Offshore industry flush with cash and ready to invest

Higher oil prices, cash flows suggest new wave of spending

Matthew Fitzsimmons, Emil Varre Sandøy, Rystad Energy

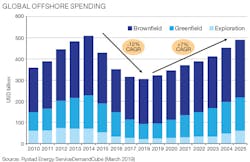

To say that the recent downturn has been felt across the offshore value chain would be an understatement. Spend has been reduced by 12% CAGR over the past four years, as E&Ps and service companies alike have fostered a renewed focus on cutting costs. The success of these efforts has put the industry in a good place to invest with recently sustained higher oil prices. Flush with record-high cash flows, offshore E&Ps are looking to put this cash to work, with $125 billion set to go into new projects in 2019.

Record high cash flows

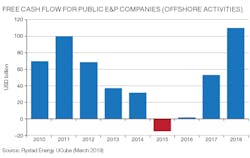

In 2018, public E&P companies experienced a new all-time high in free cash flow from their offshore operations and investment activity. Rystad Energy’s estimates shows that the free cash flow from offshore in 2018 was approximately $105 billion for these companies, distinctively higher than the previous peak at around $95 billion in 2011.

Behind the significant improvement in free cash flow is, above all things, the recovery in crude prices, improved cost levels, and moderate activity levels. To further explain the development observed in the recent years, we can go back to 2011. At this point in time, the oil price had recovered from the Great Recession, with Brent price moving around $110/bbl. Cost and activity levels were still fairly low, which resulted in E&P companies generating plenty of cash flow and showing high profitability.In the years that followed, prices remained high, which triggered sanctioning of many new projects. This resulted in more activity and higher cost levels as input factors started to get scarce. The E&P companies saw profitability starting to decline, despite the resilient oil price. When the collapse came in the fall of 2014, activity and cost levels remained relatively high in the short term as the long lead times in the industry makes it hard to respond quickly, and results took a blow in 2015.

From this low, the E&P firms have cut back on activity and instead focused on squeezing costs in order to operate as efficiently as possible. At the same time as these cost-reducing measures came into effect, the oil price started to slowly recover. The result was a super-profitable environment for the E&P sector, with Brent oil prices now around $60 to $80 per barrel while the companies’ portfolios have been trimmed to be sustainable in a low price scenario. Free cash flow grew by an estimated 100% in 2018 compared to 2017, resulting in a new all-time high. We have already observed some of this cash utilized for debt management and increased dividends, but a large share will be allocated to investments, providing the foundation for a strong investment growth going forward.

Operators making waves

Despite being flush with cash, E&Ps showed great patience when reviewing projects for sanctioning late in 2018. Saudi Aramco’s EPC bid extensions for the Berri and Marjan Expansion projects alone pushed over $18 billion of offshore commitments from 2018 into early 2019. The additional time has helped to ensure that the bidding contractors focus on their scope and cost-competitiveness. This includes expanding traditional fabrication strategies outside of South Korea, and evaluating recent improvements from yards in India, China, and the Middle East. Saudi Aramco will, by funding both of these projects, be this year’s biggest spender on offshore greenfield work.

ExxonMobil also looks primed to make an offshore sanctioning splash in 2019, bringing forward over $15 billion of offshore work for sanctioning – a volume not from the company seen since 2013.Continuing the patient, phased approach in Guyana, ExxonMobil will be looking to bring the $10 billion price tag for two phases of the Greater Liza project (Liza Phase 2 and Payara) forward for sanctioning. This phased strategy is reminiscent of how the supermajor developed the deepwater Kizomba fields in the early 2000s off the coast of Angola. From 2000 to 2012, six phases of the overall development were approved in a systematic manner that enabled lessons to be applied from one phase to the next. This, in turn, enabled subsequent developments to reduce costs. In addition, with their early works campaign underway for the onshore scope, the Area 4 LNG project in Mozambique looks well on its way to being approved this year.

Not every operator appears to have the same clear-cut sanctioning decisions to make this year. For 2019 to reach its full sanctioning potential of $125 billion in commitments, some projects will need to lower their current breakeven prices. As highlighted in Rystad Energy’s Project Sanctioning Report, nearly half of 2019’s projects currently have breakeven prices above $40 per barrel (on a greenfield capex basis). Failure to do so will result in many projects missing out on sanctioning.

