Subsea equipment standardization presents opportunities, challenges

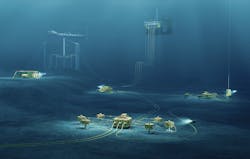

DNV GL has been involved in various initiatives to develop service specifications or documents that will enhance the approaches that are available for standardizing the subsea industry. (Image courtesy DNV GL)

Ebenezer Adom

DNV GL UK Ltd.

With the drop in oil prices, and the continuous drive by the oil and gas industry to improve efficiency and lower costs, there is a trend toward standardization in subsea field development. It is generally accepted that the premise of reducing cost should not be to the detriment of accepting equipment which is not fit for purpose.Over the years, the oil and gas industry has been grappling with the idea of the standardized solution for subsea applications with the view of enhancing safety and reliability globally and reducing capex. Various initiatives have been started by technical advisors such as DNV GL, by the International Oil and Gas Producers’ (IOGP) JIP 33 initiative, and the UK Oil and Gas Efficiency Task Force. All these initiatives are laudable but tend to have varying outcomes due to resistance within the supply chain because of intellectual property and copyrights, duplication, lack of trust, and complexity of subsea development.

Subsea fields are developed globally, and each of the locations tend to have project-specific requirements that impact the type of deliverables that are issued. If we are to have a standardized process, then this should not be the case. The impact of local regulators is influencing the cost of the project. For instance, in the United Kingdom, subsea field development follows the legislative requirements such as the Safety Case regulations with an independent verifier appointed for the safety and environmental critical equipment. This regulation is a harmonized version of the European Offshore Safety Directive and applies across the shelf states. Norway follows a similar approach to that of the UK, but it is not mandatory to appoint an independent verifier. However, most operators engage the services of a verifier for technical assurance and surveillance in the manufacturing process of the subsea equipment as good practice.

In the US, the approach is different, and it depends on field and equipment. Equipment manufacturers can issue their self-declaration that subsea equipment is fit for purpose and it is generally accepted, e.g. American Petroleum Institute (API) Q1. If the field falls under the category of high-pressure/high-temperature (HP/HT), the project requirements are completely different. In this case, operators are required to follow the mandatory guidance on obtaining Bureau of Safety and Environmental Enforcement (BSEE) approval for HP/HT application.

Countries such as India follow an approach like that of the UK. The deliverables, again, are different and operators expect alternative requirements based on the field in question. The scope of work tends to be more complex, compared with other locations, and hence an increase in overall cost of the project. Even though most of the fields developed are HP/HT, India does not follow the requirements of the BSEE.

With sanctions on Russia from the western countries, Russia is hesitant to engage or implement any of the risk-based approaches to their offshore industries which impacts the way forward with regards to standardizing of subsea field development.

In effect, there is a contrast in what is expected from operators and the engineering, procurement, installation, and commissioning (EPIC) contractors in the global oil and gas industry. Unless there is some sort of agreement in principle between regulators globally, subsea standardization might not be achieved soon, and it will lead to costs escalating on certain projects.

Recent initiatives on standardization

DNV GL has been involved in various initiatives with the sole purpose of developing service specifications or documents that will enhance the approaches that are available for standardizing the subsea industry.

To date, the following are some of the engagements or papers that have been published: Certification of subsea equipment and components (DNV GL SE-0045); Subsea equipment and components (DNV GL-ST-0035); Technical documentation for subsea projects (DNV GL-RP -0101); and Standard for forgings (DNV GL -RP-0034). Even though all the above-mentioned documents had the right intentions to stimulate the industry with the sole objective of reducing cost and improving efficiency the uptake and its application to new subsea field development has been minimal.

The Oil and Gas UK Efficiency Task Force study noted that there was a potential 25% savings for standardized subsea projects in the UKCS. The drive was therefore to implement efficiencies and savings in their supply chain when procuring equipment, with the aim of creating a sustainable industry in a lower price environment. Three significant thematic areas were identified, co-operation, culture and behaviors, and standardization. Even though the efforts are applauded, efficiency savings should not have detrimental effect on reliability and the intended functions of subsea equipment e.g. safety critical elements.

The IOGP’s recent position paper on standardization recognized that standardization is a top priority for the oil and gas industry to enable and enhance safety, reliability, and integrity of operations globally. As economic conditions dramatically challenge the oil and gas industry, standardization also is a key business driver to tackle escalating project costs and lead times.

Challenges and opportunities

With all the good intentions and initiatives, there is still a long way to go to confidently say that subsea standardization has become a reality. Until the operators ensure that the approaches highlighted in recent initiatives are captured in contractual documents, then there is little to be celebrated in terms of success stories.

For instance, in verification/certification of subsea equipment, the IOGP has issued purchase order quality requirements S-561Q for API 17D – Subsea Trees, which indicates the requirement on the design, manufacture, assembly, and testing of the equipment. As it stands, there is no evidence that demonstrates that this standardized process is embedded in the quality requirements of the supply chain. This is an opportunity that needs to be maximized in the industry moving forward, however, it will take a substantial effort from all stakeholders for it to materialize.

The challenges that industry faces at this juncture is the standardization of subsea technology and more importantly consistency from the independent third-party authorities involved in the verification of the design and manufacture of equipment. In an ideal world, it is the expectation that all certifying bodies should have similar deliverables. There are many challenges faced by operators and EPIC companies alike in understanding and appreciating the value added by subsea product certification. There is generally varying trust between original equipment manufacturers and the supply chain. What we are seeing now is that inspection test plans differ from operator to operator and on the project team involved.

The added value that subsea certification brings, is the assurance to the operators of the asset or field, that all installed equipment has undergone scrutiny by an independent verifier as part of the identified safety critical elements, within the owner’s performance standard.

Conclusion

To reduce cost and build confidence and trust in the subsea procurement/supply chain, the following approach will deliver the benefits that the industry is looking for:

• Project quality deliverables should be consistent with the supply chain irrespective of the geographical locations of the subsea field development

• Bespoke subsea equipment development should be developed with minimal client-specific requirements

• Certification bodies should be consistent on the scope of work that has been verified and should be clear and unambiguous.

References

• S-561 Supplementary Requirements to API 17D Subsea Trees.

• S-561L Supplier Deliverable Requirements List (SDRL) for API 17D – Subsea Trees

• JIP 33 Standardization of Equipment Specification for Procurement (IOGP 2017)

• Is Standardization The Key? https://www.epmag.com/standardisation-key-1547166#p=full

• Subsea Standardization- Guideline on Adopting a Simplified and Fit for Purpose Approach- Oil and Gas UK 2017

• Guidance on Obtaining BSEE Approval to Implement a High Pressure and/or High Temperature Project in the Conceptual and Final DWOP

• Regulatory Outlook – The way forward for Offshore regulatory safety regime- DNV GL