred on any first or second round acreage.

A flurry of activity may again come into play in 2016-18 as third and fourth round acreage awarded in the early 1970s reaches the end of its ultimate life cycle. Since 2006, first to fourth round acreage has accounted for nearly 40% of activity in some years; while halfway through 2011, the figure hovers just below the 30% mark. What needs to be considered is that oil companies do not like to make development decisions in short time frames or without comprehensive appraisal programs. So, in a period of uncertainty, it is perhaps easier to let these licenses quietly lapse rather than accelerate marginal additions or step-out pools.

Gauging success

E&A levels are currently at one of the lowest points in the history of UKCS drilling, yet technical success continues to be recorded amid the diminishing activity. Over the past 12 months, discoveries have been made in the central North Sea at Balloch, Burgman, Polecat/Ferret and Varadero, while appraisal drilling has progressed the finds at Blakeney, Burgman, Culzean, Josephine and West Rochelle, and drilling is currently under way at Hobby North.

In the northern North Sea, discoveries have been made at Oban and appraised at Bentley, Cladhan and Kraken while, in the southern North Sea, there have been finds at Fulham and Pegasus with appraisal progressed at Breagh East. Despite even lower relative activity levels in the west of Shetland area, discoveries have been made at Edradour and Whirlwind, while appraisal drilling recently started at Clair Southwest.

There are already 470+ undeveloped discoveries in the sector and new finds will only add to this weight. Ninety or so of these discoveries might be considered near-term developments with start-up envisaged within the next five years. There is a compelling argument to reduce or divert efforts away from yet more E&A wells in order to focus on developments and cash flow given that there are limited funds and resources. Undoubtedly it is a difficult path to steer to ensure that the E&A business is not irreversibly damaged and that an appropriate level of activity is maintained in order to drill out the resource. Up until now, a figure of about 50-60 E&A wells per year has been appropriate but we might be seeing E&A activity displaced to a new lower level by development spend.

In fact, development drilling currently outstrips E&A activity by some margin, with 136 development/production wells recorded in 2010. Rather than seeing investment in new oil and gas, it is infill locations in mature fields that are being revisited and are bolstering development well numbers.

Whatever the whys and wherefores of the current downturn, the second half of 2011 is expected to see a recovery in E&A drilling levels, with a number of new rig contracts and intents to drill being publicized by operators and participant companies. Looking further ahead, the Hannon Westwood E&A forecast captures well plans until 2015, and remains broadly consistent at around the 200 wells level, with half the pool destined for the Central North Sea.

While the drilling potential remains high, the translation into active wells appears to be softening and the current situation should be taken as a wake-up call. Recent initiatives have now run their course and other new incentives are now required to maintain a workable balance of exploration, appraisal, and development drilling.

More Offshore Issue Articles

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com