Oilfields to be operated as single industrial process

Brian Drakeley

Ray Phillips

ABB Offshore Systems Ltd.

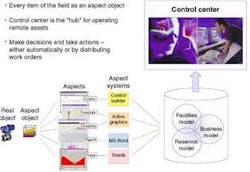

ABB's vision of the "oilfield of the future" is that it will be operated as a single industrial process, optimizing the oil and gas production from the reservoir, through the wells and subsea and surface facilities.

In other words, ABB will deliver the automated oilfield and the company will develop its ideas working alongside a number of major customers to test assumptions and solutions.

null

The major factors driving current thinking include the growing shortage of skilled exploration and production staff, the constant need for lower costs, and the drive for better operating information and thereby improved net present value of their producing assets. Although the work is currently at the feasibility stage, some of the technical building blocks are already available or in an advanced stage of development, principally in the area of monitoring reservoir activity, actuation, and control systems, and production flow measurement software. How these blocks fundamentally interact is illustrated in the loop diagram.

The universe of engineers, geologists, production technologists, and others who effectively run the exploration and production side of the industry, is aging, with little sign of adequate replacement numbers. There have even been oil industry conferences devoted solely to topics such as The Big Crew Change (organized by the Society of Petroleum Engineers). In 10 years, models suggest that skill levels will have fallen and insufficient qualified people will be available, so the need for more automation is compelling.

The principal area for increased automation is in offshore upstream activities, which include exploration, field development, and production, which are all labor intensive. Intervention costs offshore are much higher than onshore, so any technology that reduces the need for intervention operations offshore will provide direct savings to the oil companies. Around 1,100 new "platform" based offshore wells are drilled each year with a further 250 that will produce from subsea facilities. This compares with some 10,000 onshore wells, which are predominantly less expensive to drill and operate.

Technical sophistication upstream has traditionally been relatively low and actions tend to be people-driven. Manpower is usually located at the decision point where the controls are handled or initiated manually. This could be automated using con- ventional technology, provided the commitment was there.

Oil companies are also looking for additional financial re-wards from raised recovery factors. For subsea fields, around 30% to 35% of available reserves can be recovered from each reservoir by conventional means. Raising this by 5% or even 10% – a not unrealistic target – would have a dramatic effect on the economics of the field and its revenue streams. This incremental production increase has major cost saving implications because it may remove the need for further expensive drilling in the same reservoir.

Monitoring systems

To manage a reservoir effectively, the operator needs information on what's happening in the reservoir during its life.

Reservoir monitoring can be divided into three market segments:

- Wellbore sensing – permanent P&T sensors plus other well fluids characteristics such as flow rate and water cut using electrical and optical techniques

- Reservoir imaging beyond the wellbore – using microseismic (temporary and permanent monitoring installations), resistivity, and cross-well tomography, from sensors installed in the wellbore

- Active seismic imaging – from towed arrays. The use, for offshore oilfields, of permanently installed ocean bottom cable monitoring (OBC) systems as an active seismic sensing method is increasingly proposed as a means of replicating what active seismic can already achieve for onshore reservoirs.

In addition, the use of software packages that manipulate and interpret data will significantly add value to the "raw" data achieved as a data set from the deployed instrument package, i.e., turn data into information.

Control platforms

This building block includes:

- Physical infrastructure to connect sensor systems, monitoring the reservoir and process facilities, to the control hub

- Data gathering/data transmission infrastructure to deliver field data in a determined, recognizable way and one in which data can be recorded, archived, and retrieved for later analysis

- The control platform itself both in physical hardware form and in its realization of a software operating system

- Algorithms (control strategies) implemented in software to model the physical processes numerically and predict outcomes in response to recommended control (remediation) strategies.

Control mechanisms/ remediation tools

If the oilfield of the future is to be represented as a single industrial process, then on the highest level the available remediation strategies fall into these categories:

- Bring about a change in the pressure regime, for example, through the use of flow control or "choke" valves

- Change the viscosity regime, for example, by introducing electric heating

- Change the composition regime. Established methods for doing this include injecting chemicals or, on a different level of sophistication, taking out a significant amount of formation water near the wellhead to reduce the propensity of the produced fluids to form hydrates.

So, in overview, to achieve a consistent state of development and the ability to deliver the automated oilfield, the oilfield of the future requires evolution of technologies in these four areas:

- Monitoring systems

- Control platforms

- Optimization strategies

- Control mechanisms/remediation tools.

