Tupi extended well test sheds light on Brazil’s subsalt bonanza

Peter Howard Wertheim - Contributing Editor

Brazil had another reason to celebrate its May 1 national Labor Day bash. The new reason was the start-up of first oil at the mega Tupi field in the Santos basin. This first extended well test (EWT) of the subsalt formations began producing at a rate of 14,000 b/d of oil and should peak around 30,000 b/d, operator Petrobras says.

Petrobras has not reckoned the size of the BM-S-11 reserves beyond its initial estimates of 5-8 Bbbl of recoverable light oil. The amount, however, was considered staggering enough to inspire President Luiz Inacio Lula da Silva to declare that “God is Brazilian.”

The celebrations surrounding the Tupi EWT are not just about the technical success of producing subsalt oil and gas in Santos and the emergence of Brazil as one of the world’s Top 10 petroleum producers. They also mark a new era and a “second independence” for the country.

“Today, one quarter of the world’s deepwater oil production is in Brazil,” says Petrobras’ president Jose Sergio Gabrielli. “Our country offers the world’s most realistic offshore opportunities.”

Brazil’s subsalt viable at $35-$40/bbl

Enthusiasm for the EWT at Tupi owes in part to Gabrielli’s assessment that exploration and production (E&P) of Brazilian subsalt hydrocarbons is viable, even with oil prices at $35/bbl to $45/bbl.

Exploration costs apparently are on a downward trend for the Brazilian subsalt, or “presalt” as it is commonly known in the country. At the start of Tupi exploration, the first well cost $270 million. However costs have since declined to $90 million per well, and recently as low as $60 million, Petrobras officials say.

Gabrielli praised the pace with which Tupi reached long-term tests, having been discovered in 2006. “No other discovery of this magnitude was able to produce its first oil within three years’ time,” he says.

The BM-S-11 block is operated by Petrobras (65%) in partnership with BG Group (25%) and Galp-Energia (10%).

Tupi’s output could peak at some 1 MMboe/d by 2022, according to Wood Mackenzie, which considers the field “one of the most significant oil discoveries in the last 20 years.”

The consultancy points out that Tupi was surpassed only by the 12.9 Bbbl Kashagan field found in Kazakhstan in 2000. Within Brazil’s own hemisphere, there has not been a discovery of this magnitude since Cantarell in 1976. At a time when a retreat in oil prices and economic recession have taken a bite out of capital spending in other regions, national oil company Petrobras is budgeting $174.4 billion for capex through 2009-2013 period, an increase of 55% over the 2008-2012 plan of $112.4 billion announced a year before.

Petrobras plans to invest $29 billion in the presalt area to 2013, including $19 billion in Santos basin. By 2020, Petrobras expects to invest a total of $111 billion in presalt projects.

While celebrating Tupi’s first oil, Lula urged his ministers to work faster to deliver proposals for a new regulatory framework to explore presalt. “There isn’t one country in the world that discovered large reserves of oil and did not change its regulations,” he said.

Analysts speculate Brazil may implement a hybrid system based on the present concession model, with higher royalties, production-sharing agreements, and the creation of another state-oil company to administer the presalt hydrocarbons. The new state-owned company would be modeled after Norway’s Petoro, which does not engage in E&P but manages petroleum finances as an equity company. Mines and Energy Minister Edison Lobão has advocated strongly for this proposal, and the promise of federal proceeds for social projects appeals to many segments of Brazilian society.

New frontier

The EWT tests the principal carbonatics reservoir of the Tupi field and possibly one of the secondary reservoirs, to gather information for optimizing the pilot project scheduled for 2010 and ultimately the definitive systems of the Tupi field, officials say.

With the EWT, Petrobras opens the development of a new exploratory frontier. These are reservoirs in microbial-type carbonatic rocks (originating from microorganisms that fossilized millions of years ago) located at a depth of some 5,000 m (16,404 ft.) from the seabed plus 2,000 m (6,562 ft) from the waterline.

