UK, Norway offer lowest breakevens for offshore projects

Offshore staff

OSLO, Norway – Rystad Energy expects offshore project sanctioning to recover this year and reach at least $56 billion in 2021, then climb potentially to $131 billion in 2023.

According to the consultant, operators are focused on costs and profit margins, while the majors will likely concentrate individual activity on fewer countries.

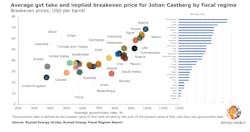

Rystad has analyzed how each country’s fiscal regime affects the profitability and breakeven price of offshore mega-projects. It has drawn up a top-five list of countries for profitable large-scale field developments.

For modeling each country’s score it used as an example Equinor’s Johan Castberg field development offshore northern Norway, a single-phase project with abundant data for benchmarking purposes.

The analysis does not take into account NOC activities in their own countries.

According to the calculations, the UK delivered the highest post-tax valuation and the best profitability conditions for operators, with a net present value (NPV) of $11.1/boe at a flat oil price of $70/bbl.

Next up were Kuwait ($11/boe), Canada ($8.9/boe), the US ($8/boe), and Colombia ($8/boe).

In Norway, however, a non-NOC company would derive an NPV of only $3.9/boe from Johan Castberg. A mitigation factor is that Norway offers a lower risk to explorers as the government takes on some of the cost of unsuccessful wells.

Globally, the average government take has fallen in recent years and this trend looks set to continue, Rystad said, as oil and gas-producing countries woo foreign investors in a competitive environment.

Fiscal regimes with a higher government take will likely struggle to compete.

For the benchmarking exercise, the consultant selected the fiscal regime that it believes best represents the country.

In Johan Castberg’s case, under the different regimes breakeven ranges from around $25/bbl to $65/bbl.

Factors that drive up breakeven prices include high royalty or export taxes and strict cost recovery methods, such as cost ceilings and deprecation spread over many years.

Lowest breakeven prices are in the UK and Norway, as both countries impose only net taxes (tax on profit), with and an easy cost recovery system.

In contrast, Indonesia, Malaysia, Egypt, Russia, and Algeria are all countries with a high gross tax or tough cost recovery methods, Rystad claimed.

01/18/2021