Streamlined upstream sector likely if low oil price prevails

Offshore staff

LONDON – The upstream oil and gas sector needs to act quickly in the current environment of unprecedented uncertainty, according to analysts at Wood Mackenzie.

Although there are strong parallels to 2015-16, the macro-environment is very different, they argue, because even if OPEC+ returns to the table for a new agreement, present events have altered the perception of risk for the long term.

There will likely be immediate and deep cuts to discretionary investment and global upstream spending could drop by over 25% year-on-year.

Companies have three main options for cutting expenditure, they claimed, namely:

- Driving efficiencies to extract the same or similar production for lower investment;

- Deferring final investment decisions for new projects;

- Reducing activity levels and costs in their base business (including short-cycle investment, exploration and operating costs).

It seems likely that large new projects will have to be put on hold and short-cycle investments pared back, with spending on projects both under development and onstream will also affected. Exploration too will be trimmed.

This means that only the lowest-cost producers with the strongest finance positions will be able to make meaningful discretionary investments.

If prices do not rebound quickly, this will significantly impact currently producing fields and future supply.

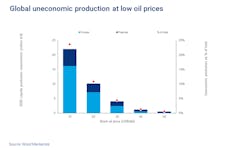

During the downturn of 2015/16 virtually no ‘out-of-the money production’ was shut-in, but prices only slipped below $45/bbl for a year, and below $35/bbl for one quarter. So there is no precedent for the scale of potential shut-ins that may follow if there is a prolonged period of low prices.

The industry’s ability to keep higher-cost barrels flowing will therefore be severely tested.

If prices do not recover, Wood Mackenzie claimed, shut-ins will be more substantial than in 2015/2016, and due to the difficulties and costs associated with reinstating mature production, some of this supply may never return.

Operators, oilfield service companies and their investors are having to contend with three dilemmas, one being equipment and services demand.

Stricter capital discipline from operators will reduce demand substantially this year, so offshore, as well as in L48, only a handful of major projects now look set to go forward this year.

Second is financial resilience. Companies had already cut back so hard, it may be difficult to identify further savings without drastic measures such as refinancing or the restructuring of business models.

Staff cuts and bankruptcies appear inevitable.

Third, excess capacity. Companies holding onto idle assets “just in case” will have to think again.

The prospect of sub-$40/bbl oil will force profound change and pain in the short term, but could ultimately create a more sustainable business for those that survive, Wood Mackenzie said.

Once upstream activity does revive, however, the reality of a much smaller and less capable service sector could hurt operators, impacting their ability to bounce back quickly.

However, the strongest service companies will drive collaboration and technology development, so the likelihood is the emergence of a smaller and more efficient industry.

03/20/2020