Project activity ramping up across Asia/Pacific

Cambodia sanctions first offshore development

Jessica Stump

Assistant Editor

Central processing facility for the North Malay Basin full-field development. (Courtesy Hess)

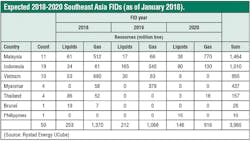

Fifty oil and gas fields, with collective resources of 4 Bboe, in Southeast Asia are expected to be approved for development between 2018 and 2020, according to a recent forecast from Rystad Energy. Some of the 50 projects are later phases of earlier developments, with the largest infrastructure already in place. Gas is set to comprise 85% of the resources reaching final investment decision (FID) over the full period - the largest volume in 2018 coming from Vietnam’s Block B project. Most of the gas to be developed in Indonesia and Malaysia will head to existing LNG plants.

The analyst estimates associated greenfield capex of $28 billion from FID to first production along with higher overall investments in brownfield, maintenance, and infill drilling activities at existing projects.

With 19 fields, Indonesia is the dominant country in the region’s FID forecast, but Malaysia accounts for the largest percentage of overall resources to be developed (37%) and required capex (42%). Here, the analyst expects Mubadala Petroleum’s Pegaga field development to go forward soon, potentially the largest individual field FID in the region this year.

Readul Islam, research analyst at Rystad Energy, said: “Strong economic growth has led to burgeoning domestic gas demand throughout the region. The resulting uptick in local gas prices as well as the pollution profile of the fuel compared to alternatives means both operators and governments are incentivized to push natural gas projects.

“Countries such as Myanmar, with offshore gas discoveries and a still emerging local gas market, look set for an export boom.”

Operators have brought many projects to sanction and first production throughout the Asia/Pacific region.

KrisEnergy Ltd. has sanctioned Apsara, the first oil field development offshore Cambodia. Located in block A of the Khmer basin in the Gulf of Thailand, Phase 1A calls for a single unmanned minimum facility 24-slot wellhead platform connected to a moored production barge capable of processing up to 30,000 b/d of fluids. The vessel will also feature gas, oil, and water separation facilities. Oil will be exported through a 1.5-km (0.9-mi) pipeline for storage to a permanently moored floating, storage and offloading vessel. Initially it is envisaged that 20 development wells will be drilled in Phase 1A.

KrisEnergy operates Cambodia block A with a 95% working interest, with the General Department of State Property and Non Tax Revenue of the Ministry of Economy and Finance holding the remaining 5%.

The block A contract area covers 3,083 sq km (1,190 sq mi), with water depths ranging from 50-80 m (164-262 ft).

Once the initial Phase 1A platform is onstream, there will be a period of monitoring reservoir performance – up to six months – before the partners commit to Phase 1B. This will likely entail up to three additional platforms producing to the Phase 1A facilities. Beyond that, Phase 1C could potentially add a further six platforms for the full 10-platform Apsara development.

BP and Reliance Industries Ltd. (RIL) have sanctioned development of the R-Series deepwater gas field in block KG D6 offshore eastern India. The R-Series (D34) project is a dry gas development in water depths of more than 2,000 m (6,562 ft), about 70 km (43 mi) offshore. It will be developed as a six-well subsea tieback to an existing control and riser platform. The project is expected to start up in 2020 and produce up to 12 MMcm/d (425 MMcf/d).

This is the first of three planned projects in block KG D6 that are expected to be developed in an integrated manner, producing from about 3 tcf of discovered gas resources. Development of the three projects, with total investment of about $6 billion, is expected to bring a total about 30-35 MMcm/d (1 bcf/d) of new domestic gas production onstream, phased over 2020-2022.

According to BP, India consumes more than 5 bcf/d of natural gas and aspires to double gas consumption by 2022. Gas production from the integrated development is expected to help reduce India’s import dependence and amount to more than 10% of the country’s projected gas demand in 2022.

