Offshore energy investments to exceed $300 billion in 2026

Key Highlights

- Asia, led by China, Indonesia, and Vietnam, remains the largest regional market, with significant contributions from wind and gas projects.

- The UK will drive nearly half of Europe's offshore investment growth, focusing on large wind projects like Hornsea 3 and East Anglia Hub 3.

- Upstream projects in 2026 will emphasize subsea tiebacks and natural gas, with major fields in the Persian Gulf, Azerbaijan, and Brazil reaching FID.

By Matthew Hale, Rystad Energy

As the offshore energy industry enters a new year, energy companies are poised to match the growth seen in 2025, partly shaking off worries of oversupplied oil and gas markets and supply chain inflation.

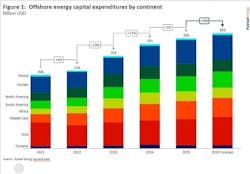

In 2026, Rystad Energy forecasts that total offshore capital expenditures (capex) will again exceed $300 billion in capex for the second year in a row and match 2025’s 5% year-over-year growth.

Offshore expansion continues, but the growth rate remains lower in 2026 compared to the highs of 2023 and 2024, which experienced double-digit gains. While investment totals are lower than the record high set in 2014, the project queue is more diversified, with upstream oil and gas contributing 70% in 2026 versus 93% in 2014.

The largest non-upstream contributor in 2026 will be the wind market, with over $60 billion in capex, up marginally from 2025. While oil and gas sanctioning may be depressed in 2026 on the back of OPEC+ production hikes in 2025, the brunt of deferrals of final investment decisions (FIDs) won’t be felt until later years when projects reach the execution stage.

Regionally, Asia will continue to be the largest market for offshore investments and the biggest source of capex increases, with Indonesia and Vietnam joining China as engines of growth. South America, led by Guyana and Suriname, will be the second-biggest contributor to the 2026 spending gains. Meanwhile, the UK is expected to provide almost half of the growth in the European region, offsetting declines in Norway and other countries.

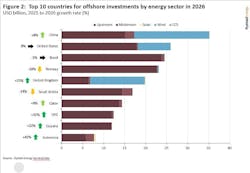

Developers of projects based in China are the largest investors in offshore energy by a healthy margin, with around half of those expenditures directed toward wind generation capacity. Among the top 10 countries, only the UK exceeds China in having a larger percentage of power projects than oil and gas, and this is largely driven by a challenging oil and gas fiscal regime. With a forecasted growth rate of 8% in 2026, Chinese offshore capital expenditures will not expand the most in total capex.

Instead, the UK will claim this title on the back of 23% spending growth followed by the UAE and Vietnam. The Hornsea 3, East Anglia Hub 3, and Inch Cape 1 offshore wind installations are among the larger projects boosting UK capex. Norway and Saudi Arabia are forecast to contract slightly in 2026 as several large facility expansions are wrapped up without being backfilled by new projects of similar scale. The slowdown of the Zuluf and Marjan expansions will impact Saudi Arabia, while several projects in Norway sanctioned during the 2020 temporary tax regime come online, causing a decline in capex spending this year.

In the US, spending on offshore wind will decline in 2026 following the pause in new permitting at the beginning of 2025 and a series of cancellations of permitted projects, including Dominion’s Coastal Virginia Offshore Wind and Equinor’s Empire Wind 1 in December. This will be almost entirely offset by increased oil and gas capex including bp’s design-one-build-many Kaskida and Tiber platforms being built in Singapore and Delfin Midstream’s FLNG vessel under construction in South Korea. In South America, Brazil’s capex will remain roughly flat in 2026 as Petrobras maintains high levels of investment, and Guyana will log another year of expansion. Indonesia will crack the top 10 in 2026 led by the development of the Geng North gas project.

Compared to recent years, the largest upstream projects reaching FID in 2026 are likely to feature more subsea tiebacks and a greater focus on natural gas-weighted production. This aligns with the current environment in which global gas markets feature a stronger long-term demand growth trajectory and crude market surpluses are imposing extreme capital discipline on upstream operators.

The largest field to be sanctioned this year is expected to be the Dorra gas field in the neutral zone shared between Kuwait and Saudi Arabia in the shallow water of the Persian Gulf. Other Middle East and Caspian projects include QatarEnergy’s North Field Compression 5 and ADNOC’s Umm Shaif Gas Cap Phase 1 fixed platforms as well as TotalEnergie’s Absheron Phase 2 tieback in Azerbaijan.

Meanwhile, ExxonMobil is set to approve another greenfield FPSO in Guyana for Longtail as well as a tieback at Turbot, and Petrobras is on track to sanction the P-87 FPSO for the Budiao field in Brazil. To round things out, Chevron looks ready to progress Stage 3 of its massive Gorgon gas development in Australia, and Cyprus is expected to join the ranks of deepwater producers with Eni’s Cronos project that will send produced gas for processing and potential export in Egypt.

The pace of offshore wind turbine installations slowed in 2024 but 2025 marked the start of deployment of 15 megawatt (MW) turbines at scale. This year, the trend will continue with almost 500 14-16 MW turbines forecast to be erected offshore. Turbines will not only grow in size, but Rystad Energy projects that the total number of turbine installations will also grow, meaning that the total installed capacity will be even larger.

Despite requiring larger and more expensive installation vessels, wind farm developers are betting that increased efficiency will more than offset the higher required capex. Despite the headwinds of a sharp turn in US policy against offshore wind and wake losses in some densily-packed North Sea farms, the industry will increase installations materially in 2026.

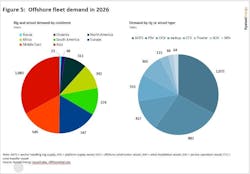

Additional offshore development will require a larger active fleet of rigs and vessels as aggregate demand from both oil and gas and wind creep higher in 2026. Asian countries, led by China, will account for one third of offshore fleet demand, totalling 1,083 years of work, while the Middle East and Europe combined will account for another third of vessel demand and roughly equal market sizes.

Anchor handling tug supply (AHTS) vessels will require the largest working fleet with over 1,075 years of demand, followed by platform supply vessels (PSVs), offshore construction vessels (OCVs), and jackup rigs. While some vessels are able to work across both the upstream and wind sectors, jackup and floating rigs are confined to oil and gas or carbon capture and storage (CCS) operations, while wind installation vessels (WIVs) are tailored toward foundation and turbine installation. With limited newbuild rigs in the pipeline and a growing wind sector, shipyards will be pushed to meet the demand for these specialized vessels in the coming years.

With crude oil prices holding above $60 per barrel and a lingering surplus following OPEC+ output increases in 2025, upstream investments remain elevated and are expected to grind higher again in 2026. Combined with the expansion of wind, solar and CCS projects, total offshore investments are projected to increase by 5% over 2025.

As the largest market, China will will further expand offshore energy infrastructure but at lower rates of growth than pre-COVID years, while the next three largest national offshore markets flatten or shrink.

The bulk of the largest upstream projects to be sanctioned in 2026 will be gas-focused, with subsea tiebacks claiming a more prominent spot in the top 10. Both the size of wind turbines and the number of units installed will grow again in 2026, and the combined demand for offshore vessels and rigs will push utilization rates higher, resulting in growing backlogs for fleet owners.

About the Author

Matthew Hale

Matthew Hale is senior vice president—Drilling & Wells at Rystad Energy. He has extensive experience in oilfield services, spending most of his career with Baker Hughes and NOV supporting product development, marketing, and corporate strategy teams. He holds a bachelor's degree in mechanical engineering and an MBA, both from Rice University.