EPC contract awards in 2026 expected to total some $59 billion

Key Highlights

- Forecast for 2026 anticipates a 28% YoY increase in EPC awards, driven by rising subsea tree demand, FPS units, and fixed platform projects, totaling around US$59 billion.

- The FPS market is expected to account for nearly half of 2026 offshore EPC awards, with significant investments planned in Argentina, Canada, Indonesia, and Namibia.

- Regional focus in 2026 will include Africa (15%), APAC (20%), Europe (13%), and the Americas (34%), with Brazil and Guyana leading project sanctions and investments.

By Mark Adeosun, Westwood Global Energy Group

Offshore engineering, procurement and construction (EPC) activities for oil and gas field development and carbon sequestration projects remained robust in 2025, with contract awards for subsea equipment and offshore platforms totaling approximately US$46 billion. This represents a 17% year-over-year (YoY) decline despite a 4% YoY increase in the number of project final investment decisions (FIDs) recorded.

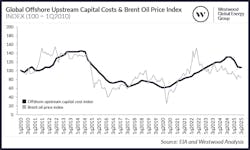

The disconnect between the FID count and EPC award value trend between 2024 and 2025 is due to the offshore upstream price index, which started declining in 2Q 2025 compared to the 2024 price index. This cost reduction supported field FID counts in 2H 2025, with a total of 30 offshore greenfield and brownfield sanctioned compared to 19 fields sanctioned in 1H 2025. Furthermore, project sanctioning could rebound to 65 FIDs in 2026, if the price index continues to decline in 2026, driven by projects that were in the final tender phase that experienced delays in 2025.

The Americas and the Middle East dominated offshore EPC contracting activities in 2025, with major projects such as ExxonMobil’s Hammerhead (Guyana), Shell’s Gato do Mato (Brazil), BP’s Tiber-Guadalupe (USA), QatarEnergy’s North Field Compression Phase 2 and Phase 3 projects (Qatar). This also included continued investments by Saudi Aramco across its producing offshore fields, driving several contract release and purchase orders (CRPOs), including CRPOs 145-148, CRPO 159 and 160.

Key projects sanctioned outside the Americas and the Middle East include TPAO’s Sakarya Phase 3 (Turkey), Eni’s Coral Norte (Mozambique), BP’s Shah Deniz Phase 2 (Azerbaijan) and Petronas’ Kelidang Cluster development (Brunei).

Overall, Westwood recorded approximately 250 subsea tree unit awards in 2025, with the Americas accounting for 49%. However, TPAO’s Sakarya Phase 3 development offshore Turkey represents the most significant single project in 2025 based on subsea tree demand. For floating production system (FPS) units, including FLNGs, Westwood recorded 14 EPC awards, with a total throughput capacity of 1.04mmboepd (715kbpd oil and 1.92bcfd of gas) and 14.6mmpta of LNG capacity. Seven of the units sanctioned were newbuilds, two were conversions, and five were upgrade contracts for existing units, including the BW Maromba to be deployed offshore Brazil; the Aoka Mizu FPSO to be deployed at Navita’s Sea Lion Phase 1 project offshore the Falkland Islands; and the Hilli Episeyo FLNG unit destined for Argentina. Ninety-four fixed platforms (topsides and jackets) EPC awards were recorded in 2025, with the Middle East accounting for 58%. PTTEP’s Arthit Phase 4 was a key project outside the Middle East, with COOEC contracted to deliver 10 wellhead platforms (WHPs) each year between 2027 and 2029 in an EPCIC contract valued at approximately US$800 million.

Looking ahead to 2026, Westwood forecasts offshore O&G-related EPC contract award value to total US$59 billion, a 28% YoY increase, underpinned by a roughly 290 subsea tree unit demand; 18 FPS units (including three FLNG units), with a total throughput capacity of 1.75 MMboe/d (1.15 MMb/d of oil and 3.6 Bcf/d of gas) and 17.4 MMpta of LNG capacity; over 70 fixed platforms; roughly 4,460 km of subsea umbilical risers and flowlines; and some 2,800 km in export pipelines.

