Offshore supply chain riding wave of O&G investment

Editor's note: This story first appeared in the January-February 2023 issue of Offshore magazine. Click here to view the full issue.

By Mark Adeosun, Westwood Global Energy Groups

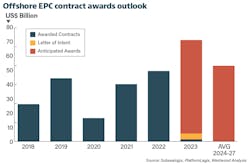

The offshore oil and gas industry experienced a significant rebound in contracting activities in 2022 with upstream engineering, procurement and construction (EPC) contract award value totaling approximately $51 billion (excluding letters of intent). This rebound took place even amidst the challenges of an inflationary cost environment and global supply chain uncertainties in a year that was defined by Russia’s invasion of Ukraine. The $51 billion mark represents the highest EPC award value since 2013 and a 27% increase year-on-year, driven by 74 offshore field FIDs.

Overall, Westwood recorded a total of 294 subsea tree unit awards in 2022 – a 17% downward revision compared to our January 2022 outlook, as the year was beset with major project delays and cancellations. EPC-related activities for floating production systems (FPS) sanctioned in 2022 accounted for 2 MMboe of additional throughput capacity, the highest since 2012. A total of 99 fixed platforms were sanctioned in 2022, with sanctioning activities in the Middle East accounting for 70%, driven by QatarEnergy’s North Field East development and Saudi Aramco’s Zuluf, Safaniya, Qatif and Umm Shaif expansion project. Over 3,750 km of subsea umbilicals, risers and flowlines (SURF) and 3,800 km of line pipe were sanctioned last year.

Outside brownfield expansion projects in the Middle East, major projects sanctioned in 2022 included ExxonMobil’s Yellowtail development (Guyana), the additional phases of Petrobras’ Buzios project (Brazil), as well as Shell’s Jackdaw (UK), Crux (Australia) and its Rosmari-Marjoram development offshore Malaysia.

In Western Europe, there was a significant focus on boosting natural gas supplies as the region battled with the surge in prices as Russian supplies dropped off, prompting significant investment to fast-track several floating liquefied natural gas import terminals. Furthermore, a flurry of new projects, including Aker BP’s Yggdrasil (formerly NOAKA), Valhall PWP-Fenris and Skarv satellite projects; Wintershall’s Dvalin North; and Equinor’s Irpa, Verdande and Orn fields contributed to a positive subsea order intake in 4Q 2022 ahead of the expiration of the Norwegian temporary tax incentive.

Looking ahead

As we look ahead to what could be in store for the offshore industry in 2023, Westwood forecasts offshore oil and gas-related EPC contract award value to total approximately $73 billion, driven by 80 project FIDs over the next 12 months. This represents a 43% increase on EPC award value recorded in 2022. While concerns remain over supply chain uncertainties and inflationary pressures on field development cost, E&Ps have increased early-stage engagement with the supply chain, with over $5 billion of contract award value anticipated in 2023 already under a letter of intent.

Evaluating contracting activity by equipment type, Westwood anticipates 265 subsea tree units to be awarded this year, of which 41% already have a letter of intent issued; 31% of expected awards are classified as “firm”; 16% as “probable”; and 12% as “possible.” Fifteen FPS units, three FLNG units, over 200 fixed platforms (topsides), 5,400 km of SURF and 6,000 km of line pipe are expected to be sanctioned this year.

Regionally, offshore investment in 2023 will be concentrated in the Middle East, accounting for 29% of forecast EPC spend. This will be driven by contract awards related to projects such as Saudi Aramco’s Safaniya, Manifa and Majan development, as well as QatarEnergy’s North Field South (NFS), North Field Compression project and the Bul Hanine – Redevelopment project. Chevron is also expected to invest in its Leviathan and Tamar fields offshore Israel, as it aims to increase the maximum capacity of both fields.

Africa and the Americas will account for 43% of forecast spend, with major projects such as ExxonMobil’s Uaru development (Guyana), Azule Energy’s Agogo development (Angola), Eni’s Baleine Phase II project (Ivory Coast) and Petrobras’ SEAP development offshore Brazil expected to drive EPC award value in 1H 2023. Despite the lack of major standalone projects in the US GoM, the region accounted for over 25 subsea tree unit awards in 2022. Westwood anticipates that the US GoM will continually thrive on fast-track developments and infill drilling over the near term, as seen with Talos Energy’s Lime Rock and Venice discoveries following a successful 2022 deepwater drilling campaign. Both discoveries will each require a subsea tree tied back to Talos’ Ram Powell facility.

In Western Europe, the ESG investment narrative and public perception remain against the development of large O&G projects. However, major projects such as Equinor’s Rosebank project located in the West of Shetlands offshore UK, is on course for a Q1 2023 FID, while Ithaca Energy is said to be progressing with pre-FID works on its Cambo field (UK) to validate costs, mature engineering, and progress commercial and contractual frameworks. However, no firm development timeline has been indicated.

Beyond 2023, frontier areas like Suriname, East Mediterranean, and certain African countries could become major hubs for offshore oil and gas developments, depending on the outcome of E&A operations currently in progress. Westwood anticipates strong levels of EPC contracting activities over the 2024-27 period sustained by oil prices (averaging over $65 per barrel), favorable project economics, and robust hydrocarbon demand. Given this, we forecast annual oil and gas-related EPC award value to average $54 billion.

Another key element that represents a significant opportunity for the offshore energy services supply chain is carbon capture and storage (CCS), which is vital for the energy transition. Identified CCS projects requiring new subsea infrastructure that have progressed to or beyond the concept phase will account for over 1,500 km of subsea line pipe demand over the 2023-25 period. Upside remains for subsea contracting opportunities, as several CCS projects with undefined infrastructure requirements are expected to progress. Furthermore, the development of new solutions to help decarbonize the oil and gas industry, as seen with the proposed deepC Store’s floating storage and injection (FSI) Hub offshore Australia, will provide new ESG-compatible growth opportunities for the supply chain.

About the Author

Mark Adeosun

Research Manager, Offshore Field Development

Mark Adeosun is currently the Research Director for Westwood Global Energy Group’s SubseaLogix and PlatformLogix market analytic tools. Since joining Westwood in 2013, he has worked directly with as well as advised several clients within the oilfield services supply chain, as part of both analytic and commercial advisory projects.