Ten deepwater GoM developments assessed for execution, contracting, cycle times

Richard D’Souza, Richard B Offshore LLC, and Shiladitya Basu, KBR Consulting

A major objective of a greenfield deepwater field development with a host platform is to achieve the first production milestone set at project sanction. A field development consists of subsurface characterization, reservoir depletion, drilling and completion, subsea production system, host platform and export system.

Of these, the floating host platform is a major capital expense and presents a significant execution challenge. Following a successful deepwater discovery, an operator is pressed to get the field on production as expeditiously as possible. If the discovery is large enough to support a host platform, the cycle time from discovery to first production can be long and capital expenditures quite significant. The commercial success of the development depends on selecting the right development plan and setting milestones for each development phase.

An operator embarking on a deepwater project must credibly benchmark cycle times for sequential field development stages (appraise, select, define and execute). Many variables determine these cycle times including reservoir characterization, fluid properties, estimated recovery, location, access to pipeline networks, water depth, subsea architecture, platform size and complexity and contracting strategy.

The authors undertook a critical assessment of ten recent, producing deep and ultra-deepwater field developments in the US GoM, focusing on project execution of the floating platform. Selected field developments represented all floating platform types; several contracting strategies; a wide range of water depths; and various reservoir geologies and field locations that cover the entire GoM. The goal of the study was to provide operators and developers with solid benchmark data, and help them assess their cycle times and improve their contracting strategies.

Field development study

The aforementioned study critically assessed the execution plans and cycle times of 10 deepwater GoM projects with host platforms. This included three semisubmersible platforms (Independence Hub, Delta House, Jack/St. Malo); three spar platforms (Perdido, Tubular Bells, Lucius); three TLPs (Shenzi, Stampede, Olympus on Mars B); and one FPSO (Turritella on Stones). These projects cover a broad swath of lease areas, water depths, geologic plays, and recoverable reserves. Six of these projects are reviewed below. Additional details on these projects and the other four projects can be found in the OTC paper written by the authors for this year’s conference (OTC-31115-MS).

Delta House development

The Delta House field operated by LLOG is located in MC 254 in 1,370 m of water. The development consists of six subsea wells producing to a purpose-built semisubmersible (semisub) hub with field architecture designed for future expansion.

The development is notable for its unorthodox execution and commercial approach that enabled LLOG to achieve first production in a little over three years from the February 2012 discovery. LLOG preemptively approved the engineering of an Exmar Opti-Ex semisub platform and selected Hyundai shipyard (HHI) to build the hull and Kiewit (KOS) to fabricate and integrate the topsides.

Following their first two discoveries, they negotiated a deal with private equity firms ArcLight and Black Rock to provide capital for host fabrication based on a commercial structure that would assure the lenders a reasonable return at the low end of the reserve range and for the producers to pay an equitable tariff at the high end.

The project was sanctioned in March 2012, a month after discovery. KOS installed the 9,300-mt topsides in a single lift. First production was in April 2015, three years after sanction.

Jack/St. Malo development

The Jack and St. Malo (JSM) fields, operated by Chevron, located in Walker Ridge in 2,100 m of water, are deep, subsalt Paleogene reservoirs characterized by low permeability and high pressure. Artificial lift was required to achieve recovery factors needed for commercial exploitation. At the time of discovery in 2003, technology to develop the fields did not exist and there was considerable uncertainty in predicting well performance. To reduce uncertainty, Chevron drilled several more appraisal wells and conducted an extended well test, before approving development of the unitized fields in October 2010 based on an expected recovery of 500 MMboe.

The initial phase involved tying back four subsea wells at Jack and six at St. Malo, to a platform located midway between the two. A semisub was selected because of its ability to support the large topsides and integrate it quayside. The deep draft hull was designed by KBR/GVA and the topsides by Wood. The hull was contracted to Samsung shipyard (SHI) and delivered at KOS in April 2013. KOS built the three main topsides modules and integrated them on the hull.

The platform was hooked-up to the 16 mooring lines in January 2014 by Heerema’s Balder semisub crane vessel (SSCV). After a year of in-field hook-up and commissioning activities, first production began in December 2014.

Perdido development

The Shell-operated Perdido drilling and production spar platform is moored in 2,380 m of water in Alaminos Canyon. It was developed as a regional host to support production from the Great White, Silver Tip, and Tobago fields. Of the 34 subsea wells, 22 are directly accessible by the drilling rig on the spar. The Tobago subsea well is the deepest producing well in the world. Production is commingled in five subsea separation and boosting systems on the seabed and separated hydrocarbons conveyed to the platform by five top-tensioned risers. First discovery was in 2002. The project was sanctioned in 2006.

Technip was awarded an EPC contract for the hull and mooring system, which they delivered to KOS in June 2008. It was wet towed, upended, stabilized, and hooked-up to nine mooring lines, installed by HMC, by September 2008.

