Study finds new projects to be 45% less carbon intensive compared to 2016

Editor's note: This article first appeared in the March-April issue of Offshore magazine. Click here to view the full issue.

By Adi Akheramka, Independent Project Analysis

The E&P industry has made significant progress in decarbonization over the past few years. This can be observed by highlighting some of the emerging decarbonization trends, outcomes and practices of ongoing and recently completed projects.

That said, there are still some main gaps that the industry needs to address. These observations have been made based on IPA’s greenhouse gas (GHG) performance evaluations of industry projects, and were presented at the Upstream Industry Benchmarking Consortium (UIBC) meeting in November 2022.

Current state of decarbonization

In 2021, the global capex spent on renewable energy was $361 billion. The common consensus is that this investment has to increase significantly if we are to meet our climate goals. On the other hand, the global capex for upstream oil and gas (O&G) was $380 billion in the same year. Most net-zero frameworks suggest that this number has to decrease, with the speed of decrease varying between frameworks. However quickly this capex decreases, a significant amount of money will be spent on O&G in the next few decades. The average life of field of projects in IPA’s hydrocarbon production database is 22 years. This means that the opportunities we are progressing now and the design choices we make today will most likely be in place producing hydrocarbons into the mid-2040s. Therefore, in addition to allocating more funds to scale up renewable energy, it is critical that we also ensure that the O&G assets in development now are being advanced with a low-carbon mindset.

Measuring carbon competitiveness

To help business sponsors and project teams make effective low-carbon choices, IPA has been evaluating the carbon competitiveness of projects for the past three years. IPA’s Greenhouse Gas Performance Assessment suite of metrics assesses onshore and offshore project outcomes, as well as the practices that enable competitive performance. The GHG Intensity performance metric is evaluated at different stages in the stage-gated process based on the projects’ production and injection profiles, their reservoir and fluid characteristics, design- and power-related choices, and a few other project-specific characteristics. At the same time, we assess the project’s readiness to deliver a competitive low-carbon project and highlight any gaps in practices that need to be addressed. All of these GHG Performance Assessment tools and frameworks were developed under the guidance of industry subject matter experts (SMEs) via the IPA Carbon Working Group (CWG), an IPA-led group of owner firms working together to benchmark and improve the low-carbon and sustainability performance of projects and project systems.

Integrating GHG performance

A common metric used for opportunity screening for hydrocarbon production projects is $/boe (capex spent per amount of hydrocarbon produced). This metric, often referred to as unit development cost, helps decision makers compare opportunities in their global portfolio and screen out the ones that are not competitive enough. A similar trend is emerging with the use of a kgCO2eq/boe metric (GHG emissions emitted per amount of hydrocarbon produced) to compare and screen opportunities based on their carbon competitiveness. This metric, referred to as GHG intensity, reflects the overall emissions from the development over the life of operating that asset or field.

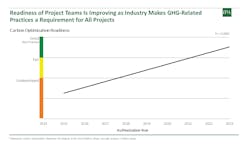

A measure of the GHG intensity of different projects over time provides a good indication of whether the opportunities we progress as an industry are improving in their carbon competitiveness. Based on the data collected by IPA from 40+ ongoing projects (projects pre- and post-FID but not operational yet), we do see a definite trend suggesting an improvement. Figure 1 highlights the Estimate GHG Intensity (project teams’ estimates of their life of field emissions) improving for projects based on their authorization years. Projects in the planning phase now and expected to be authorized in 2023 are, on average, 45% less carbon intensive compared to projects authorized in 2016.

While we do not yet see this “GHG-based high-grading” of portfolio consistently across all companies—or even across all opportunities in a company’s portfolio—this emerging trend does highlight the growing integration of GHG intensity improvement through the early definition phases of project development. We see the GHG performance of the opportunity driven primarily by the hydrocarbon type (ratio of gas and oil produced), reservoir and fluid characteristics, and concept selected to develop the reservoir.

Emerging best practices

Historically, less than one-third of E&P projects achieve more than one of their established objectives across cost, schedule, production, and predictability. The addition of GHG emissions targets makes achieving multiple objectives even more difficult. To deliver optimized results across a range of project key performance indicators (KPIs), a project team needs to rely on an array of activities to balance those objectives. IPA’s carbon optimization readiness assessment (CORA) examines the completeness of inputs, practices, and processes used to balance GHG emission targets against other project KPIs, such as cost or value.

Achieving a GHG emissions outcome optimized with a project’s cost target requires establishing clear objectives, an integrated team with a GHG emissions specialist, mature emissions and cost estimates, tools to weigh the effect of project decisions on KPIs, and assessment of delivery risk. The CORA considers these factors.

