Oil and gas capex to remain elevated, even grow marginally

Editor's note: This feature article first appeared in the January-February 2024 issue of Offshore magazine. Click here to view the full issue.

By Matthew Hale, Rystad Energy

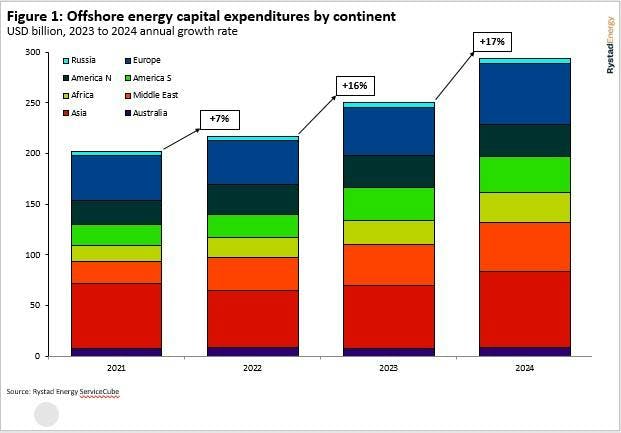

As suppliers to the offshore industry enter a new year, energy developers are poised to grow capital expenditures (capex) beyond last year’s recent high water mark of $250 billion, spanning oil and gas and power markets. After expanding project spending by 7% in 2022 and 16% in 2023, Rystad Energy projects the same metric to reach 17% in 2024. This is still below the record set in 2014 when offshore upstream capex reached an all-time high, and offshore wind expenditures contributed less than 3% of the total. In 2024, offshore wind and floating solar will contribute almost 19% of this sum as solar and wind installation continue to take a larger share of the power generation mix. Regionally, Asia will continue to be the largest market for offshore investments led by China, while Norway and the UK will push the European continent higher.

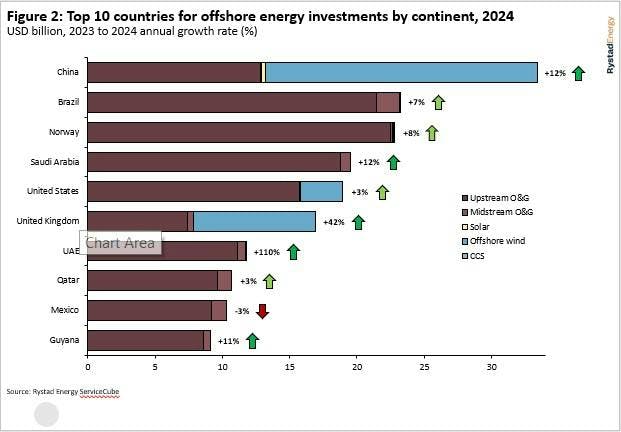

As in many other domains, operators for China-based projects are the largest investors in offshore energy by a healthy margin, with over half of those capital expenditures in wind generation capacity. Of the top 10 national markets, only the UK can claim more power projects in comparison to oil and gas. With a forecasted 2024 growth rate of 12%, Chinese capital expenditures will expand by the most in dollar terms, followed by the United Arab Emirates (UAE) and the UK. The UAE will post an exceptional growth rate of 42%, driven primarily by the sanctioning of the Hail and Gasha project, which will produce 1.5 billion cubic feet per day (Bcfd) of natural gas per day and capture and store 1.5 million tonnes per annum of carbon dioxide. In the US, despite a contraction in offshore wind in 2023 as developers attempted to negotiate higher offtake electricity prices, wind capital expenditures will grow in 2024, offsetting a slight decline in upstream oil and gas investments. All of the top 10 countries will expand, with the exception of Mexico, which still faces foreign investment headwinds, despite the sanctioning of Woodside’s Trion development and Pemex’s plans to arrest several years of offshore production declines.

The bulk of expenditures are driven by the sanctioning of large upstream projects with Brazilian floating production storage and offloading (FPSO) vessels featuring prominently among the largest 2024 final investment decisions (FIDs). The P-84 and P-85 FPSOs are currently tendering for deployment on the Atapu and Sepia fields. The shallow waters of the Persian Gulf make up half of this top 10 list of FIDs with notable projects in Saudi Arabia, Qatar and the UAE. Most of this will feature large, fixed platforms, while the latest Upper Zakum expansion will rely on artificial islands based on extensive dredging services. ExxonMobil is expected to sanction its Tilapia project in Guyana this year with another jumbo FPSO development and associated subsea equipment orders. TPAO’s Sakarya Phase II project has already awarded contracts to Saipem, SLB and Subsea7 with FID later this year. Finally, CNOOC will commit to the second phase of the Bozhong 19-6 gas and condensate project in the Bohai Bay after commencing production from the initial development in November 2023. These investment decisions will further stretch the offshore fabrication supply chain, which is still ramping up from a big 2023.

Reports of the demise of the offshore wind industry have been largely overblown, with more wind turbines slated for installation this year than in 2023. It is expected that 2024 will be the first year to see a material volume of turbines installed which exceed 12 megawatts (MW) in individual output capacity. Rystad Energy estimates that 280 12-14 MW turbines will be installed in 2024, up from a handful in 2023 and surpassing the installations of 10-12 MW turbines. Therefore, this year will be a milestone as well as a test in the emerging trend towards larger and larger wind turbines, which also come with increased installation and maintenance costs balanced by better efficiency and higher output. While the share of these larger models is set to grow, smaller 4-8 MW turbines are also expected to reach 543 units this year from 450 in 2023, with around half of these units in mainland China and Taiwan.

Shifting attention to the vessel and rig markets, the total demand for offshore units can be visualized by taking into account both the oil and gas and wind energy sectors. Asian countries will account for over a quarter of vessel demand at 878 years of work led by China, while the Middle East will be the second largest region for vessels with 591 years. When examining different types of vessels, we see that anchor handling tug supply (AHTS) vessels will require the largest fleet to supply over 1,000 years of demand, followed by platform supply vessels (PSVs), offshore construction vessels (OCVs), and jackup drilling rigs. Some vessels are able to work across both the upstream and wind sectors, while jackup and floating rigs are confined to oil and gas or carbon capture, utilization and storage (CCUS) work and wind installation vessels (WIVs) are limited to foundation and turbine installation. With limited new build rigs in the pipeline and a fast-growing wind sector, shipyards will be strained to meet the demand for these specialized vessels in the coming years.

With crude oil prices projected to remain above $80 in 2024, oil and gas capital expenditures will remain elevated and even grow marginally. Combined with the expansion of offshore wind installations, total offshore investments will increase by 17% over 2023. China will lead the way, with both the UAE and UK contributing materially to this expansion. Shallow water expansions in the Middle East will be supplemented by large FPSO-based greenfield developments in Brazil and Guyana. In 2024, a noteworthy milestone is on the horizon for 12-14 MW wind turbines, and the combined demand for offshore vessels and rigs will push utilization rates higher, leading to another banner year for service providers.

About the author: Matt Hale is Rystad Energy’s Lead Analyst for Energy Services Americas. He has extensive experience in oilfield services, spending most of his career with Baker Hughes and NOV supporting product development, marketing, and corporate strategy teams. Hale holds a bachelors in mechanical engineering and an MBA, both from Rice University.

About the Author

Matthew Hale

Matthew Hale is senior vice president—Drilling & Wells at Rystad Energy. He has extensive experience in oilfield services, spending most of his career with Baker Hughes and NOV supporting product development, marketing, and corporate strategy teams. He holds a bachelor's degree in mechanical engineering and an MBA, both from Rice University.