Offshore Europe

Jeremy Beckman • London

Shell to exit Draugen

Shell continues to scale back its production interests in northern Europe. The company’s Norwegian subsidiary has agreed to sell its operated interest in the Draugen field and its 12% stake in the Gjøa field to Trondheim-based OKEA for $556 million. Draugen, which came onstream in the 1990s through a concrete gravity base platform, was the first field development in the Norwegian Sea and was one of Shell’s flagship assets offshore Europe, although subsequently eclipsed by the company’s long-distance subsea-beach Ormen Lange project to the north.

Pending approvals by the partners and the Norwegian authorities, Draugen’s personnel will transfer to OKEA, and the new operator plans to use the associated base in Kristiansund as the operations center for all its Norwegian development projects, including its Grevling field development in the Sleipner area.

In UK central North Sea, Shell is seeking approval to decommission its Curlew area facilities in block 29/7 comprising an FPSO and associated subsea pipelines and structures (mid-water arch, manifold and distribution unit). According to the company, the various fields served will reach their economic limit next year, with no further tie-in opportunities to extend operations. Phase 1 of the planned program includes flushing of pipelines, disconnection of all lines from the subsea trees and the FPSO risers and mooring lines, followed by sailaway of the vessel. Later phases will focus on well P&A and removal of subsea structures.

However, the company stressed that it remains committed to exploration in the sector, with authorization to drill two wells in the Norwegian Sea and North Sea this summer. It also participated in the UK’s 30th offshore licensing round, under which the Oil & Gas Authority offered 123 licenses over 229 full and part-blocks to 61 companies.

BP, Serica add to UK acreage

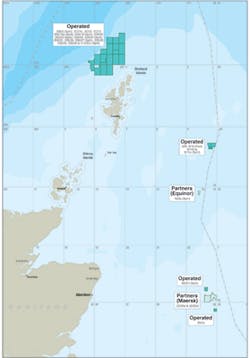

Others to issue details of their UK awards include BP, which picked up interests in seven licenses, five as operator. Two of these are in Quadrant 208, north of Shetland, and another is close to the company’s Capercaillie and Vorlich discoveries in the UK central North Sea. Equinor gained eight operated licenses in various parts of the UK shelf, one with a commitment to drill a well on the Lifjellet prospect in the Jaeren High area in 2019.

Serica Energy will operate block 23/21b in the central North Sea, west of its Columbus gas field development. However, the company’s plans to recomplete a well on the Rhum gas field, which it acquired recently from BP, may be impacted by the US’ decision to re-impose sanctions against Iran: Iranian Oil Co. UK has a 50% interest in Rhum.

BP’s latest UK offshore license awards. (Courtesy BP North Sea)

Green light for Johan Castberg

Norway’s Petroleum and Energy Ministry has sanctioned Equinor’s plan for the $6.12-billion development of the Johan Castberg fields in the southern Barents Sea, 62 mi (100 km) north of the company’s producing Snøhvit field. Equinor aims to recover 450-650 MMboe of resources over 30 years via 30 subsea wells connected to a winterized FPSO, with start-up slated for 2022. It estimates annual opex at $143 million, including the costs of the operations center in Harstad and a dedicated supply/helicopter base in Hammerfest.

One of the latest contracts to be awarded for the project is a seawater sulfate removal unit, to be supplied by the SUEZ/Halvorsen TEC consortium and installed on the FPSO. This will allow seawater to be injected at less than 20 parts per million of sulfate content and fewer than 20 parts per billion of oxygen, helping to safeguard the production wells against barium/strontium scale build-up.

In the North Sea, Equinor and its partners have committed to drill three new production wells, using the Odfjell semisubmersible Deepsea Atlantic, to extract a further 70 MMboe from the Fram field. The program will be made possible by the addition of a new $123-million module that will ease gas processing capacity constraints on the host Troll C platform.

Johan Sverdrup utility platform accommodation block on the Kamag K24 at Stord. (Courtesy Sarens)

In the Utsira High region of the North Sea, the semisub Deepsea Bergen has discovered estimated resources of 15-35 MMboe for Equinor via a well on the Lille Prinsen prospect in the PL167 license. Once the partners are clearer on the full potential, a development should follow through nearby infrastructure.

The major ongoing project in the area is Johan Sverdrup Phase 1, where Allseas’ Pioneering Spirit recently placed the 22,000-metric ton (24,251-ton) topsides for the drilling platform onto the pre-installed jacket in a single-lift operation. Next March, the vessel is due to install two further topsides, including one for the utility platform. Sarens recently completed load-out, weighing and jacking of this platform’s 12,000-metric ton (13,448-ton) accommodation, recreational and utility control systems module at Kvaerner’s yard in Stord, western Norway. The operation involved moving the structure from the fabrication hall a distance of 200 m (656 ft) on self-propelled, modular transporters to a barge at the quayside.

Norway awards frontier licenses

Norway’s recent 24th licensing round conferred 12 production licenses on 12 companies in total. Three of the licenses are in the Norwegian Sea – two in deepwater in the western part of this sector. The remainder are in little explored areas of the Barents Sea, two being close to existing production licenses. Equinor gained interests in seven licenses, five as operator, including acreage on the western margin of the Barents Sea and in the Hoop area close to OMV’s Wisting oil discovery. The company plans to acquire and interpret data and discuss the results with its partners before going public on potential drilling prospects.