RIL has contracted WorleyParsons to provide project management consultancy services, which will be led and executed by the company’s Advisian Houston office. OneSubsea has received an EPC contract for the supply of the subsea production system which includes trees, subsea manifolds, control system, tie-in system, multi-phase meters, intervention tooling and test equipment. The contract also includes installation and commissioning support and life-of-field services. The operator also has issued a letter of award to McDermott International whereby the contractor will be responsible for engineering, procurement, installation, and pre-commissioning of subsea flowlines, vent lines, and a pipeline-end manifold for connection with six subsea wells. Its scope includes in-field pipelines, a Monoethylene Glycol line, pipeline-end terminals, jumpers, risers, the umbilicals system, and modification of the control riser platform to interface with the new facilities.

Reliance has an option to extend the program to five to seven more subsea wells for the Satellite-Cluster (S-Cluster), with two additional subsea structures and flowlines in water depths of 1,400-1,800 m (4,593-5,905 ft). McDermott’s Engineering Center in Chennai will provide engineering and project management oversight, supported by the company’s branch in Kuala Lumpur and vessels from its global fleet. Work on the base scope should be completed by 2Q 2020, and the optional scope in 1Q 2021.

Last October, Indonesia’s government approved Premier Oil’s BIGP project in Natuna Sea block A. All major contracts have been awarded and the company is targeting first gas in 2019. Production will backfill the company’s existing Singapore and domestic market contracts.

In the Madura Strait off Indonesia, Husky-CNOOC Madura has started production from the BD gas/condensate field development. The facilities comprise an unmanned wellhead platform, an FPSO, and four production wells. Water depth is 55 m (180 ft).

Offshore China, this year CNOOC expects to start up the Weizhou 6-13 oil field; the Penglai 19-3 oil field 1/3/8/9 comprehensive adjustment project; the Dongfang 13-2 gas fields; and the Wenchang 9-2/9-3/10-3 gas fields.

Late last year, CNOOC started production from the Weizhou 12-2 oil field Phase II project in the Beibu Gulf in the South China Sea. Water depths average around 35.7 m (117 ft). Development, which is linked to existing facilities on the Weizhou 12-2 oil field, called for construction of a wellhead platform. Seven wells are currently in service, producing around 6,400 b/d. This year the operator expects to attain peak production of 11,800 b/d.

Last July, Hess started production from the North Malay Basin full-field development in the Gulf of Thailand, in partnership with Petronas. This covers nine fields in block PM 302 with combined recoverable resources of more than 1.5 tcf of gas and 20 MMbbl of condensate. Facilities include one central processing and four wellhead platforms with 14 shallow production wells, and a floating storage and offloading unit. The location is 300 km (186 mi) offshore the Tregganu Gas Terminal in 55 m water depth.

In southeast Australia, Cooper Energy reached FID on the Sole gas project in the Gippsland basin offshore Victoria. Estimated capex is $605 million, comprising $355 million for development of the offshore Sole field and a $250-million upgrade of onshore Orbost gas processing facility. Sole will be developed via two production wells (to be drilled later this year) with subsea wellheads, connected through a 65-km (40-mi) pipeline and a control umbilical to Orbost. Production is expected to begin in mid-2019.

Offshore Western Australia, Woodside Petroleum Ltd. has reported that the Greater Enfield project is 43% complete, and remains on budget and on schedule for first oil in mid-2019. In 1Q 2018, the two-year drilling campaign and subsea installation are expected to begin.

The Greater Western Flank Phase 2 project is 74% complete, according to Woodside, and on schedule for start-up in the first half of 2019. This project involves eight production wells tied back to the existing Goodwyn A platform by a 35-km (22-mi) subsea pipeline. Offshore construction activities are planned to begin in the first half of the year. Subsea installation and commissioning of infrastructure is expected to begin in the second half of 2018 and take about five months to complete.

The company also brought the Persephone project, a two-well subsea tieback to the North Rankin complex, online six months ahead of schedule and more than $300 million under budget.

As for the country’s mega LNG projects, Wheatstone delivered first production from Train 1 last October. Operator Chevron expects LNG Train 2 to start up in 2Q 2018. As for the Ichthys LNG project, operator INPEX targeted start up by the end of this month.