Shell decided to lift the topsides block in one major lift, followed by several smaller lifts. The topsides block was designed by Alliance, fabricated by KOS 24 months after contract signing and installed on the hull in March 2009. A year of offshore hook-up and commissioning activities followed requiring a 280-man floatel provided by Hornbeck. First production began in March 2010.

Lucius development

The Lucius discovery well, in 2,100 m of water, was drilled in December 2009 by Anadarko in Keathley Canyon. The Pliocene reservoir had thick pay zones in a compact area. Anadarko chose an all-subsea development tied back to a truss spar because of their successful history of building and operating spar platforms. The development was sanctioned in December 2011 based on an estimated recovery of 300 MMboe.

Sole source contracts for the fabrication of the hull, topsides and installation were signed in early 2012 with Technip, KOS and HMC respectively, consistent with their long-standing approach employed on six previous GoM spar projects.

The hull was fabricated at Technip’s Pori yard and delivered to KOS in May 2013. It was wet towed to the site in August 2013, upended and hooked-up to the nine mooring lines installed by HMC, and stabilized with fixed ballast.

The topsides was fabricated by KOS and transported to the site in February 2014. The main deck module was installed by HMC in one major lift, followed by eight smaller lifts. An accommodation vessel quartered a 500-man construction crew during the year-long integration and commissioning that followed. Production commenced in January 2015.

Stampede development

The Stampede development, in about 1,000 m water depth in Green Canyon, began as two separate fields; Knotty Head, discovered by Nexen in December 2005 and Pony discovered by Hess in July 2006. They are both deep, subsalt middle Miocene reservoirs that created significant drilling and reservoir characterization challenges. Field development was delayed by a combination of falling oil prices in 2009 and the Macondo drilling moratorium in 2010. In 2012 the operators reached a joint agreement to unitize the two fields with a combined 300 MMboe of reserves as Stampede, with Hess as operator.

The development plan consists of two six-slot subsea drill centers with an initial 10 producers and injectors, tied back to a conventional TLP, chosen because its heave restraint facilitated the use of SCR’s and the topsides integrated quayside. The project was sanctioned in October 2014.

Modec was awarded the EPC contract for the DMAR-designed hull and tendons. SHI was awarded the hull fabrication contract in January 2015. It was delivered to the KOS yard in August 2016.

KOS fabricated the Wood-designed topsides and integrated it on the hull in five major lifts. The fully integrated platform set sail to the site in June 2017. Twelve tendons, fabricated by KOS, were preinstalled by HMC and the TLP connected in four days. First production began in January 2018, six months later.

Mars B development

Shell’s Mars B development was initiated in March 2009 with the discovery of the upper Miocene West Boreas reservoir in the western portion of the giant Mars-Ursa basin in 900 m of water. In January 2010 Shell discovered South Deimos. The Mars A 24-slot drilling TLP that began production in 1996 was capacity constrained, so Shell proceeded with the Mars B development, also with a 24-slot drilling TLP, to produce the new discoveries estimated at over a billion barrels.

The Mars B development consists of the Olympus TLP with six subsea wells on Deimos and Boreas tied back. The project was sanctioned in September 2010, nine days after the Macondo well was killed. Olympus was Shell’s sixth and largest TLP. It was built to post Katrina and Macondo requirements, which, along with the ultra-deep high-pressure reservoirs resulted in the platform displacing 108,000 mt, more than twice the Mars A TLP.

SHI was awarded the hull fabrication contract. KOS was awarded the topsides and tendon fabrication contracts and the 16 tendons were pre-installed by HMC’s Balder SSCV.

The fully integrated hull sailed to the site in May 2013 and was hooked-up to the tendons by July. After six months of offshore hookup and commissioning, first production began in February 2014.

Cycle time benchmarks

Each project was assessed for the following phases: appraise/select, define and execute project phases. Major factors that impact the discovery-to-sanction cycle times are reservoir and fluid characteristics, field development plan, remoteness from existing infrastructure, and need for new technologies.

Major external events that also impacted cycle times were the 2005 hurricanes, the 2008 financial meltdown and the 2010 Macondo incident.

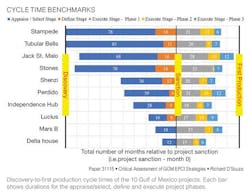

This bar chart shows discovery to first production cycle times of the 10 projects. Each bar show durations for the Appraise/Select, Define, and Execute project phases.

Discovery to sanction

Cycle times for Jack/St. Malo and Stampede were the longest, ranging from seven to eight years, as they required extensive appraisal and technology qualification. The three- to four-year cycle times for I-Hub, Perdido, and Shenzi are more the norms for a deepwater project because of the familiar reservoir geology and accessibility. Perdido’s performance was exceptionally good, especially given that it is remote, in ultra-deepwater and required novel mudline boosting technology. The one- to two-year cycle times for Delta House, Lucius, and Mars B were abetted by good reservoir analogues and standardization.

