FPSOs to lead offshore market recovery

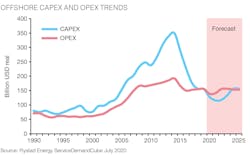

Offshore capex and opex spends have converged over the last two years, both equaling approximately the same monetary value in both 2018 and 2019. The deep capex cuts by E&P companies following the onset of the COVID-19 crisis and the resulting oil price crash is estimated to result in an 18% year-on-year drop in offshore capex spend in 2020. The significant spending cuts will, therefore, result in the global offshore capex spend trailing 8% below the opex spend in 2020, which in absolute terms represents a difference of $11 billion. The gap between the opex and capex will increase further to 18% in 2021 and 24% in 2022. This situation, where the market opex exceeds the market capex, has never been experienced by the modern offshore oil and gas industry before.

The spend gap signals that offshore greenfield sanctioning and brownfield modifications are slowing down. This activity slowdown will cause problems for many segments in the offshore service industry, especially for suppliers within the EPCI segment who earn their revenues primarily from E&Ps’ capex spending. The severe cuts to field development capex is also expected to adversely impact subsea equipment suppliers and installation/construction companies, as well as drilling rig contractors and downhole services firms. Service companies have already felt the impact of reduced spending, with many companies reducing their workforces in an attempt to save their margins.

Despite a troubling first half of the year, the industry is getting cautiously optimistic about the future. Brent oil prices have, in recent months, traded stable in the low $40s/bbl as global lockdowns have been relaxed, which in turn has led oil demand to show signs of improvement. The improved oil demand is driven by both increased road fuel and jet fuel consumption. Global road traffic has improved dramatically from March to the end of June. Traffic in Western Europe was back at normal levels at the end of June, compared to the 40% reduction witnessed in March, when the continent more or less went into lockdown to brace for the spread of the COVID-19 pandemic. June was also the first month with growth in the global number of flights since the virus outbreak. Even with most signs pointing in the right direction, the threat of a second wave of COVID-19 cases is a significant downside risk to the oil market’s path to recovery. With this risk being present, E&P companies will be extremely cautious in their investment decisions, holding back on greenfield sanctioning until more definitive signs of recovery appear.

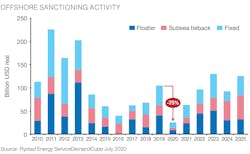

The cautious approach by E&Ps is clearly visible in the upcoming offshore sanctioning activity. Low oil prices and lockdown-led supply chain disruptions will drag this year’s offshore sanctioning activity down 75% year-on-year. The timing could not be worse as the offshore market was experiencing a healthy growth momentum over the last three years and 2019 saw more than $100 billion being sanctioned, the highest since 2013.

Following the lows this year, Rystad Energy expects sanctioning activity to begin recovering in 2021 when the first bulk of the many delayed offshore projects start getting sanctioned. Activity levels are still expected to stay below 2019-levels for both 2021 and 2022, before surpassing last year’s levels in 2023. The medium-term growth from 2021 to 2023 would be driven mainly by the offshore fields that are developed with floating platforms, primarily FPSOs. Fields with floating platforms will attract the largest investments, accounting to 41% of the total offshore sanctioning value in 2021-2023, beating both fixed platforms (38%) and subsea tiebacks (21%). The potential floater dominance in this recovery period would be a contrast to the previous post-crisis recovery period from 2015 to 2017, where floaters only accounted for 30% of the offshore sanctioning.

The popularity of floaters comes as operators have been able to optimize the field economics of FPSO developments, making these complex deepwater projects attractive also in a low oil price scenario. South America stands out especially as an attractive region for FPSO-led activity in the years to come, with Petrobras continuing its developments in the presalt basin, joined by Shell, Equinor and other international E&Ps. In Guyana, ExxonMobil started production from the prolific Stabroek block in December 2019 from the FPSO Liza Destiny, and the major has at least four new floaters destined for the Guyanese waters on the menu.

Rystad Energy expects that the FPSO-driven recovery of offshore sanctioning activity from 2021 to 2023 will help drive capex spend back up and will close the gap between opex and capex spends. Global offshore capex is set to reach back up to the opex levels in 2024 at approximately the same real spend level as in 2019.