Viridien and Challenger leveraging seismic tech to explore in North Sea, offshore Uruguay

Both Viridien and Challenger Energy are utilizing seismic technologies to improve subsurface imaging, revealing promising hydrocarbon prospects in mature basins and supporting strategic offshore exploration and production initiatives.

Viridien processing latest North Sea Utsira 3D survey

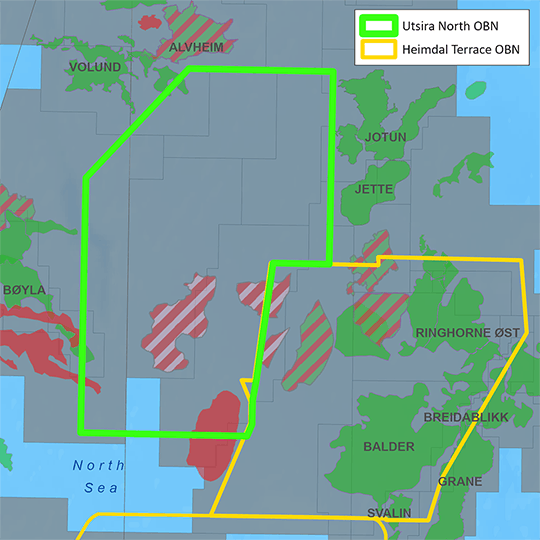

Viridien has started the processing and imaging phase for the Utsira North multi-client ocean-bottom node (OBN) seismic survey in the Norwegian North Sea.

Acquisition was completed earlier this summer. The company expects to issue final imaging results for industry licensing next summer.

The 513-sq-km Utsira North OBN survey covers an area east of the Aker BP-operated Alvheim Field in the Southern Viking Graben. It is designed to assess further opportunities for near-field exploration and production of existing reserves in mature basins.

Viridien’s imaging teams are deploying techniques including proprietary time-lag full-waveform inversion technology.

The company expects the results to deliver improved resolution of the region’s complex geological intervals, shedding light on how deep-seated faults help determine sediment distribution. The project should also clarify the presence of reservoir facies.

Challenger identifies further prospects offshore Uruguay

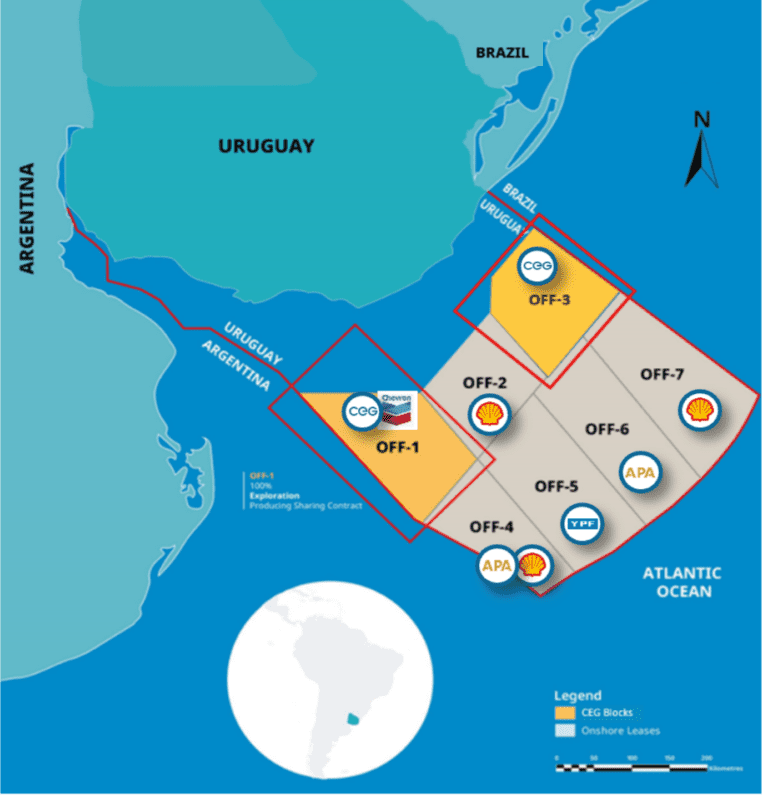

Challenger Energy said in a Sept. 9 operational update that it had completed the first phase of a technical work program for the AREA OFF-3 Block offshore Uruguay.

Activity mostly involved reprocessing, interpreting and mapping of 1,250 sq km of 3D seismic data, along with various geophysical and geochemical work.

Two geotechnical desktop reports remain to fulfil the first-period minimum work obligation, but these can be completed at any time before the expiry of the first exploration period in June 2028.

Among the findings are multiple new seismic attribute-supported prospects and leads, all identified from this year’s reprocessed 3D data, and further corroborated by degree of structural conformance, DHI (flat spot) and amplitude variation with offset (AVO) analysis.

The two main prospects, Benteveo and Amalia, have a combined best estimate (Pmean) of ~380 MMbbl recoverable with an upside (P10) case of ~980 MMbbl, the company added.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.