Consultant cautions against hasty project sanctioning

Offshore staff

OSLO, Norway – E&P companies remain keen to speed up approval of their new projects. But hasty sanctioning could lessen certainty over the project’s ultimate cost, according to Rystad Energy.

The consultant expects projects with high levels of engineering definition to remain within around 20% of the initial cost estimates.

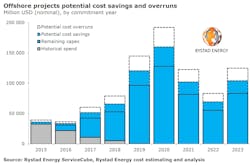

“For offshore operators,” said Matthew Fitzsimmons, vice president of Rystad Energy’s Oilfield Service Research division, “that means the expected variation for projects to be sanctioned during the period from 2019 to 2023 could be as high as $220 billion.

“Historically, the ability of operators to perform to their estimates has significantly impacted their subsequent sanctioning.”

Rystad’s analysis indicates that sanctioning activity for new projects has risen of late and this will likely cause a 10-15% spike in offshore unit prices by 2022.

For those projects set to be sanctioned over the next four years, there is a wide range of anticipated success rates. Even when calculating funding based on comprehensive engineering definition, operators could still incur cumulative cost overruns of $111 billion, Rystad claimed.

But at the same time, project teams also can save $111 billion compared to their expected funding estimates.

When FID is taken on a project based on well-substantiated cost estimates and tried and proven concepts and execution plans, the project team is better placed to pursue potential cost savings.

Conversely, accelerating sanctioning without proper engineering can lead to actual costs soaring by close to 50%.

“Even if oil prices stay above $60 per barrel over the next five years, offshore sanctioning could slow down due to project performance,” Fitzsimmons said.

“To manage inherent sanctioning risk, we’ve observed that operators are delaying their final investment decisions in order to mature the engineering definition. This will lower the uncertainty that their funding estimates will carry.

“Failure to do so will not only have an adverse impact on the operator’s ability to control cost overruns, but also the minority share owners of the field.”

Rystad highlighted Shell’s Prelude FLNG project off northwest Australia, launched in 2011 with an estimated price tag of just over $11 billion. However, due to engineering and fabrication issues, costs rose by more than 36% to an expected $15 billion.

“These overruns caused Shell to cancel an order with Samsung Heavy Industries for three FLNG units worth $4.6 billion in 2016,” Fitzsimmons said. “So, in essence, these cost overruns prevented Shell from sanctioning several additional FLNG projects.”

06/11/2019