It is pertinent to note that 13% of the forecast spend is tagged as “possible,” indicating a proportion is at risk of delay beyond 2026. Approximately US$29 billion (49%) of the forecast spend in 2026 is classified as “firm,” with a letter of intent (LoI) already issued to the preferred contractor, or a frontrunner identified, based on favorable commercial terms. Some US$22.4 billion (38%) of forecast spend is classified as “probable” and is associated with EPC work scopes that are in active tender and are sensitive to both the oil price index and the offshore upstream capital cost index.

Hence, should oil prices hold above US$60/bbl, and the capital cost index continue to decline, this segment of spend will more likely be committed to, ensuring 15% YoY growth in EPC award value when combined with forecast spend in the “firm” category.

The FPS market is forecast to account for 48% (US$28 billion) of offshore EPC contract awards in 2026, with planned FLNG investment off the coast of Argentina and Canada accounting for US$8.7 billion. Furthermore, given that Petrobras did not sanction any FPSOs in 2025, the Brazilian NOC is expected to sanction at least two units this year, with negotiations reportedly at an advanced stage with SBM Offshore for the supply of the SEAP II unit.

Other major FPS contracts expected in 2026 include Eni’s Geng North FPSO unit (Indonesia); ExxonMobil’s Longtail development offshore Guyana; Azule Energy’s PAJ FPSO, for which China’s CIMC Raffles has reportedly emerged as the frontrunner for the EPC work scope; and TotalEnergies’ Venus development offshore Namibia.

Regionally, Africa will account for 15% of forecast EPC spend in 2026, while the APAC region will account for 20%. Europe will account for 13%, with the ongoing fiscal and regulatory posture in the UK limiting investment. However, offshore Norway, investment will be concentrated on satellite fields and brownfield expansion projects. Projects offshore Cyprus are expected to progress over the next 12-18 months, with Eni planning to sanction its Cronos field as a tieback to facilities offshore Egypt before the end of 2026, while Chevron’s Aphrodite is expected to progress through the engineering phase this year and a potential FID in 2027.

The Americas will account for 34% of forecast spend, predominantly driven by Brazil and Guyana, as Petrobras continues to invest in the presalt basin, supported by equipment call-out multi-year Global Frame Agreements signed with multiple contractors. In the Gulf of America, Westwood anticipates that the region will continue to thrive on subsea infill drilling and fast-track developments over the near term, following the sanctioning of BP’s Tiber-Guadalupe project in 4Q 2025. No FPS unit is expected to be sanctioned in the US Gulf in 2026, as Shell’s Leopard field is now expected to be sanctioned post-2026.

The Middle East will account for 17% of forecast EPC award value in 2026, with Saudi Aramco expected to progress with a number of its CRPO tenders. ADNOC is expected to progress key projects such as the Umm Shaif – Gas Cap Project, Abu Dhabi Offshore 2, SARB Phase 2, and the Belbazem Phase 2 project, all offshore the UAE.

While a significant number of projects are expected to progress in 2026, offering offshore EPC contracting opportunities to the tune of US$59 billion, uncertainties remain, given that oil prices are expected to remain suppressed in 2026 and E&Ps are likely to maintain capital discipline. As a result, lower supply chain costs could support continued offshore EPC investment throughout the year. Still, the EPC contracting timeline remains fluid, as oil prices could dip below $60/bbl if the global economy slows, OPEC+ members continue to unwind production cuts and Venezuelan oil returns to the market as proposed by the US administration, leading to a more pronounced oil oversupply, further widening the oil supply-demand balance.

About the Author

Mark Adeosun

Research Manager, Offshore Field Development

Mark Adeosun is currently the Research Director for Westwood Global Energy Group’s SubseaLogix and PlatformLogix market analytic tools. Since joining Westwood in 2013, he has worked directly with as well as advised several clients within the oilfield services supply chain, as part of both analytic and commercial advisory projects.