Abadi LNG plan gets the green light

Offshore staff

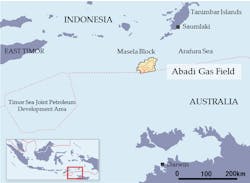

SINGAPORE – Indonesia’s government has approved INPEX’s revised plan of development for the Abadi LNG project.

The company and partner Shell will develop the giant Abadi field in the Arafura Sea via an offshore production facility and a 9.5 MM metric tons/yr (10.47 MM tons) onshore LNG plant, at a total estimated cost of $20 billion.

According to Wood Mackenzie research director Andrew Harwood, the revised PDO details the recently agreed amendments to the Masela production-sharing contract (PSC).

The improved terms include a 20-year extension, a further seven years to compensate previous delays, and enhanced fiscal terms. INPEX expects to take a final investment decision within three years, and first gas should flow in 2028.

“Post Jokowi’s election win, the government has shown greater flexibility on fiscal terms,” Harwood said. “In addition to the PSC extension, the government has agreed to an enhanced contractor profit split, investment credit and indirect tax exemptions which will provide for a post-tax contractor profit share of 50%.

“For Indonesia, making progress on Abadi is critical. Domestic LNG demand is expected to rise to 13 MMt/yr by 2030 as gas demand grows and production declines.

“Abadi is also crucial to the next phase of growth for INPEX, post-Ichthys. At peak, we estimate Abadi to contribute 180,000 boe/d … [toward the company’s] ambitious long-term production target of 1 MMboe/d.”

INPEX will now initiate environmental and engineering studies ahead of FID, but there remain various hurdles to clear, Harwood added. One is a crowded EPC market due to the record number of LNG projects competing for sanction over the same period.

Another is the remoteness of the field from the onshore facility, which could involve laying 150 km (93 mi) of pipeline.

07/15/2019