Not surprisingly, the technology development status and level of qualification for the whole range of products and services involved in this vision is far from consistent. Many are entirely routine, such as active seismic surveys or pressure-regime control at wellheads, while others are embryonic, such as optimization strategies across the whole production process. A number of important technologies have seen first field deployment and qualification, and some of these where ABB has contributed significantly to the development are described below.

Monitoring

Software analysis and presentation packages add substantial value to raw data sets. One example of this is a proprietary microseismic data analysis and visualization tool that ABB calls Xmetal (microseismic event timing and location) and is used to map microseismic images onto geo-technical models. As another example, ABB has produced its Well Monitoring System software to tie together information from pressure and temperature sensors at the wellhead and downhole and provide the client with information on oil, gas, and water flow rates and flow assurance surveillance data. In addition, the operator is provided with sensor validation and sensor "redundancy."

Increasingly, operators are recognizing the value of monitoring beyond the wellbore, using sensors in the wellbore. One example of this is "passive" microseismic monitoring, and some of the potential benefits to be accrued are:

- Monitoring of flood conformance and water front movement

- Identification of fault seal/conductivity

- Imaging of flow anisotropy associated with fracture dominated reservoirs

- Targeting of new injector/producer wells sites

- Construction and validation of predictive reservoir models

- Interpretation and calibration of time-lapse seismics.

In addition to WMS, for ABB the focus in the monitoring services segment is on microseismic data acquisition, processing, and interpretation. Essentially, microseismic events are micro-earthquakes that occur in the reservoir as a result of fluid movement. But it is important to note that not all reservoirs are receptive to use of this technology.

The majority of microseismic surveys performed to date has been of the so-called temporary surveys type typically performed for:

- Hydraulic frac operation monitoring

- Drill cuttings injection monitoring

- Trials to examine the potential for deployment of permanent surveys, i.e., proof of concept in specific fields

- Analysis of specific geological problems.

ABB has an established track record in temporary and trial microseismic surveys in the oil and gas industry. Of more significance to the future of this technology and for the automated oilfield is the current development work aimed at producing cost-effective and reliable, permanently deployed microseismic monitoring systems. Such an experimental system has been deployed in a producing field for over a year, and the results have proved extremely valuable in updating the reservoir model.

Microseismics are referred to as passive seismic monitoring, and in the area of active seismic monitoring, ABB has formed an alli-ance with a Houston-based company, Input/ Output Inc., to provide the industry with permanently-deployed 4D/4C OBC seismic monitoring systems (Offshore, January 2003).

In the area of control mechanisms, we identified devices (chokes) to change the pressure regime in the oil/gas production facility.

Besides the ABB business solutions for subsea and topsides control systems, which naturally form an important part of the automated oilfield system, the company is developing an intelligent well control and communication system called advanced downhole monitoring and reservoir control (Admarc) for downhole applications. Admarc is based on an architecture that uses dissimilar redundancy and fault-tolerant design features to enhance system reliability.

The downhole flow control device (FCD) can be operated via electrical, hydraulic, or electro-hydraulic actuation means. One of these operational means is selected as primary and the other as the secondary or back-up operational mode. In the unlikely event that the primary means undergoes a system failure, the back-up mode can be enacted.

null

Sensors and data acquisition circuits at the FCD provide feedback on the zonal production/injection status, e.g., P, T, to the operator via the communications link. Diagnostic information on equipment condition in service is also provided.

The Admarc FCD has variable choking capability, offering an almost infinite number of positions between fully open and fully closed.

The basic version of the system use electronics rated for 300° F. In addition, ABB is qualifying downhole electronics that are rated for 225° C. The higher rating is achieved via proprietary electronics manufacturing techniques together with the use of application specific integrated circuits designed specifically for this application.

It should be noted that the use of electronics that are rated above actual well application ambient temperatures results in a direct increase in overall reliability. That is the driver for the development of the high temperature electronics.

Last, in the area of control platforms, we expect to see an increasing use of object linked environment (OLE) process control (OPC) standards – the glue that holds industrial process automation together.

OPC standards are the key to inter-operability between different vendor systems and interfaces between real time, continually changing data and historical data already stored.

OPC is open connectivity in industrial automation and enterprise systems that support industry. Interoperability is assured through the creation and maintenance of open standards specifications.

The OPC Foundation (www.opcfoundation. org) has seven standards specifications completed or in development. As an example, OPC Historical Data Access provides access to data already stored so that historical archives can be retrieved in a uniform manner. ;