“The target is to verify how the reservoirs behave when submitted to prolonged production, verify if there is hydraulic communication in the reservoir, verify mechanisms of possible damage to the geological formation, and check outflow conditions of fluids being produced,” José Formigli, executive manager of Petrobras’ E&P presalt program tellsOffshore magazine.

Tupi’s initial development phase includes the FPSOCidade de São Vicente with a turret contracted from BW Offshore for 10 years. The contract has an option for another five years, plus an option to purchase the vessel at the end of this period. The FPSO is a Suzemax category with 140,000 dwt, anchored at 2,140 m (7,021 ft) water depth for the EWT at well 1-RJS-646.

Tupi’s 28-30º API oil will be transported 290 km (180 mi) to the coast by relief ships. The natural gas produced during the EWT will be used to generate energy for the production unit. Any remaining will be flared. The 14,000 b/d production of oil is associated with 500,000 cm/d (17.66 MMcf/d) of gas.

The FPSO is gathering data about the field to be used for long-term production solutions at Tupi as well as for future presalt developments, Formigli says.

Key takeaways from the EWT

Cristiano Sombra, coordinator of Prosal (the technological program for production and development of presalt reservoirs at Petrobras’ R&D center, Cenpes) says the EWT at Tupi represents an important lesson for the future.

“The EWT is expected to yield answers and information related to reservoir behavior; reservoir flow and pressure behavior; reservoir compartmentalization and degree of intercommunication; complete sampling of reservoir rocks and fluids; and formation of damaging mechanisms and control. In addition, the EWT will give information about equipment behavior in the presence of CO2 (8 - 12%), as well as the subsea flow assurance.”

Sombra explains that “the optimum results, from a reservoir point of view, would be a sustained high flow rate, controlled damage mechanisms, no evidence of compartments close to the wells, good reservoir quality in both wells, and no significant corrosion. From a flow assurance point of view, the absence of significant inorganic or organic precipitates would be optimum results of the EWT.”

According to the Cenpes executive, the age of the reservoirs is Aptian, a subdivision of the Cretaceous. These reservoirs are microbial carbonates, an unusual type of reservoir rock deposited in a lake formed during the South Atlantic rift. When this lake became hyper saline, a thick salt layer was deposited above the microbial carbonates. During the evolution of this lake these became an open sea, normal marine salinity prevailed, so the deposition of evaporites ceased. The role of the salt was crucial for petroleum accumulations below: the salt was the seal that prevented the petroleum from migrating upwards.

An intact salt layer holds the oil underneath like an impermeable lid. The salt also has a high rate of temperature conductivity, allowing the area below to transfer its heat and cool off. Because the salt crust is flexible, it acts like a cushion, preventing pressure from being transmitted to other layers.

All EWT results from this complex geological scenario will be analyzed and used as lessons to be applied for the pilot test in 2010, including reservoir, materials, and flow assurance.

“A better understanding of the reservoir characteristics will ensure a better evaluation of the pilot project, as well as better choices for the future definitive production strategy for the presalt,” says Sombra.

The EWT will run 15 months with output peaking at roughly 30,000 b/d. The FPSO will be connected to two wells. Testing of well 1-RJS 646 will continue during the first nine months and the second well 9-RJS 660 in the remaining six months.

By year-end 2010, after the EWT is complete, the Tupi Pilot Project is scheduled to begin with the FPSOAngra dos Reis, capable of processing 100,000 b/d of oil, as well as 5 MMcf/d of natural gas. The vessel has storage capacity for 1.6 MMbbl of crude oil, says Formigli.

The pilot project will consist of five producing wells, two wells alternating injections of water and gas, and one water injection well. Some of these wells will be drilled before first oil of the pilot test.

According to Formigli, two of the wells will be directional, with an average depth of 6,500 m (21,325 ft) and one horizontal well with a total length of 6,400 m (20,997 ft).

Doubling Brazil’s production

Petrobras is required to declare Tupi’s commercial viability to the National Petroleum and Biofuels Agency (ANP) by December 2010.