Execute stage cycle times

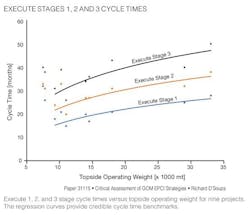

The sanction to first production Execute phase is analyzed in three stages. Execute 1 is from sanction to hull delivery quayside at a GoM yard. Execute 2 is from hull departure to the fully integrated platform hooked-up to its moorings. Execute 3 is the riser, umbilical hook-up and commissioning duration to first production.

Execute 1, 2, and 3 stage cycle times versus topsides operating weight for nine projects are shown. The regression curves are well correlated and provide credible cycle time benchmarks versus topsides operating weights.

Contracting strategies

Operators of these 10 projects adopted various contracting strategies commensurate with their financial, technical and project execution resources. Major operators (Chevron and Shell) managed their major capital projects as they had the systems and resources to do so and prefer to control risks and interfaces of their complex, frontier developments. They negotiated and awarded segmented contracts for the fabrication, transportation, integration, installation and commissioning of the hull and topsides, most often to contractors that they had employed on prior projects. Independent operators Anadarko, LLOG, and Hess chose to pay a tariff to a third-party platform owner, but the design, fabrication, and installation was done by an Integrated Project Team populated with owner and operator personnel, to specifications generated by the operators. Anadarko executed Lucius in much the same way as the majors. BHP conducted a FEED design competition for the Shenzi TLP with two EPC contractors with proven track records for delivering platforms in the GoM, awarding the winner Modec with an EPC contract. Hess awarded Modec an EPC contract for delivery of the Stampede hull and tendons and awarded segmented contracts for the topside’s fabrication, integration, and installation. These hybrid contracting strategies generally worked well.

All operators prioritized Health, Safety and Environment (HSE) during project execution, and have maintained an excellent HSE track record.

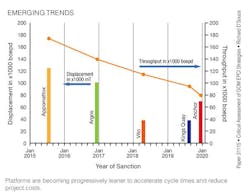

Emerging trends

In the aftermath of the 2014 oil price collapse, most operators set a $35/boe break-even hurdle rate for sanctioning a deepwater development. As a result, only five deepwater projects were sanctioned in the period following: Appomattox (Shell, 2015), Mad Dog 2 (bp, 2017), Vito (Shell, 2018), King's Quay (Murphy, 2019), and Anchor (Chevron, 2019). These projects have two other things in common: most operators are supermajors and the host facility for each development is a production semisub.

This suggests an industry trend of standardizing the semisub for future host facilities in the deep and ultra-deepwater GoM. The rationale for this choice is its combination of the broad bandwidth of water depth and payload, flexibility for expansion, whether in construction or in-service, quayside integration of topsides and contracting flexibility. In July 2021, Shell sanctioned Whale with a facsimile of the Vito semisub.

A second trend is specifying smaller and leaner platforms.

A third trend is to award a single contract for fabrication and integration of the topsides and hull to a single contractor. Appomattox and Anchor follow the traditional approach of hull fabrication in the Far East and topsides fabrication and integration in the GoM. However, Mad Dog 2 (Argos FPU), Vito, and King's Quay awarded a single fabrication and integration contract to SHI, Sembcorp Marine and HHI, respectively.

Conclusion

Over the past 35 years, the US GoM has been at the vanguard of developing progressively deeper and more technically challenging reserves, while continuously adapting to oil price volatility and external events. Future developments will be leaner, greener, smarter, increasingly standardized and with shorter cycle times.

Acknowledgment

Based on a paper presented at the Offshore Technology Conference in Houston, Texas, August 16-19, 2021 (OTC-31115-MS).

About the Author

Richard D'Souza

Vice President

Richard has an undergraduate degree in Naval Architecture from the Indian Institute of Technology and graduate degrees in Naval Architecture and Civil/Structural Engineering from the University of Michigan and Tulane University. He started his career in the oil patch in 1976 with Friede and Goldman in New Orleans, a consulting firm that pioneered semisubmersible, drillship and jack-up mobile offshore drilling units. He moved to Houston in 1978 with Pace Marine Engineering Systems a marine consulting firm and was Director of Arctic Technology. He co-founded Omega Marine Engineering in 1985 which engineered the first floating production system in the Gulf of Mexico. Aker Engineering acquired Omega in 1991 and he was Vice President of the Marine group. Under his direction Aker became the predominant deepwater engineering group in the industry and executed most of global deepwater field development and front end floating production projects involving semi, spar, TLP and FPSO platforms. He joined KBR in 1999 as Vice President of Deepwater Technology and organically built a deepwater engineering group to support execution of EPC projects worldwide. He became Director of Granherne Americas in 2004 and Vice President Granherne Global operations in 2009. Granherne is the global consulting arm of KBR and the premier provider of field development planning, process, safety, marine, subsea flow assurance and integrity management services, with 200 technical professionals in four regions. Richard has authored over 70 technical papers in field development planning, deepwater technology and floating production systems in major offshore conferences and publications. He has actively participated in numerous industry committees, panels and forums including SNAME, SPE, DOT, API, ISO, OMAE, ASME, OTC and DeepStar to promote deepwater technology and development. He has dedicated his career to training the next generation of deepwater technical professionals.