Not all projects created equal

Brazil’s Petrobras presents a prime example of an operator that will have important funding decisions to make this year. The company has an offshore portfolio of $17 billion in greenfield projects up for sanctioning in 2019. However, if its recent bid extension on the Mero 2 project was any indication, it will not be paying a premium to chase schedule. In fact, it appears that its bid extension was to ensure SBM Offshore could participate with rivals BW Offshore and Modec International. As SBM Offshore has more local content capabilities in Brazil, Petrobras’ extension will help to ensure its bid round will be as competitive as possible.Petrobras has also shown sanctioning patience through its ongoing Buzios V FPSO tender. Since being identified as the lower bidder in the first half of 2018, Exmar has been unable to secure financing. Rather than to accept the second-lowest bidder Modec’s high day rate and move forward with the project, Petrobras has explored other options and officially delayed start-up until 2022. As of this writing, Petrobras has entertained a re-bid and even entered into exclusive negotiations with Modec to try and combat forecasted breakeven prices of over $50/bbl for the project. It is willing to forgo 60,000 boe/d in 2022 and 2023 to secure reduced costs. While sanctioning decisions for most of Petrobras’ portfolio are expected late-2019, the company will continue to be challenged by breakeven prices above $40/bbl.

Regionally, Asia, North America, and South America hold the highest percent of at-risk projects. In Australia, the Julimar asset under the Wheatstone development appears to be best positioned to be sanctioned. Woodside announced back in November 2018 that it would target a final investment decision on the field in the second quarter of 2019. The project team will look to complete FEED in the first half of 2019 to support the investment decision.

Subsea industry to rise

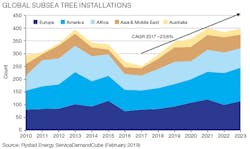

A boom in subsea tree installations in the coming years is likely to be a key component in the expected increase in E&P expenditure for subsea equipment and installation. In Norway and the UK, Rystad Energy sees a trend toward higher E&P spending on subsea tieback projects, as the number of such field developments is poised for substantial growth over the next four years. In the rest of the world, growth in spending on subsea tiebacks is expected to be offset by even higher growth in spending on floater projects.

From an average of 303 subsea trees installed per year in the period 2000-2014, the number of new installations followed the general decline seen across offshore markets since 2014, hitting the bottom in 2017 when only 240 trees were installed. As the oil price has recovered, with Brent rising from $44/bbl on average in 2016 to $72/bbl on average during 2018, the subsea market has shown clear signs of improvement. Subsea tree installations can be seen as a main driver for this growth, spawning the need for infield lines, control modules, manifolds and other equipment. Rystad Energy expects a substantial increase in demand in coming years, with over 350 subsea trees forecast to be installed per year by 2021.

Rystad Energy expects a recovery on the market for subsea tree installations, and we now see a new wave of subsea developments in the coming years, supported by effective cost cutting measures and cooperation between suppliers and E&Ps.Drillship market

turning the corner

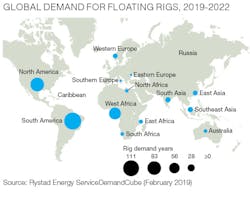

Sixth and seventh generation drillships secured new contracts during 2018 representing just under 60 rig years of contracted backlog. This is double the activity level seen in 2017, when this market segment garnered only 30 rig years of work. Contract starts outpaced rollovers, giving a much-needed uplift to utilization in the ultra-deepwater segment. Rystad Energy however expects utilization in this segment to continue to face challenges throughout the year as many of the recent contract starts have durations of only three to four months. The rig owners receiving the highest volume of contracted years are Transocean, Diamond Offshore, and Seadrill, and the majority of these awards were centered in the Gulf of Mexico and Latin America, where Chevron, BP, and ExxonMobil were the most active clients.

Just over five years of options on high-spec drillships were exercised last year, while 1.8 years of options were declined. The majority of the declined options were not exercised based on the unsuccessful outcome of exploration wells drilled as part of the initial firm contract. There are still 17 years of options that were agreed to during 2018 that remain to be exercised.