Tupi’s commercial production is expected to begin in 2013 with 219,000 b/d of oil, rise to 368,000 b/d in 2014, 582,000 b/d in 2015, 952,000 b/d in 2016, and 1.315 MMb/d in 2017. By 2020, Petrobras projects presalt output to reach 1.815 MMb/d from 23 presalt production platforms in place.

This figure would almost double Brazil’s total oil output, now standing at an average of 1,900 b/d, around 80% of mostly Campos basin heavy oil.

The current exploration focus is in the three southernmost basins: Santos, Campos, and Espirito Santo, covering a length of over 800 km (500 mi), with an average 200-km (125-mi) width. Santos basin has the largest number of presalt reservoir discoveries up to now: Iara, Carioca, Guará, Parati, Bem-Te-Vi, Caramba, Júpiter, Iguassu, Azulão, and Corcovado.

The whole presalt region may contain as much as 100 Bbbl of oil, claims Marcio Mello, a former Petrobras geologist, now head of Brazil’s Petroleum Geologists Association and president of the consulting company High Resolution Technology (HRT) Petroleum in Rio de Janeiro.

Tupi is just one of several “elephant” finds of more than a billion barrels each. According to London-based BP Plc, which ranks countries by production, if these finds prove to be commercially viable, they may position Brazil as the world’s fourth-largest oil producer after Saudi Arabia, Russia, and the US. Brazil currently ranks 13th.

The discovery of Brazil’s bonanza has implications for the industry far beyond the country’s borders. Petrobras’ partner, Galp Energia of Portugal, for example, now plans to shift its focus to E&P from refining and marketing, thanks to its stakes in some of Brazil’s leading Santos discoveries, said company CEO Manuel Ferreira de Oliveira.

“The Santos basin is one of the largest geological jewels that nature has offered to the oil and gas industry in recent times,” he said, adding the basin would be profitable at current prices.

BG Group is another of several foreign companies betting heavily on Brazil’s presalt. The British company has interests in seven concessions in the Santos basin covering a total area of approximately 7,450 sq km (2,876 sq mi). BG’s CEO Frank Chapman said: “The Santos basin is now one of the world’s most important hydrocarbon regions and will be a major source of global supply for decades to come.”

Reform required for unitization

Petrobras may have technological challenges under control but most companies operating in the presalt region face the question of unitization when hydrocarbon reservoirs touch two or more concession blocks.

According to a proposed unitization agreement, the owner of an exploratory block over an oil deposit which extends to other neighboring blocks is obliged to negotiate with the owners of neighboring blocks on joint exploitation of the deposit, as if it were a single block.

“But, negotiating a unitization agreement is quite complex, since very large amounts of money are involved and companies must come to an agreement about complex technical issues. One of the issues is the measurement of the reserves of each block for the purposes of sharing the income proportionally and criteria to renegotiate such sharing, should an unbalance arise in the proportion initially established,” explains Oswaldo Dela Torre, an associate lawyer at the energy, petroleum, and mineral sector of Mattos Filho Advogados in São Paulo.

“The regulation of the unitization between blocks already granted by the ANP and those not yet granted, has been considered by the government as the main obstacle to the continuity of the bidding rounds for the presalt areas. It has been said that the ANP is expected to submit for public consultation a bill of law which is intended to regulate the issue,” Dela Torre tellsOffshore magazine.

One uncertainty is what happens to presalt reserves found adjacent to areas not yet drawn up by the government for concession. In this case, the government, as the licensing authority, has grounds to argue that new regulations must be implemented to address unitization issues before any new areas can be tendered. This has not been regulated yet and eventually must be resolved, Dela Torre says.

The unitization question came to a head after the recent publication of updated results of the drilling activity performed in block BM-S-22, operated by ExxonMobil, in consortium with Hess and Petrobras, where the Azulão well was drilled. If the 5 and 10 Bbbl reserve estimates are confirmed, they would surpass the reserves of Tupi and ExxonMobil would be the operator of the project with the largest estimated deposit in the presalt area.

