Qatar’s North Field Expansion start could be delayed until 2021

Offshore staff

OSLO, Norway – Qatar’s goal of expanding its liquefaction capacity by 49 MM metric tons/yr (54 MM tons) to 126 MM metric tons (139 MM tons) will likely involve investments of more than $50 billion on the offshore North Field, according to Rystad Energy.

The first stage of the project, with an estimated price tag of around $35 billion, was due to be sanctioned this year, but approval looks more likely now in the first half of 2021, the consultant said.

First-phase work includes contracts for associated onshore liquefaction and storage facilities, with tenders in progress for construction of four new LNG trains, utilities and off-site facilities, a helium recovery unit, non-technical buildings, warehouses, workshops, and associated facilities.

The second stage of the expansion will probably not be approved until 2023 at the earliest, Rystad claimed.

Qatar Petroleum is re-assessing the North Field Expansion (NFE) project due to current low gas prices before approaching international partners, and has extended the commercial bid deadline for liquefaction facilities to 2Q 2020.

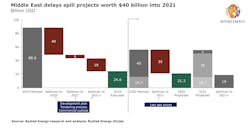

Rystad Energy has lowered its forecast for new capex investments across the Middle East this year to around $21.3 billion, compared with more than $56 billion under its previous estimate.

“Because of the spillover of delayed sanctions from 2019 and 2020, next year could see projects worth more than $55 billion reach a final investment decision – if current schedules hold,” said senior upstream analyst Aditya Saraswat.

In the UAE, Rystad Energy estimates sanctioning of new gas projects this year will total around $12.5 billion, while in Saudi Arabia, sanctioning of the delayed Zuluf oil field expansion, targeting 5 Bboe, will likely be approved early in 2022 at a cost of more than $10 billion.

03/02/2020