Report: Project FIDs to ramp up into year-end

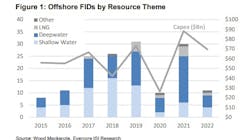

NEW YORK CITY – Final investment decisions for offshore field development projects will keep ramping up to the end of this year, according to Evercore ISI’s latest Offshore Oracle report.

A total of 11 offshore developments have been sanctioned year-to-date, the most recent being Shell’s Jackdaw shallow-water gas project in the UK North Sea. The project consists of four wells tied back to Shell’s Shearwater gas hub, with a new unmanned fixed platform to be provided by Aker Solutions for $200 to 300 million. Production is expected to begin in 2025 and reach up to 40,000 boe/day. Jackdaw is part of Shell’s plan to invest $24-30 billion in the UK energy system over the next decade.

While Equinor has further delayed sanctioning the Rosebank development also in the UK North Sea until 1Q 2023, the consulting firm said that “we expect FIDs to accelerate into year-end.”

The report also noted that Wood Mackenzie is tracking 17 potential offshore projects to be sanctioned over the next four months, followed by another 50 projects in 2023 including Rosebank and ExxonMobil’s next development off Guyana (Uaru).

Exxon recently made two new discoveries off Guyana, bringing its total to more than 25, representing 18% of global discovered resources and 32% of discovered oil resources since 2015. With low breakeven costs of about $28/bbl and low emission intensity of 9 kilograms of CO2 per boe (on par with Brazil and Norway), four FPSOs have been ordered for Guyana since 2017 for total development spend of nearly $30 billion.

In addition, Evercore noted the below global rig trends over the past month:

- Floater marketed utilization ticked up 34 basis points (bps) to 82.2%, with ultra-deepwater edging up 15 bps to 82.8% and deepwater rebounding 302 bps to 75.0%, while mid-water slipped 27 bps to 83.3%

- Dayrates were disclosed for five (of seven) ultra-deepwater contracts, with the average increasing by nearly 25% to $385,000/day over the past month when only seven (of 16) contracts disclosed average dayrates of $311,000/day.

Jackup marketed utilization slipped 39 bps to 90.1%, led by the North Sea at 96.6% and followed by the Middle East at 93.8%, Southeast Asia at 91.4%, and Mexico at 90.0%.

08.23.2022