E&P spending recovering, supported by Middle East rig demand

Offshore staff

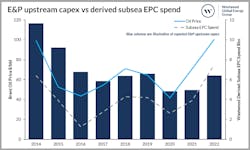

LONDON — Westwood Global Energy Group foresees a 28% increase in E&P upstream capex this year driven by higher commodity prices.

The consultant expects 77 offshore field developments to be sanctioned this year, 20% more than in 2021, with a steep increase in engineering, procurement and construction subsea spending.

However, the war in Ukraine could provide further headaches to the supply chain still feeling the impact of COVID-19 by intensifying inflation and supply chain pressure for materials and labor.

In the Middle East, Saudi Aramco reportedly has plans to expand its working fleet of jackups from 50 to 90 rigs by year-end 2024. This has led some rig owners to acquire newbuild and long-idle equipment to secure as much of the work on offer as possible.

Aramco has recently awarded contracts for 11 incremental jackups, with another nine scheduled later this year, with potentially 15-20 new rigs to be contracted in 2023.

According to Westwood’s Mark Adeosun, the first 11 awards include four known newbuilds, with more likely to feature in the second tranche of awards. There are 25 jackups under construction that do not have contracts in place, he added.

Acquisitive drillers in the region include Advanced Energy Systems and Arabian Drilling, while ADNOC Drilling is said to have purchased four rigs, with plans to acquire six more.

04.29.2022