IPA measures elements of CORA for all projects during their GHG Performance evaluation. Figure 2 presents the trend we see in the project team’s readiness with authorization year. There is a significant positive trend highlighting the increasing adoption of practices identified under CORA with newer projects. On average, projects authorized pre-2017 were lagging in their readiness to deliver their GHG targets, whereas most projects authorized post-2021 fall in the best rractice range. This is expected as more companies formalize the use of internal guidelines and frameworks for project teams to address GHG performance.

On deeper analysis, we see very little variability in the maturity of GHG estimates developed by different project teams. They use mostly the same inputs and are largely consistent in the level of definition required for those inputs at the different project phases. As the adoption of this new KPI increases across other companies globally, having alignment on a standard level of maturity expected in GHG estimates at different decision gates would help us to understand real progress.

Optimizing different KPIs

IPA measures the carbon competitiveness of projects based on the project team’s estimates of GHG emissions compared with the industry average GHG emissions of a project with similar characteristics. Based on the overall performance trends IPA has seen in the industry and the relative competitiveness between companies, some clear patterns are emerging that separate the industry leaders from the followers.

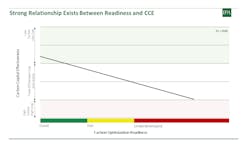

While understanding the carbon competitiveness of any project is the first step, it is important to optimize the balance between cost competitiveness and carbon competitiveness. IPA’s Carbon Capital Effectiveness (CCE) analysis compares the project’s carbon and cost effectiveness. It is commonly expected that achieving a low-carbon project comes at increased cost. While this is sometimes true, in several cases decisions made by the project team helped deliver a low-carbon and low-cost project. A well‑framed and well-defined project should achieve the optimal balance between GHG intensity and cost. Such a project is best prepared to succeed in both outcomes.

Figure 3 shows the relationship between the optimal outcome measure, CCE, and project team’s readiness, CORA, for projects in the IPA database. As can be seen, projects with a good CORA score are significantly more effective in developing low-carbon low-cost projects than projects that lag in their practices.

Treating GHG emissions as a cost

The decarbonization journey is not just about getting to the optimal solutions but also getting there quickly. There is a sense of urgency in achieving low-carbon performance. This is certainly reflected in the actions of some of E&P sector companies. Most UIBC companies now evaluate GHG performance for each E&P project and use this metric to drive key decisions. This trend has really only emerged in the last few years. As companies make addressing GHG a requirement, we are seeing certain Best Practices emerge and their adoption is already increasing across project teams. An important evolution is that companies and project organizations are now beginning to treat GHG emissions just like cost. They are realizing there is a carbon budget, global and corporate, and are making decisions to maximize value while staying within that budget. We absolutely have to continue on this path of improvement.

Decarbonization journey continues

While we are making great progress in improving the carbon competitiveness of hydrocarbon production, there are still gaps we need to address as an industry to succeed in this endeavor. Some of the key gaps are:

Inconsistency in measurement and reporting. Most regions now require companies to report their emissions on a regular basis. However, the regulatory expectations are often at a much higher level—portfolio level, sometimes asset level, rather than project level. This leads to a disconnect between the GHG estimates and capex decisions made at an individual project level, and the measurement of actual performance after startup. Like hydrocarbon production, we need to establish strong feedback loops to understand what really happens after startup—that is, did the project deliver on its promise? And what can we learn from the deviation between estimate and actual performance?

Addressing Scope 3 emissions. The industry seems to have a good understanding of their Scope 1 and Scope 2 emissions, and in most cases an effective plan to address these. Plans to address Scope 3 emissions, however, are not well established yet. Some project organizations have begun estimating Scope 3 emissions (including those from fabrication yards, transport and installation, contractors and vendors, etc.) in their decision making. We need to increase focus on this issue and work toward setting up frameworks to influence Scope 3 emissions in a positive way.

Integrating GHG performance into decision making. Early adopters have shown that there is a way to continue to deliver value and, at the same time, progress a low-carbon agenda. While significant, they still only represent a fraction of the global hydrocarbon production. All hydrocarbon producers, especially those in regions that do not yet have a price on carbon, have to integrate GHG performance in their decision making for long-term success.

About the author

About the Author

Adi Akheramka

Research Team Lead for Carbon Management and Sustainability, IPA

Adi Akheramka is IPA’s Research Team Lead for Carbon Management and Sustainability. His focus is on improving the sustainability performance of individual capital projects and project delivery systems through effective benchmarking and adoption of industry best practices. He works with several Fortune 500 and other companies across industrial sectors to help them progress their emissions reduction, water management, and waste management agendas. Adi has participated as a speaker, panelist, and moderator at many industry conferences, including the World Petroleum Congress (WPC), the International Meeting for Applied Geoscience & Energy (IMAGE), and events organized by the National Ocean Industries Association (NOIA) and Society of Petroleum Engineers (SPE).