Quantifying project vulnerability enables capital resilience

Editor's note: This feature first appeared in the May-June 2024 issue of Offshore magazine. Click here to view the full issue.

By Richard Westney and Nicholas Klosky, R/MW Consulting Inc.

So-called “black swan” events – a consequential occurrence that is seemingly almost impossible to predict – have always been plentiful offshore. They’re circling overhead as deepwater drilling goes to previously unthinkable depths, massive floating production facilities are assembled offshore, and ever-larger wind turbines assembled. Black swans also can be generally defined as unpredictable events that are beyond what is normally expected, and which carry severe consequences. And, when they strike, significant cost overruns and delays occur, seriously compromising business goals.

Recent examples include FPSOs such as Equinor’s Johan Castberg project, which experienced a 40% cost overrun and significant delays due to the impact of escalating market conditions for offshore services and key materials, as well as COVID-related restrictions during fabrication. And Ørsted backed out of the Ocean Wind 1 and 2 projects offshore New Jersey due to the concern that key suppliers might not deliver on cost and schedule commitments, causing schedule delays and compounding the effect of rising interest rates. The result was a $4-billion impairment.

Owner/operators, lenders, investors, and contractors have been talking about this for decades. If offshore energy is to remain a vital part of the mix as the energy transition unfolds, a new approach is required so that uncontrollable black swan risks can be defeated.

Making projects resilient

The uncontrollable risks surrounding today’s offshore projects are difficult to predict, they may or may not occur, risk exposure often increases with time, and the impacts are often devastating. Clearly, they cannot be assessed, monetized, and mitigated in conventional ways. But, when the focus is shifted from risk management to resilience, practical solutions for defeating black swans can be found.

Resilience can be defined as the ability to recover from, or adjust easily to, misfortune or change. While operators may not be able to prevent a risk from occurring, resilience can be built into strategies and designs to preserve the project’s objectives in spite of adverse scenarios. A carefully crafted project resilience plan will give financial stakeholders the confidence they need that their investment goals will be met.

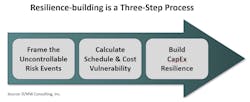

Building a project resilience plan for an offshore development requires addressing three key questions:

- What are the uncontrollable risks that the project may face?

- How vulnerable are the project’s cost and schedule objectives to these risks?

- What can be done to reduce cost and schedule vulnerabilities and build resilience?

Building capex resilience is a three-step process. The key to building resilience is understanding the project’s schedule and cost vulnerability.

Framing the uncontrollable risks

The essence of uncontrollable black swan risks is that they are extraordinary – either because they are unlikely to occur, or because they are outside the normal, ordinary risks and impacts that projects typically experience. Building capex resilience requires framing each of these risks in terms of its chance of occurrence and the likely impacts on schedule and cost if it should occur. Most offshore projects are exposed to a set of extraordinary, uncontrollable risks.

Offshore developers and contractors will recognize these 16 risk factors (in the “four types of uncontrollable risk” chart) as the sources of events that have impacted past projects. While each may be somewhat unlikely, every major offshore project will have a combination of these factors that is likely to impact the schedule and cost. The challenge is to build a probabilistic model that will provide a reasonable assessment of the cumulative and compounding impacts of these risk factors – in other words, determine the schedule and cost vulnerability.

Providing actionable recommendations

Conventional project risk analysis – focused on ordinary project risks – operates on cost categories and critical activities, setting ranges representing best- and worst-case outcomes, and performing Monte Carlo analysis to develop a probabilistic view of cost and schedule. The method for calculating vulnerabilities to extraordinary, uncontrollable risks is, by necessity, quite different. In this case, carefully selected probability functions and analytics are used to model the special characteristics of each of the uncontrollable risk factors including:

- Unpredictability of occurrence – uncontrollable risks may not occur, or they may occur once, or they may occur more than once.

- Compounding risk impacts – uncontrollable risks typically have compound impacts; for example, if the risk of a severe delay in permitting occurs, this can disrupt engineering continuity and move procurement and construction to a time of higher market activity.

- Interdependency of schedule and cost risks and impacts – uncontrollable risks typically have a high correlation between cost and schedule that increases overall impact.

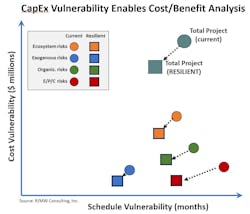

Capex vulnerability is the likely schedule and cost impact from the combined effect of uncontrollable risks. The results of a capex vulnerability analysis are displayed in the “capex vulnerability” chart.

The front-end definition stages offer the best opportunities to make strategic decisions that will enhance resilience. For example, optionality in agreements can enable alternative actions to reduce impact as can engineering for ruggedness; influence strategies can help reduce the likelihood of some exogenous risks. Examples of these resilience-building levers include:

• Optionality – financing strategy, commercial agreements, execution planning

• Ruggedness – scope definition, technology selection, design standards and specifications

• Influence – public and community relations; federal, state, and local governments; industry associations.

Resilience-building for offshore projects is not a new idea – the industry could never have progressed to ever-deeper water depths without it. For example, project teams create optionality by providing additional deck space for added process equipment if reservoir conditions change; ruggedness by exceeding minimum design requirements; and influence via increased emphasis on public relations. The problem is that the significant cost of these changes can be hard to justify, and, when funds are limited, it is hard to know which resilience-building options to choose.

Vulnerability analysis overcomes this problem by providing a quantitative basis for cost/benefit analysis. Project teams can now compare the cost of increasing optionality, ruggedness, and influence with the resulting reduction in schedule and cost vulnerability enabling ranking of resilience-building options and ensuring well-informed decisions.

These are definitely “interesting times” in the energy sector. Offshore operators are moving rapidly to meet growing global demand while at the same time reducing carbon footprint and progressing net-zero goals. By changing the focus from risk mitigation to resilience building, uncontrollable black swan risks can be addressed in a rigorous way, providing investors and contractors with the predictability that offshore projects require.

About the Author

Richard Westney

Richard Westney is recognized as a thought leader, strategic adviser and problem solver for executives, investors and project managers engaged in the development and delivery of capital projects in the energy sector. He is the founder of Westney Consulting Group, ranked among the top five Capital Projects and Infrastructure consulting firms and acquired by McKinsey & Company in 2019.

Since 2019, Westney’s consulting work has been as a director of R/MW Consulting Inc., a Houston-based firm focused on the challenges faced by owner/operators, investors, and engineering & construction contractors engaged in capital projects in the energy sector.