Jadestone takes first step toward development of NDUM gas fields offshore Vietnam

Offshore staff

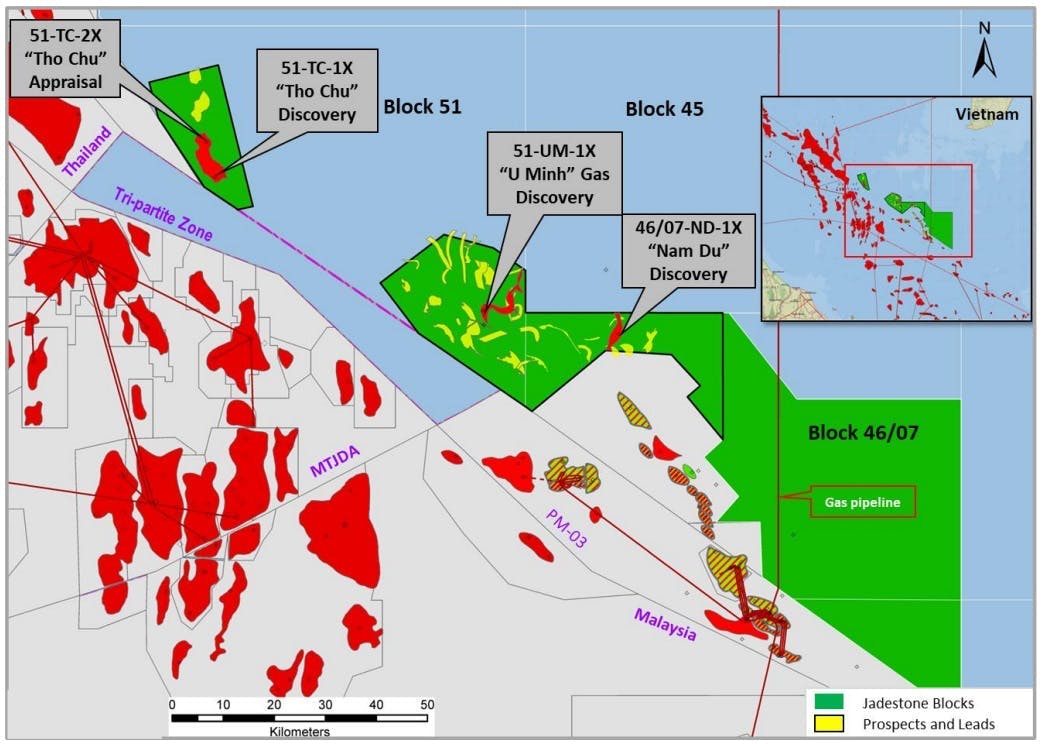

SINGAPORE — Jadestone Energy has signed a heads of agreement (HoA) with PetroVietnam Gas concerning development of the Nam Du and U Minh (NDUM) gas fields in the blocks 46/07 and 51 production sharing contracts offshore southwest Vietnam.

This represents the first step toward commercialization of the shallow-water fields. The HoA calls for the supply of 80 MMcf/d under a take-or-pay arrangement over a minimum plateau period of 55 months, with first gas potentially in late 2026.

Jadestone has a 100% interest in the NDUM fields, which contain estimated 2C resources of 171.3 Bcf of gas and 1.6 MMbbl of liquids, according to ERCE’s report issued in December 2017. There could be upside around the discoveries, with any future commercial finds likely producible via straightforward tiebacks to the NDUM facilities.

The HoA also allows the company to submit an updated field development plan to the Vietnamese authorities for approval ahead of a final investment decision.

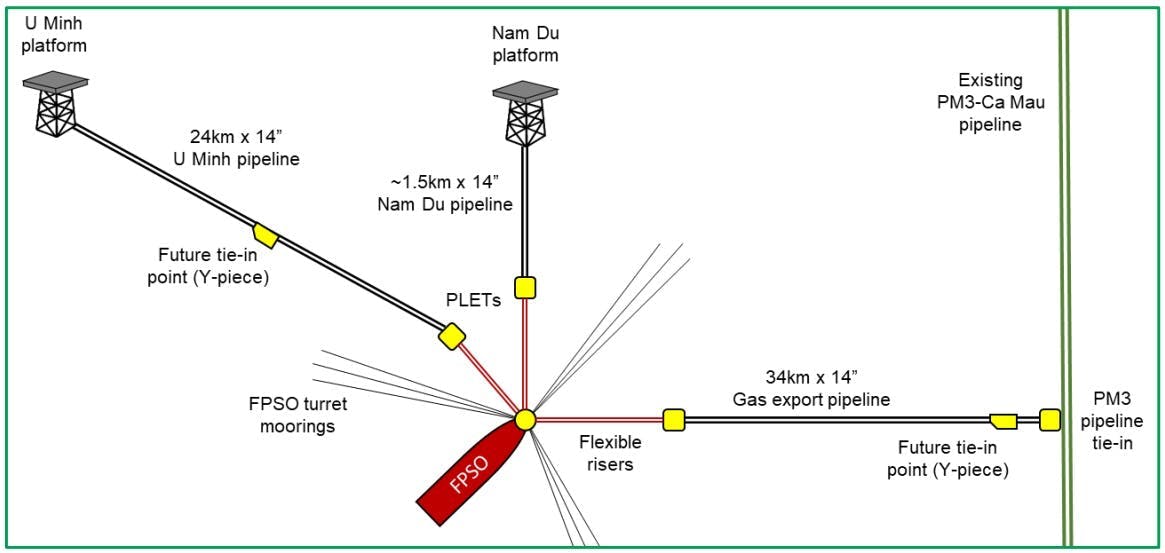

Current plans call for two minimal facility unmanned wellhead platforms with a design capacity of 100 MMcf/d, each with two production wells and connected to a leased gas-processing FPSO located at Nam Du. The gas has a low CO2 content with no mercury or H2S contaminants.

Condensate would be exported from U Minh via shuttle tankers.

The planned subsea gas export pipeline would tie into the existing Ca Mau pipeline, with tie-in points added to receive upside from future tiebacks.

President and CEO Paul Blakeley said, “While there remains significant work ahead to deliver a … detailed project plan and development schedule to first gas, this is a clear signal of intent from the government to see this resource developed.

“The likely timing of FID at Nam Du/U Minh would result in capital expenditure occurring no earlier than mid-2025, thereby supporting an organic funding solution through Jadestone’s cash flow generation, available debt and the added potential of bringing in partners during the development phase.”

01.26.2024