The big news at the end of 2018 in this market segment was Chevron’s award of a five-year contract to Transocean for one of its two state-of-the-art Jurong Espadon drillships, currently under construction in Singapore. Even with Chevron’s five-year contract award, the average duration of firm work awarded during 2018 is less than one year, and contract lead times are still less than two months. For 2019 we still see 38 rig years of uncontracted rig supply on the market. Transocean has just under six rig years of availability in 2019, while Pacific Drilling has just over five years, followed closely by Ensco and Seadrill with just under four years each.

Rystad Energy’s demand forecast from RigCube shows the majority of floating rig demand coming out of North America, South America, and West Africa for the period 2019 through 2022. There are outstanding tenders from Woodside, BP, Noble Energy, Petrobras, Total, and Tullow Oil for work in this market segment. The equipment and capabilities of sixth and seventh generation drillships make them well-positioned to win work, aided by their flexibility to work across a wide range of water depths.Growth projections

Looking at offshore greenfield investments by region, the global trend is evident for all regions as well, except for Australia. In the period 2011 to 2015, investments in new offshore projects were high in all regions, as the oil price was high and offshore production was seen as the key source of supply to meet the future demand. Asia was the region with the highest offshore activity, followed by Europe and Africa.

Then came the shale revolution, causing the oil price to crash and the impressive influx of production volumes limited the need for offshore production growth. In response, E&P companies cut their investment budgets and focused on costs, which is reflected in the sharp decline for the 2016 to 2020 period compared to the preceding years. Even though the oil price has come up and sentiment in the industry has slowly improved since 2016, greenfield offshore investment levels are still expected to be relatively low though out 2020 due to the lag effect, as it takes time to sanction and develop offshore projects.

We have to wait until the 2021-2025 period to see a new offshore investment cycle kicking in. Australia is the exception here as the region is hampered by a significant drop in new LNG projects, paired with a large share of uncommercial projects with too high breakeven price.

North America is the most important region in terms of growth ahead, with projects such as North Platte, Ballymore, and Bay du Nord as the main drivers. Also worth noting is that the 2021-2025 investment levels in the Middle East, the Americas, and Europe are expected to exceed the levels observed in 2016-2020, underlining the potential magnitude of the investment cycle we see coming.

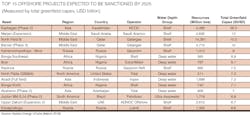

At a project level, we see several large offshore projects expected to be sanctioned in the upcoming years. In the table, we show the top 15 projects to be sanctioned by 2025, in terms of estimated total greenfield capex.

At the top of the list is the second phase of the giant Kashagan field in Kazakhstan, with an estimated $36.3 billion in investments required in order to develop the project. Operator North Caspian Operating Co. is developing this field with both artificial islands and FPSOs, and the second phase of the development could add as much 5,266 MMboe.The Middle East is the region with the highest number of projects represented on the list, and has four out of the five largest offshore projects in terms of resources. The North Field B project in Qatar, at 14 MMboe, is the by far largest in terms of estimated reserves and holds almost three times as much as the second largest project. This seems like a contradiction to the earlier regional analysis, but it actually shows how the Middle Eastern projects to be sanctioned in the upcoming time period are huge projects, but few in numbers.

The opposite can be said about the European projects, as Europe is expected to be the largest region in terms of investments, but not represented at all on the top project overview. This is a result of the increasing share of subsea tieback projects in Europe, where each individual development is relatively small both in terms of resources and investments required, but the grand total becomes significant due to the high number of projects.

This increase in global spend has only been made possible by E&Ps building record high free cash flows. While recent cost cutting measures and low levels of sanctioning activity have kept expenditures down, higher oil prices have enhanced the take-home of producing assets. The offshore industry now looks healthier and ready to start increasing work levels. However, there is work still to be done to make all projects economically attractive to have successful sanctioning decisions. If these efforts are successful, the industry will be taking major strides to build a new wave of offshore spending this year. •

The authors

Matthew Fitzsimmons is Vice President, Oilfield Service Research, Rystad Energy; and Emil Varre Sandøy is Analyst, Upstream Research, Rystad Energy.