FPS sentiments survey: market to stay active through 2028

Key Highlights

- Industry sentiment remains positive but has declined from record highs, with 68% confident in meeting targets this year, down from 86% last year.

- Cost inflation is moderating, primarily driven by labor and commodities, with some respondents expecting increases of less than 5%.

- Project delays in 2024-2025 have eased capacity constraints, providing a buffer for supply chains and moderating cost pressures.

By David Boggs, Energy Maritime Associates

Industry sentiment for the new year remains highly positive, though it has gradually declined from the record levels seen two years ago. These sentiments, and data provided here, were obtained from Energy Maritime Associates’ recent Global Floating Production Market Sentiments Survey.

The survey, now in its thirteenth year, gauges the current global market sentiment as well as where the industry is heading in the future.

Project delays in 2024 and 2025 have tempered optimism but also provided breathing room for the supply chain, easing capacity constraints and moderating cost inflation.

Survey responses indicate that the industry is expected to remain active for at least the next 2–3 years, despite growing concerns over political instability, falling oil prices, and financing challenges.

Business outlook

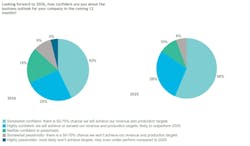

Sentiment in the offshore energy sector remains predominantly positive, with 68% of respondents expressing confidence in achieving their revenue and production targets this year. However, this marks a two-year decline from 86% last year and a record high of 93% in 2023.

After four years of increasing optimism, negative sentiment reappeared last year. This trend has continued with 13% of respondents having a pessimistic outlook, compared to 6% last year, 0% in 2024, 5% in 2023, 8% in 2022, and 19% in 2021. Of these 13% with a negative outlook, 4% are extremely pessimistic. There were no extremely pessimistic respondents in the previous two years. On the other end of the spectrum, about 1/4th of respondents are highly confident, similar to last year. In the middle are 19% of respondents that are neither confident nor pessimistic, up 10% over last year.

This seems to indicate that while there is overall optimism in the outlook for the offshore energy sector, there is a growing gap between those at the top and others with a more uncertain view.

Some quotes from survey respondents:

- “We have a strong positive outlook for 2026. We expect several contract awards.”– FPSO Contractor

- “Highly confident we can achieve the revenue for this year, driven by demand in Brazil.”– Engineering Company

- “UK Government’s policies are badly affecting the offshore oil and gas market.”–Services Provider.

Cost inflation

While costs continue to increase, the rate of growth appears to be moderating. However, there is a diversity of opinions. Most respondents, 38%, believe costs will increase 5%-10% in the next year, while a slightly smaller amount, 34%, think that cost inflation will be less than 5%.

On the other extremes, 1/5th of respondents believe that costs could jump by more than 10%, reversing a three-year trend. In 2022, 40% of respondents believed costs would increase by more than 10%. This dropped to 20% in 2023 and 13% last year. An increasing number believe that there will be no cost inflation – growing from 1% last year to 8% this year.

The primary driver of cost inflation continues to be labor, with high demand for skilled engineers and construction workers. Commodities ranked as the second biggest factor, unchanged from last year. After a one-year hiatus, logistics replaced financing as the third most significant factor in rising costs.

Some quotes from survey respondents:

- “We do see a tightening supply chain market with a large demand of new projects, which we believe will lead to higher prices.”–FPSO Contractor

- “There is almost no more room for escalation after the outsized inflation we’ve seen the last few years. And the anemic oil prices wouldn’t allow much inflation due to project economics.”– Energy Company.

Looking over the horizon

Each year, Energy Maritime Associates solicits respondents’ perspectives on future activity levels. Comparing last year’s projections for 2025 with actual activity reveals that expectations were somewhat optimistic, with all areas experiencing less activity than forecasted.

This year, respondents have moderated their expectations for tendering and proposals, with a 10%-11% shift from high activity to medium. There is no shift in expectations for project execution, which may indicate more repeat contracts and/or larger scopes of work. We also see contractors becoming increasingly selective of where to allocate tendering resources.

Greatest growth obstacles

Political issues remained the greatest obstacle to offshore project growth, unchanged from last year. Concerns persist regarding global conflicts and political uncertainties, particularly in the US and UK. Note that this survey was conducted in December 2025, prior to the US intervention in Venezuela.

Oil prices have re-emerged as the second-most significant obstacle, rising from sixth place in 2023 and third place last year. This is consistent with recent trends, as oil prices have continued to decline, and there are growing concerns about global oversupply. According to the EIA, the average price per barrel for West Texas Intermediate crude oil was $77 in 2024, $65 in 2025 and expected to drop further to $51 in 2026.

Concerns about access to finance appear to be easing. While still the third largest growth obstacle, this is down from second place last year, driven by easing interest rates and investor dissatisfaction with renewable energy returns. In addition, the market has responded to provide alternatives after many institutions ceased or restricted funding for hydrocarbon developments. Contractors throughout the industry have turned to alternative sources of capital, such as bonds and infrastructure funds.

For some lease contracts, operators are offering pre-payments to reduce financing costs. To cut costs and increase competition, Petrobras is now looking to contract FPSO units on a Build-Operate-Transfer (BOT) basis with a 6-7 year period between construction and purchase.

Concerns about industry capacity have continued to decline, dropping from 16% in 2023 to 9.3% last year and 6.1% this year. This is similar to levels last seen in 2021-2022 (5%-7%). Activity levels as not increased as much as expected in 2024 and 2025, with delays in many project awards providing additional breathing room.