The BM-S-22 block is adjacent to the super giant Carioca field where Petrobras, along with Repsol YPF and BG Group, has found oil. The argument that the reservoir at Azulão extends to blocks covered by Petrobras’ concessions gave rise to the discussion about ExxonMobil’s obligations to negotiate a unitization agreement at such time as those reserves are confirmed, says the lawyer.

The basics for unitization agreements are regulated already by Article 27 of Brazil’s Petroleum Law. ANP’s concession agreement model contains clauses which deal exclusively with unitization, and these are in some cases compulsory. Clearer and more precise rules to regulate unitization agreements in Brazil would certainly provide greater regulatory clarity for the sector, concludes Dela Torre.

Editor’s note: Contributing Editor Peter Wertheim is based in Rio de Janeiro, and can be contacted by e-mail at[email protected].

Technology challenges under control

Despite a list of mind-numbing technological challenges, José Formigli, manager of Petrobras’ E&P presalt program, tells Offshore magazine why Petrobras is certain it has the technology to master the presalt:

Offshore: Petrobras E&P officials claim that there are no insurmountable technical challenges in Tupi...

Offshore: Some critics say Petrobras is adapting deepwater post-salt (like in the Campos basin) E&P technology to presalt and that this won’t work.

Formigli: Petrobras is extending the use of deepwater technology, which has in Campos basin one of the most advanced worldwide sites of application, for the presalt in Santos basin. Whenever necessary, adaptations or even new developments are done to guarantee the technical feasibility for the safe and economical exploration effort as well as production development of the discoveries.

Offshore: What are some of the main differences between presalt and deepwater post-salt technologies?

Formigli: Drilling through thick salt layers demands special design and execution procedures for achieving the producing zones. Microbialites are the type of carbonate from the production formation, demanding special studies for reservoir characterization. High CO2 content in the produced gas plays a significant role in those adaptations that are necessary for the production development projects. Special metallurgies have to be adopted for well and subsea equipment, as well as some components of processing plants. In order to reduce the CO2 atmospheric emissions, Petrobras will reinject all the separated volume from the gas flow. Besides the concrete environmental benefit, there may be a significant beneficial collateral effect on the recovery factor of the reservoir.

Offshore: Some argue that under Brazilian law CO2 cannot be released into the atmosphere. Does the environmental pressure present an obstacle?

Formigli: It’s not true that the Brazilian law forbids CO2 emission. As previously explained, Petrobras is separating and reinjecting that contaminant on the produced gas flow as a voluntary policy.

Offshore: Some skeptics say that to get to the presalt oil Petrobras will have to sink tons of equipment to depths where the water pressure would crush a sinking ship like a soda can. Also, when oil as hot as 100º F (38º C) suddenly meets pipes rising through extremely cold water on the ocean bottom, the paraffin could solidify and block the pipes.

Formigli: Flow assurance issues, like wax and hydrate control, are very common in Campos basin operations and do not represent any new challenging issues.

Offshore: Some specialists argue the salt layer instability makes horizontal drilling very difficult.

Formigli: Considering the vertical permeability variation that may be present throughout the thick carbonate producing formation, the traditional mindset applied to Campos basin deepwater relatively homogeneous sandstones is not directly applicable to Santos basin presalt. Of course deviated and multilateral wells, as well as horizontal ones (currently less probable) may be applied in the future as alternative well geometries to increase reserves’ recovery, besides productivity per well.

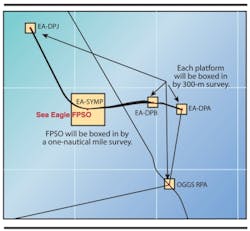

Offshore: Getting workers and equipment to and from the offshore platforms is a logistical challenge. Helicopters cannot cover the 340 km (211 mi) to Tupi and other offshore sites and back without running out of fuel.

Formigli: Mid-distance logistical support hubs are on the drawing board and no final decision has been taken yet about which type of marine structure will be used.