Supply chain costs are a continued concern, with FPS costs now ranking just below environmental regulations and above Environmental, Social, and Governance (ESG). By comparison, other costs such as subsea (5%) and drilling (3.1%) are of less concern.

Potential bottlenecks

Offshore installation tops the list this year as the largest potential bottleneck, up from third place last year. This is driven by massive consolidation in the transport and installation market, as well as competition from defense, renewable and decommissioning projects.

Power generation equipment is a rapidly growing issue, with concern doubling from last year. AI data centers are purchasing large quantities of all types of gas turbines, resulting in increasing lead times. Although suppliers are expanding capacity, these turbines are expected to remain the longest lead item for many projects.

Fabrication yards continue to rank as a top concern, holding second place again this year. The increasing size and complexity of FPS topsides have reduced the number of yards capable of building and loading these massive structures. Additionally, many yards are also engaged in constructing LNG terminal modules and other onshore facilities.

Conversely, concerns about shipyard capacity have eased, likely due to the slowdown in FPSO awards during 2024–2025. Shipyards were the biggest concern for the past two years but have dropped to fourth place this year. To address constraints in the newbuild shipyard market, the industry has adopted alternatives such as constructing offshore vessels in non-traditional yards and converting oil tankers in repair yards.

Top growth regions

Brazil remains the top growth region again this year, as it has been since the beginning of the FPS Market Sentiments Survey. Petrobras is posed to award two FPSOs to SBM for the SEAP-1 & 2 developments and has plans for multiple units to develop new presalt fields as well as replace aging FPSOs in the Campos Basin. Independent operators are redeveloping older fields, while larger players such as Equinor and Shell are progressing new developments. Energy Maritime Associates (EMA) is tracking 17 potential projects in Brazil, which could require up to 30 floating production units.

West Africa ranked second this year, closely followed by South America (ex-Brazil), with 14% and 13% of votes respectively.

West Africa has growth prospects in mature areas like Angola, Nigeria, and Ivory Coast, as well as new discoveries in frontier areas like Namibia. Optimism is fueled by government policy incentives to develop idle discoveries, increasing opportunities for both FPSO and FLNG projects.

South America (ex-Brazil) has opportunities in a growing number of locations. ExxonMobil has placed orders for 7 FPSOs in Guyana and has plans for at least an additional 3 units (10 in total). In 2024, Total awarded the first FPSO for Suriname, which could also require multiple units. At the end of 2025, Navitas took FID for the Sea Lion development offshore the Falklands, which with utilize Bluewater’s Aoka Mizu FPSO.

Respondents are more optimistic about the outlook for the Norwegian North Sea, which jumped from thirteenth place up to seventh place. Conversely, the outlook for the UK North Sea remains bleak, driven by extension of the windfall tax, which has effectively halted most potential developments.

Favored FPS types

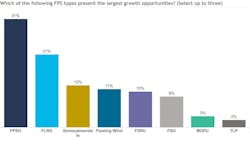

FPSOs remain the clear leader, cited by 31% of respondents as having the most promising growth potential.

FLNG prospects continue to rank second, unchanged from last year. There are currently eleven units on order—though some are speculative. Argentina is emerging as a key FLNG market, with Golar securing two contracts and additional developments underway. EMA is tracking 15 projects that could require up to 21 FLNG units.

Production semisubmersibles have surged into third place, up from sixth last year. Demand for these facilities is strong, with BP, Shell, and Woodside ordering multiple units for projects in the Gulf of Mexico and Australia. EMA is monitoring 18 projects that could require a production semi.

Enthusiasm for floating wind remains subdued, in fourth place again this year. Declining government support and escalating costs have dimmed the outlook for offshore wind in general, and floating wind in particular.

Gauging the supercycle

The offshore oilfield service sector has enjoyed robust growth since 2021, but rates in many areas now appear to have plateaued, suggesting an equilibrium or upper limit. With oil prices continuing to decline, some warning signs are emerging.

Despite this, optimism remains strong. Nearly 40% of respondents believe the sector will stay active through 2028, while about one-quarter expect the cycle to extend beyond 2029. This outlook is slightly less bullish than last year, likely due to lower oil prices.

However, a growing number of respondents believe the cycle may end sooner than expected. The share of respondents who think it will last only 1–2 more years surged from 18% last year to 32% this year. Meanwhile, just 4% believe the cycle will end within a year—unchanged from last year.

Conclusion

The industry sentiment remains highly positive, though it has gradually declined from the record levels seen two years ago. Potential bottlenecks for growth and activity include constraints and limits on offshore installation capacities, experienced fabrication facilities, and power generation equipment. Growth prospects for offshore hydrocarbon developments are strongest in South America—particularly Brazil—and Africa.

These opportunities are primarily focused on FPSO and FLNG projects in both mature and frontier basins. In contrast, the outlook for floating wind projects remains subdued due to escalating costs and limited government support. While activity levels are projected to stay high through 2026–2028, new orders will likely face headwinds from project economics and geopolitical developments.

About the Author

David Boggs

Managing Director, Energy Maritime Associates

David Boggs is the Managing Director of Energy Maritime Associates, which publishes market-leading reports on the floating production industry and advisory services for developments requiring FPSOs, FLNGs, FSRUs, semis, spars, TLPs, MOPUs, and FSOs. Boggs has over 20 years’ experience in the offshore oil and gas industry including as General Manager–Commercial for fleet of leased FSOs and FPSOs. He has a BA cum laude from Harvard University and an MBA with honors from the University of Texas at Austin.